One 97 Communications, the parent company of the renowned fintech platform Paytm, announced a remarkable 25 percent surge in revenue, reaching Rs 9,978 crore for the fiscal year 2023-24. The company credited this growth to increases in Gross Merchandise Value (GMV), device installations, and expansion in financial services distribution.

Since its Initial Public Offering (IPO), which marked the company’s public debut, Paytm achieved its first full-year Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) before Employee Stock Ownership Plan (ESOP) profitability, amounting to Rs 559 crore, according to its latest earnings release.

However, in the January-March quarter, Paytm’s revenue slightly declined by 3 percent year-on-year to Rs 2,267 crore. The company clarified that this reduction was due to reduced marketing spending, particularly in February and March, as it paused most user growth expenditures. Paytm plans to reinvest in these areas in the upcoming fiscal year.

Paytm anticipates substantial improvement from the second quarter of the fiscal year 2024-25, focusing on resuming paused products and achieving consistent growth in operational metrics. In the first quarter of the current fiscal year, Paytm’s priorities include acquiring new merchants, reactivating inactive merchants, and reallocating devices from inactive merchants to new ones.

Despite a smaller net addition of device merchants expected in Q1 FY 2025, Paytm forecasts improvement thereafter, aiming to recover to previous trendlines by Q3 FY 2025.

Revenue from payment services surged by 26 percent to Rs 6,235 crore, while net payment margin increased by 50 percent to Rs 2,955 crore. Gross merchandise value (GMV) soared by 39 percent to Rs 18.3 lakh crore. Moreover, the number of merchant-paying subscriptions for devices reached 1.07 crore as of March 2024, marking a rise of 39 lakh.

Revenue from financial services and other sectors also experienced significant growth, up by 30 percent to Rs 2,004 crore, with the value of distributed loans increasing by 48 percent to Rs 52,390 crore.

Paytm acknowledged that the active rate and per device subscription revenue were impacted, with merchant subscription revenue per device per month declining to Rs 90 in Q4 and expected to bottom out at Rs 80 in Q1. However, Paytm anticipates this figure to rise towards Rs 100 by Q4 of the current fiscal year.

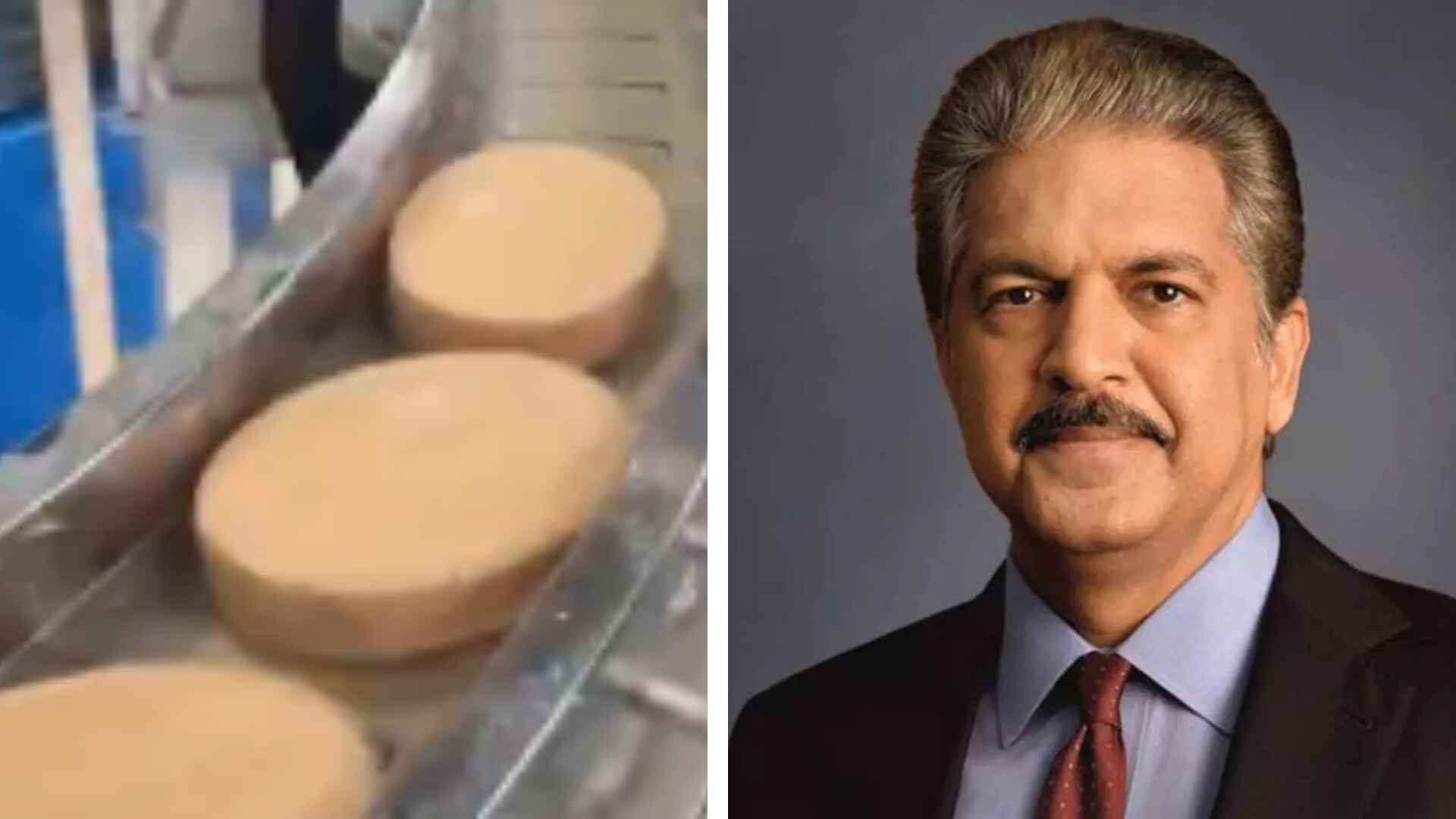

Furthermore, Paytm emphasized its commitment to addressing merchant needs through innovative product launches, exemplified by the introduction of two “Made in India” soundboxes customized for merchants’ requirements, boasting louder speakers and longer battery life.