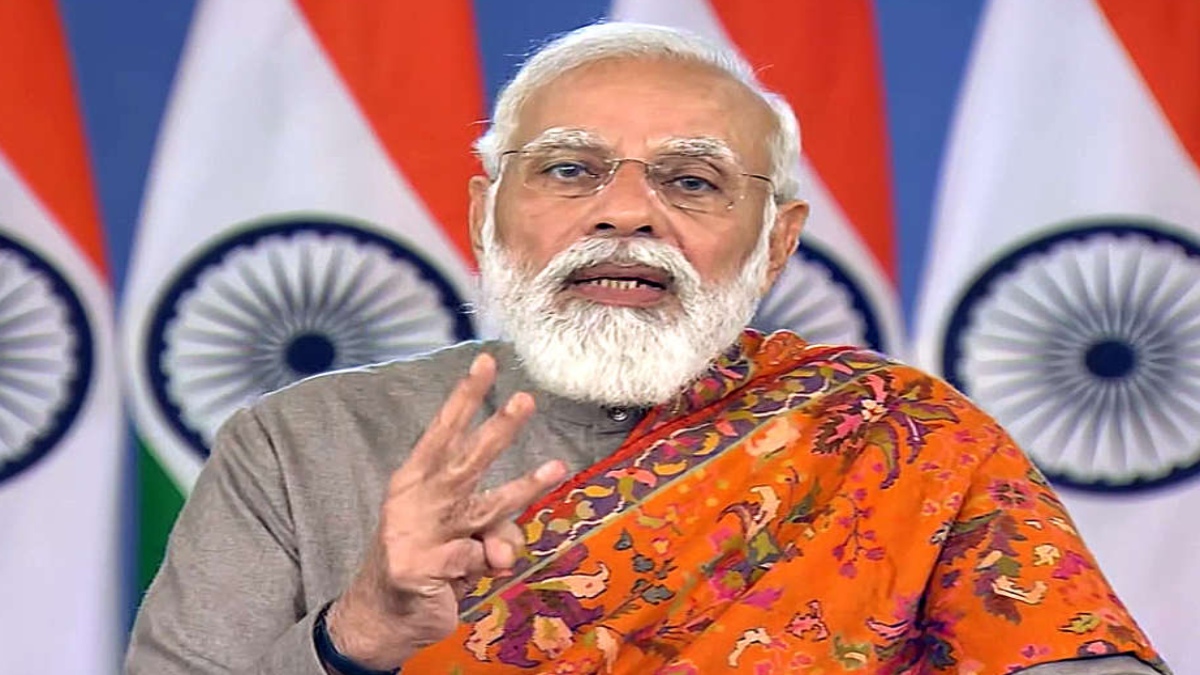

The Modi government has allocated Rs 9259 crore to Air India Assets Holding Limited (AIAHL), a government-owned special purpose vehicle set up to handle Air India’s (AI) debt and non-core assets, for the next financial year starting from April 1, 2022, as per the Union Budget 2022-23. The revised estimate of capital expenditure for the ongoing fiscal, FY22, (2021-22) is Rs 6.03 lakh crore. This includes an amount of Rs 51,971 crore towards the settlement of outstanding guaranteed liabilities of AI and its other sundry commitments. In FY22, the Modi government infused equity of Rs 62,057 crore to clear AI’s dues before its disinvestment. Unlocking value through either quick resolution, monetisation, or via sale as in the case of the loss-making Air India, which went back to the Tatas in January 2022, the Modi government has exhibited excellent business sense. The Tatas, as part of the deal, had to pay Rs 18,000 crore to acquire Air India from the government. This follows the group of ministers (GoM) known as the Air India Specific Alternative Mechanism (AISAM), approving the bid winner, after hectic parleys for months together. The long-awaited Air India divestment is one of the biggest reforms by the Narendra Modi government. The Air India privatisation is a glowing testimony to the political will power of Prime Minister Narendra Modi in ensuring “Minimum Government, Maximum Governance”.

The Tata group holding company, through Talace Private Ltd, submitted the winning bid of Rs 18,000 crore as the enterprise value of Air India, against a reserve price of Rs 12,906 crore. The winning bid comprised a payment of Rs 2700 crore and retaining a debt of Rs 15,300 crore. After the government received Rs 2700 crore from Talace, a unit of Tata Sons, it transferred shares of Air India (100% of Air India and its low-fare subsidiary, Air India Express Ltd, and 50% stake in ground handling company, Air India SATS Airport Services Pvt. Ltd) to Tata Sons. The Tatas beat Ajay Singh of SpiceJet, to clinch the deal. The Tata group already holds a 51% stake in full-service airline Vistara, in which Singapore Airlines is the minority partner. It also owns a majority stake in AirAsia India Ltd, with Malaysia’s AirAsia Bhd, as the junior partner.

Air India’s total debt stands at over Rs 61,562 crore with over Rs 1.1 lakh crore having been spent on the airline since 2009. 75% of the said debt is being transferred to a special purpose vehicle (SPV). Certain immovable assets held by the airline such as real estate, housing projects, etc have been transferred to the SPV, Air India Asset Holding Ltd (AIAHL), and will be monetised to repay the airline’s outstanding debt. The airline’s art collection, which comprises over 4000 works, however, has been left out of both the disinvestment and asset monetisation processes.

What does the country get? Air India has been a loss-making entity since 2007, when it was merged with State-owned Indian Airlines, with successive Congress regimes milking it dry in the most embarrassing display of how a greedy nexus between politicians and bureaucrats sank the grand old flagship airline of India. Over the years, Air India accumulated losses rapidly with a loss of Rs 20 crore per day in one of the worst legacies of the erstwhile corrupt Congress regime, which is singularly responsible for sinking this airline with a series of damning economic policies, from the word go. The new owners are keen on turning around the finances of the loss-making carrier. Air India’s accumulated losses rose to Rs 77,953 crore in 2020-21 (FY21) from Rs 70,820 crore in FY20. In FY21, the carrier’s net liabilities exceeded its assets by Rs 58,316.68 crore. Industry experts have said the Tatas will bring in experts with expertise in turning around loss-making carriers and will be bold enough to take tough decisions such as the dismantling of various unions. The country’s taxpayers will be better off and the government will have the luxury of transferring a loss-making asset to a corporate entity that has established credentials in the aviation sector thereby leading to optimum utilisation of resources. The government will no longer be burdened by a strain on its resources from a thoughtless move 69 years back by India’s first Prime Minister.

What do Tatas get? According to aviation experts, the Tatas might have to spend at least $2 million on each aircraft in the fleet only on refurbishments, apart from added costs on pending maintenance checks. The fleet also needs to be modernized. As things stand, Air India’s aircraft lease contracts are very high, while the Boeing 777 are not very efficient and the Airbus A321 do not offer the same range and capabilities as the new models. (As of 2017, it had a fleet of 121 aircraft (excluding 4 B747-400s) comprising Airbus and Boeing aircraft such as the A319s, A320s, A321s, B777s, and B787s). Don’t forget that Air India is one of the most extensive flight service providers in India, flying to 98 destinations (56 domestic destinations with around 2712 departures per week and 42 international destinations with around 450 departures per week) as of November 1, 2019. The Air India acquisition will give the Tata group access to 4400 domestic and 1800 international airport slots at Indian airports and 900 slots at foreign airports, including London’s Heathrow and New York’s John F. Kennedy International Airport.

How does the Tatas benefit from the acquisition? Air India comes with global brand recall, assets, hangars, and bilateral rights to fly to many countries. It has slots and parking bases at key airports, trained pilots, and staff, which provide a ready product to serve the international market. With Air India and Vistara, the Tata group can now pose a threat to international long-haul aspirations of the likes of IndiGo or the international cargo plans of SpiceJet. The acquisition helps the group leapfrog in the domestic aviation space, ahead of most of its competitors with a market share of 27%-35%, just behind market leader IndiGo (52-58% market share).

What do the employees get? Better HR practices are what the Tata group will bring to the table to introduce efficiency in terms of overall service standards. None of the 12,085 odd employees will be retrenched for the next year. Employees will be eligible for VRS from the second year onwards with all benefits. They can stay in company colonies for six months after the takeover. Employees will continue to get statutory benefits like PF, gratuity etc. Tata group will continue to provide benefits to employees.50,000 retired employees will continue to get medical benefits under CGHS and NHIS.

Will it remain the official national carrier?

By definition, a national carrier is an airline operated by, or on behalf of the government. Since Air India is no longer operated by the government of India anymore, it is by definition no longer the national carrier.

What happens to Vistara and Air Asia? The Tata group holds a majority interest in Air Asia India and Vistara, a joint venture with Singapore Airlines. Air India is the conglomerate’s third acquisition in the aviation sector. Aviation experts believe that the Tata group will eventually merge its low-budget airlines, Air India Express and Air Asia India. They will, however, have to take Singapore Airlines onboard, before drawing up any plans to synergize the operations of Air India and Vistara.

What do customers get? Better, more efficient services, is the answer. Customers will see improved ticketing and operations, including the choice of food and beverages served onboard the newly rebranded flight. Remember, service quality onboard a private airline is worldwide always better than a government-owned one. India is no different. The very lot that is accusing the Modi government of selling family silver is the same bunch that if given half a chance, would always opt for a Vistara or an Indigo rather than an Air India. Since government-owned companies are not driven solely by commercial motives, over the years if such companies even manage to stay afloat, service quality, still declines.

It has taken a tall leader of PM Modi’s stature, to undo the damage done by Nehru’s decrepit socialism 69 years back. Under the Air Corporations Act, 1953, Nehru nationalised nine airlines, namely, Air India, Air Services of India, Airways (India), Bharat Airways, Deccan Airways, Himalayan Aviation, Indian National Airways, Kalinga Airlines, and Air India International. These were thereafter brought under the ambit of two PSEs, Indian Airlines and Air India International. The unpalatable but hard truth is not merely the fact that airlines were brought under government control but more importantly, running of airlines by private businesses was made illegal and a criminal offence with punishments ranging from a fine of Rs 1000 to an imprisonment for three months under Section 18(2).

Nationalisation was the “fevicol” Nehru used to fix even all that was rock solid and did not need glue to start with, in the first place. However, Nehru’s Mahalanobis model of Socialism, including the Industrial Policy Resolution of 1956, ruined one sector after another. For example, via the Life Insurance Corporation Act, 1956, Nehru nationalised 154 Indian insurers, 16 non-Indian insurers and 75 provident societies into a single entity, Life Insurance Corporation of India (LIC). But again, it is the progressive Modi government that has decided to bite the bullet and go ahead with the divestment of LIC, which over the years, has in any case, become a lethargic behemoth. So far, the government has mopped up Rs 12,030 crore from PSU disinvestment and strategic sales in FY22. This includes Rs 2700 crore from Air India privatisation and another Rs 9330 crore through minority stake sale in various Central Public Sector Enterprises (CPSEs).In the current fiscal, the big-ticket disinvestment of Life Insurance Corporation (LIC) is in the works, besides the strategic sale of BPCL, Shipping Corp, Container Corp, RINL, and Pawan Hans. The government has indeed revised the disinvestment target for FY22 from Rs 1.75 lakh crore to Rs 78,000 crore and the said target for FY23 is Rs 65,000 crore. That said, numbers alone do not tell the entire story in this case.

PM Modi, in his speech in Parliament, last year, outlined why it was not tenable to have Indian Administrative Service officers (“babus”) run enterprises of all kinds. During the run-up to the 2014 election too, Modi repeatedly emphasized that the government has no business to be in business. And while the pace of disinvestment and privatisation have been the subjects of much debate, there seems to be a clear policy push based on this worldview. The pandemic has also provided the government a reason, and an opportunity, to push ahead with larger second-generation structural reforms.

(To be continued…)

The writer is an Economist, National Spokesperson of the BJP and the Bestselling Author of ‘The Modi Gambit’. Views expressed are the writer’s personal. The second part of the article will be published next week.