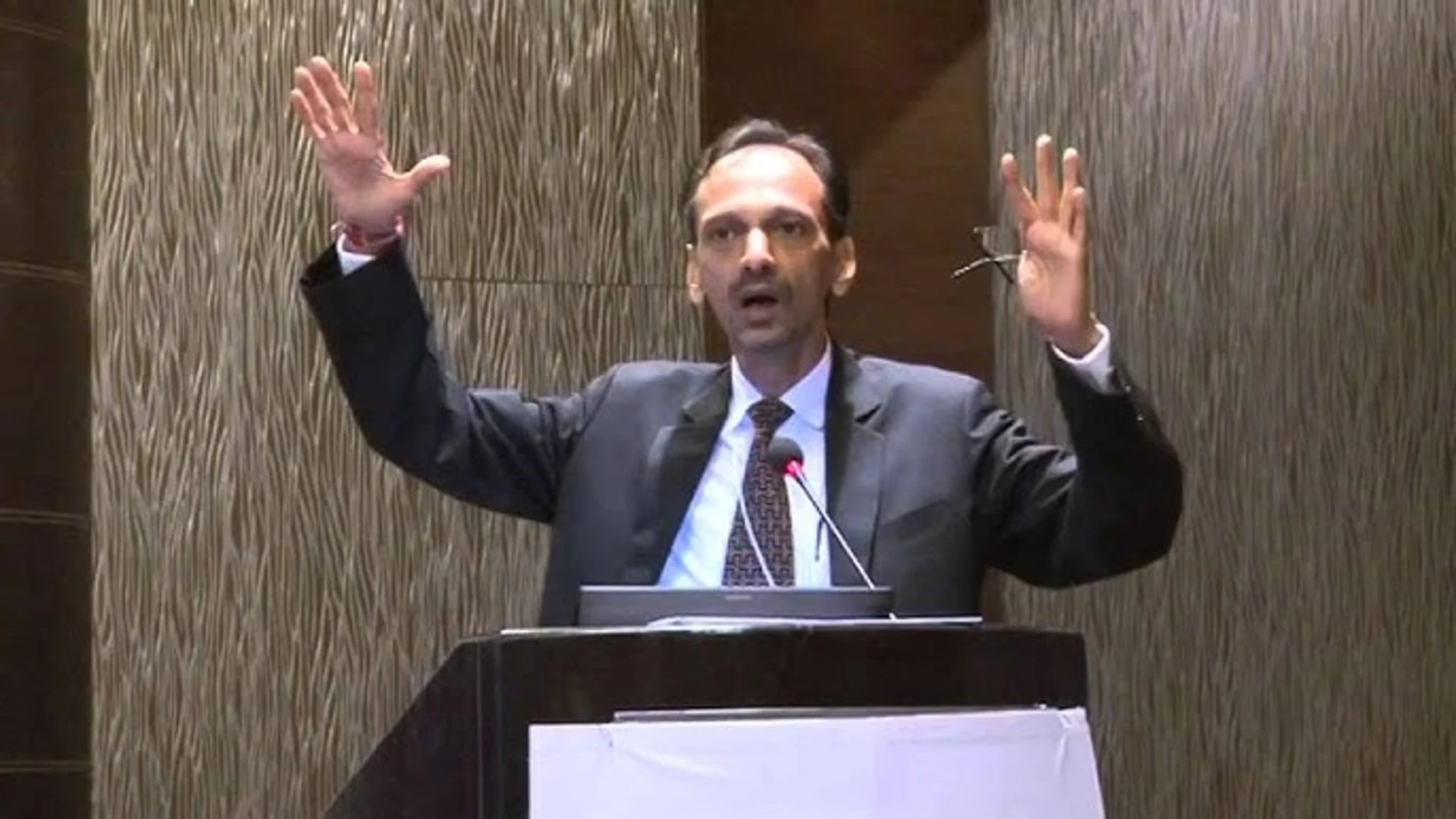

India Ratings and Research (Ind-Ra) predicts a decline in inflation for FY25 but warns that immediate rate cuts from the Reserve Bank of India (RBI) are unlikely due to persistent high food prices. According to Ind-Ra’s Chief Economist Devendra Kumar Pant, inflation must stabilize close to the RBI’s 4% target before considering rate adjustments. This stance aligns with the RBI’s October 2024 policy update, where it held rates steady, signaling caution due to inflation risks and global uncertainties in West Asia, which could influence food and fuel prices.

Ind-Ra also points to positive signs in rural demand, noting that increased real wages in July and August 2024 could bolster consumption. Moreover, India’s above-normal monsoon has improved reservoir levels, potentially supporting agricultural output. However, weak manufacturing growth, recorded at just 3.6% over the first five months of FY25, reflects challenges due to uneven income distribution and dampened consumer demand, limiting broader economic gains.

On the trade front, Ind-Ra highlights a widening goods trade deficit amid strong imports and declining global demand for exports. Still, resilient services exports and remittances are expected to keep the current account deficit manageable at an estimated 1.0% of GDP. The rupee, forecasted to average 84.08 against the USD, may depreciate more slowly with anticipated capital inflows and India’s inclusion in global bond indices, which should also strengthen forex reserves.

ALSO READ: Maharashtra: BJP Leader Claims Nawab Malik Is A ‘Terrorist’, ‘Dawood’s Agent’

Amidst these mixed economic indicators, Pant emphasized the importance of upcoming festive sales as a key gauge for potential growth revisions in FY25.