Globally, the ever-increasing debt is generating a concern, for instance, according to the Institute of International Finance (IIF) global debt passed $305 trillion in 2022; mostly due to China and US. Interestingly, the global debt is on rise in each year. While In 2021, global debt reached a record $303 trillion, in 2020 the amount was $226 trillion. A primary reason for such a debt build-up is that Covid-19 and now the war in Ukraine have pushed global debt to new highs. One comfortable factor in this regard is that a “Debt Service Suspension Initiative (DSSI)” was launched by Group of Twenty (G-20) countries in April 2020 to assist the poorest and most vulnerable low- and middle-income countries.

Interestingly, China accounted for over half of the combined aggregate net inflows to low- and middle-income countries in 2020. According to the World Bank data, short-term debt, of which about a third was trade related, accounted for the largest share of China’s end-2020 external debt stock, 53 percent at end-2020, down a tad from 57 percent at end-2019. Long-term debt was the fastest-growing component, rising 22 percent in 2020 to $1.1 trillion. The major contributor was the $217 billion in bond issuances by public and private entities in the China Interbank Bond Market (CIBM) purchased by non-residents. Non-resident participation in China’s onshore bond market has risen steadily since 2016 when the market was opened to foreign investors. At end-2020, Chinese bonds held by non-residents totaled about $635 billion and accounted for 58 percent of China’s long-term external debt.

According to the World Economic Forum, from 2019 to 2020, the aggregate value of household, private and non-financial debt in advanced economies (AEs) have increased by 33 per centage points, in China the same combined value has increased by 22 per cent, in emerging market middle income economies it has increased by 16 per cent, and in low income developing countries it has increased by 8 per cent. Intriguingly, the US is the most heavily indebted country in the world with total external debt stock estimated at US$ 23.4 trillion, constituting 22.6 per cent of the total global debt at end-December 2021. Following the US are the UK (9.5 per cent), France (7.0 per cent), Germany (6.7 per cent) and Japan (4.5 per cent). China and Brazil were the only two EMDEs in the list of top 20 most indebted countries. With the increase of 14.5 per cent in its level from December 2020, China has moved its position from 12th to 9th among most indebted country in December 2021, whereas Brazil which occupied the 20th position last year, was on the same position in December 2021. (This is also highlighted in the “India’s External Debt-A Status Report” 2021-22, Ministry of Finance, GoI; pp.56).

An IMF Working Paper (WP/22/122, June 2022) by the authors Martinez L, Francisco Roch, Francisco Roldan and Jeromin Zettelmeye on “Sovereign Debt”, has thrown certain interesting questions and analysis. For instance, in response to the question of whether today’s debts in advanced economies can be repaid without some combination of high inflation, financial repression, or even default (contradicting the assumption that advanced country debt is default risk free); the paper has cited some authors, such as Olijslagers et al. (2021) and Jiang et al. (2021), who have argued that there is an inconsistency between today’s high debt levels, primary fiscal balances that are expected to remain in deficit far into the future. Further, according to Mitchener and Trebesch (2021), there are four main peaks in emerging market defaults in the last 200 years: in the 1830s, the 1880s, the 1930-40s, and the 1980s. More than half of emerging market countries were in default during these periods. Most of periods have included many Latin American countries, but the 1930-40s wave triggered by the Great Depression was global, and the 1980s defaults included many African and some Asian developing countries. Advanced countries defaulted less frequently. At least ten percent of advanced economies were in default during and immediately after the Napoleonic wars in the early 19th century, during a long period from the 1830s to the 1870s, and during the 1930s-40s. In 2012, Greece became the first advanced country since the 1960s to undergo a deep debt restructuring.

A latest incident is Sri Lanka debt crisis, whereas the country has defaulted in May for the first time in their history. The country confronts budget and current account deficits, hyperinflation, a devalued currency, and a massive sovereign debt. The root of the problem started since 2009, when the then President Mahinda Rajapaksa resorted towards huge foreign loans to pay for war expenses and started infrastructure projects to attract tourism. Global lenders like China provided debt to serve existing debt, due to low level of forex reserves of Sri Lanka. The Sri Lankan President, instead of taking attempts to shore up forex reserves and necessary economic reforms, has undertaken popular political policies like tax cuts which was a disaster. Unfortunately, the Covid-19 pandemic has devasted the tourism industry, and Sri Lanka was not any exception to this. Further, the decision to ban chemical fertilizers in 2021, to make Sri Lankan farming “all organic” devasted the tea industry, Sri Lanka’s main export crop.

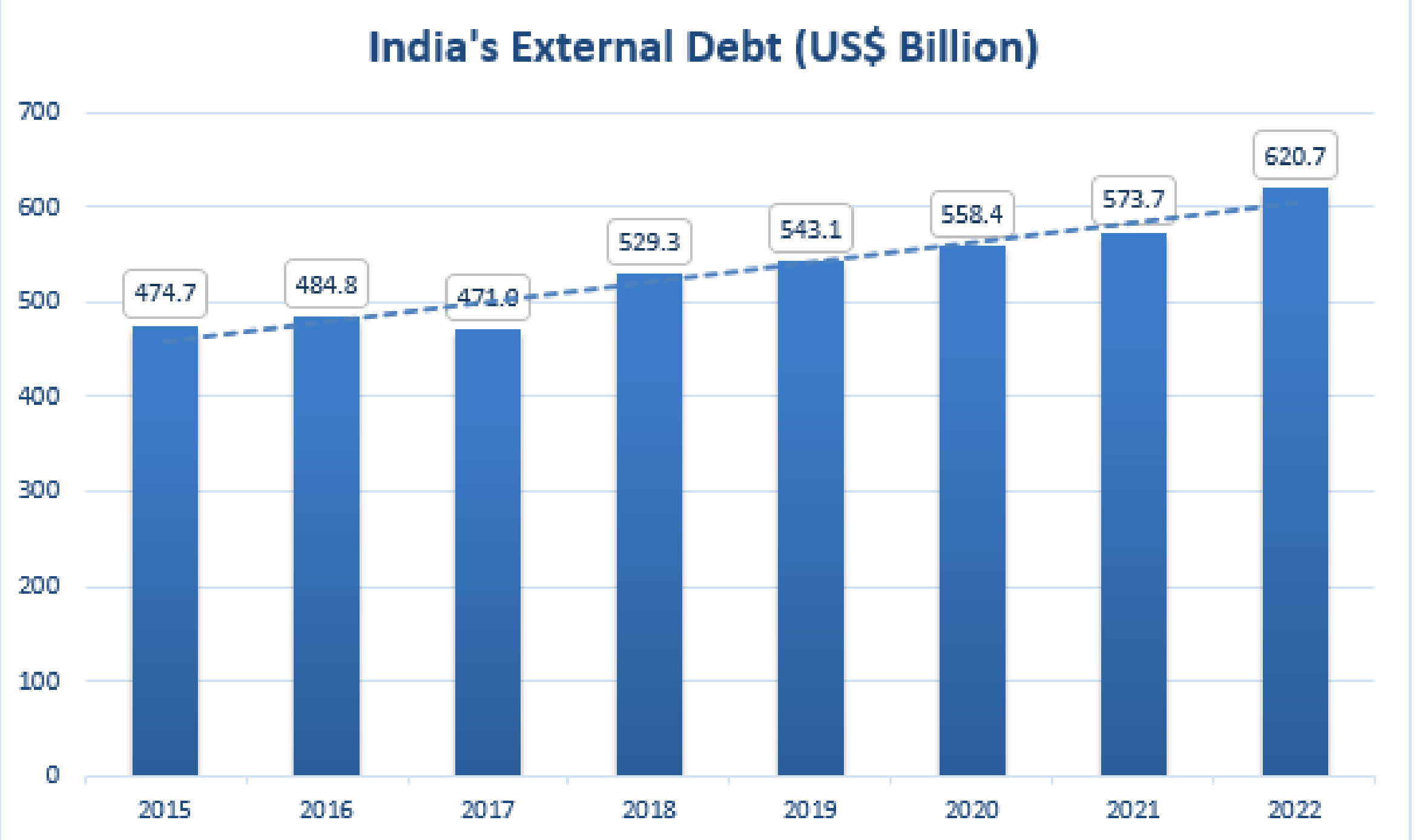

In India, at end-March 2022, the external debt stood at USD 620.7 billion, growing by 8.2% compared to the previous year. External Debt to GDP ratio remains at 19.9%, debt-service ratio at 5.2% and forex reserves to external debt ratio at 97.8%. The long-term debt constituted 80.4 per cent of the total, while the rest of 19.6 per cent was short-term in maturity. Short-term debt is incurred primarily to finance imports. The sovereign debt at US$ 130.7 billion climbed higher by 17.1 per cent over its level a year ago, mainly because of additional allocation of SDRs by the IMF during 2021-22, whereas non-sovereign debt has increased 6.1 per cent to US$ 490.0 billion over the level as at end-March 2021. Commercial borrowings, NRI deposits and short-term trade credit are the three biggest constituents of the non-sovereign debt, accounting for as much as 95.2 per cent. While NRI deposits declined by 2.0 per cent to US$ 139.0 billion, commercial borrowings at US $ 209.71 billion and short-term trade credit at US$ 117.4 billion rose by 5.7 per cent and 20.5 per cent, respectively. The non-financial corporations were the largest-borrowers with an outstanding external debt estimated at US$ 250.2 billion as at end- March 2022.

The US dollar denominated debt continued to be the largest component of India’s sovereign external debt, with a share of 34.1 per cent as at end-March 2022, while the SDRs emerged as the second leading currency (31.1 per cent). India’s gross external debt service payments were lower at US$ 41.6 billion in 2021-22 than US$ 49.4 billion during the previous year, recording a decline of 15.9 per cent. Among the sources of debt, commercial borrowings (CBs) is the dearest with an implicit interest rate of 4.3 per cent, followed by NRI deposits (3.3 per cent) and external assistance (1.2 per cent). The debt service ratio during 2021-22 declined to 5.2 per cent from 8.2 per cent during the previous year due to an increase in external current receipts and decrease in debt service payments. The external debt service payments are projected to rise to US$ 54.7 billion in 2022-23 and then reduce to US$ 40.0 billion in 2023-24.

In FY 2020-21, the Central Government debt/liabilities increased by more than 9 per cent points of GDP, primarily due to Covid-19 pandemic, that disrupted projections of government’s public finances substantially.

Despite, the increase of yearly interest burden by the GoI, a cross-country comparison shows that stock of India’s external debt is modest. On the other hand, among the Emerging Market and Developing Economies (EMDEs), India, as at end-December 2021, was the third largest externally indebted country following China and Brazil. Interestingly, recently India has

surpassed Britain to become the fifth largest economy in the world. A decade ago, India was ranked 11th among the world’s largest economies, while Britain was at number five. India is now behind the US, China, Japan, and Germany in terms of economy. By 2027, India is expected to become the 4th largest economy in the world overtaking Germany. According to the IMF’s World Economic Outlook (WEO), from a share of under 1.5% in global GDP (in current dollars), the Indian economy is expected to account for more than 4% of global GDP in 2027. At the current juncture, we have seen many developed countries are suffering from severe challenges like inflation, geopolitical tensions, de-globalization and protectionary measures, energy crisis, and even certain countries are not totally immune from probable economic recession. In recent times, we have experienced shocks like Covid, Russia-Ukraine war, global inflation among others, and a potential shock stemming out of the global debt challenge cannot be ruled out. The challenge for certain developing countries like India is to devise strategies to safeguard from such global shocks, while maintaining domestically macroprudential policies.

Vipin Malik is Chairman and Mentor, Infomerics Ratings.

Sankhanath Bandyopadhyay, Economist, Infomerics Ratings.