US President-Elect Donald Trump’s sudden outburst on BRICS has created much buzz. The incoming 47th President of the United States, in his unique style, has threatened the BRICS countries not to take America for a “sucker” that they could do business with it, while having their own BRICS currency, thus ditching the dollar. He threatened the imposition of 100% tariffs on BRICS countries if they adopted any such currency, which would be seen as de-dollarisation—an attempt to discard the dollar as the main mode of doing business worldwide. At one level this is what makes Donald Trump different from other US Presidents, he is not shy of exercising the power he has and has in fact already warned that he would impose 60% tariff on Chinese goods. For him, it is not just about America first, but also about America as the sole leader of the world. But the problem is that he is basing his outburst on the narrative being peddled by western experts/think-tanks and the media that BRICS is anti-West, specifically anti-US, and that a BRICS currency is in the offing.

The truth is, there is no BRICS currency on the horizon—there is no plan, no roadmap, nothing. The push for a BRICS currency is coming primarily from China and Russia, and India in particular has been opposed to any such currency, one of the reasons why a BRICS currency has not come into existence till date. India’s opposition, although publicly not stated, is primarily because any BRICS currency would be driven by China, and it is China’s tune that Russia is singing. While it is understandable why countries such as Russia and Iran would push for a BRICS country. They are sanctions-battered and have been looking for alternate means to carry on with trade and a BRICS currency would serve their interest since it will help them bypass the western sanctions regime. Both countries have been thrown out of the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system, through which banks send information and instructions on money transfers, which is essential for international trade. The US has been accused of weaponising the dollar through the rampant use of sanctions, pushing many countries towards a financial abyss. This holds true for Russia and Iran in particular.

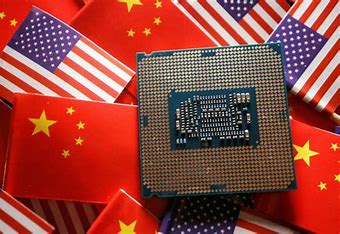

As for China, it is focused on dislodging the US as the number one world power. At present, it sees the world as bipolar, with the US and it dominating the two poles, which eventually will become unipolar, with China being the only superpower. Arguably, it is already moving towards that direction. China’s move towards de-dollarisation includes steps towards increasing its gold reserves and reduce its investments in US Treasury bonds, so that its economy is insulated from any hard-hitting sanctions by the US. Meanwhile, China has been pushing for business in its own currency, especially among the BRICS-plus nations, which countries like Russia have lapped up as it takes care of its financial needs, helping it to bypass the sanctions. This is one of the reasons Moscow has been pushing New Delhi to do business with it in the Chinese yuan, instead of the Indian rupee, as it is easier to use that money specifically when trading with China, Russia’s biggest trading partner. So, it is in China’s and Russia’s interest to have a common BRICS currency, to bypass the dollar. But it also means replacing one “hegemon” with another—the US with China—with the possibility of the Chinese Communists having major control of the international financial system, which they will eventually weaponise. Lest we forget, the BRICS countries already control 32% of the world GDP, primarily because of the size of the Chinese economy. And China controlling the international financial system means the rise of authoritarianism and an attempt to reshape the world in Chinese communist characteristics, something the free world can do without.

Ironically, it is the sanctions regime of the US that has pushed many countries towards the BRICS, in a bid to insulate themselves from any future sanctions. It is because of this that China’s currency has been strengthened. So instead of using threats, President Trump needs to stop weaponising the dollar, as that will eventually hurt the US the most and aid the rise of China. As for India, it needs to convey to President Trump in clear terms that it was never a part of the business of launching a BRICS currency, and that this multipolar platform still does not have its own currency is largely because of the efforts of New Delhi. President Trump also needs to understand that BRICS is not anti-West, it is just non-West, which Prime Minister Modi has been speaking of, a view reflected by Russian President Vladimir Putin too recently. As long as India is a part of that platform, BRICS will never be anti-West.