INTRODUCTION

The term Company is having roots from the Latin word com meaning with or together; panis that is bread.

By this we can infer that the earliest meaning of “Company” would be, “People who have their meal together”.

DEFINITION OF ‘COMPANY’

A company is; “a voluntary alliance of a definite number of people having some common interests between them that is now united by some commercial or industrial undertaking to carry out legitimate business”

Strictly speaking, the word company has no special technical or legal meaning.

Speaking in the terms of the Companies Act, 2013 “a company means a company formed and registered under” the Companies Act”

Under the common law a company is a “legal entity” or a “legal person” that is separate from the lives of its members and also capable of surviving beyond it.

In general terms, a Company is an association of persons who are together or united to attain some common objective, that would be to earn some profit, promotion of arts/science or even some charitable purpose.

A Company has to be registered under the Companies Act, 2013. A company is totally different from a “Partnership” or “Sole Proprietorship”, because their sources are very limited and their liabilities are unlimited but in the case of a company the liability is limited.

MEANING AND CONCEPT OF CORPORATE VEIL

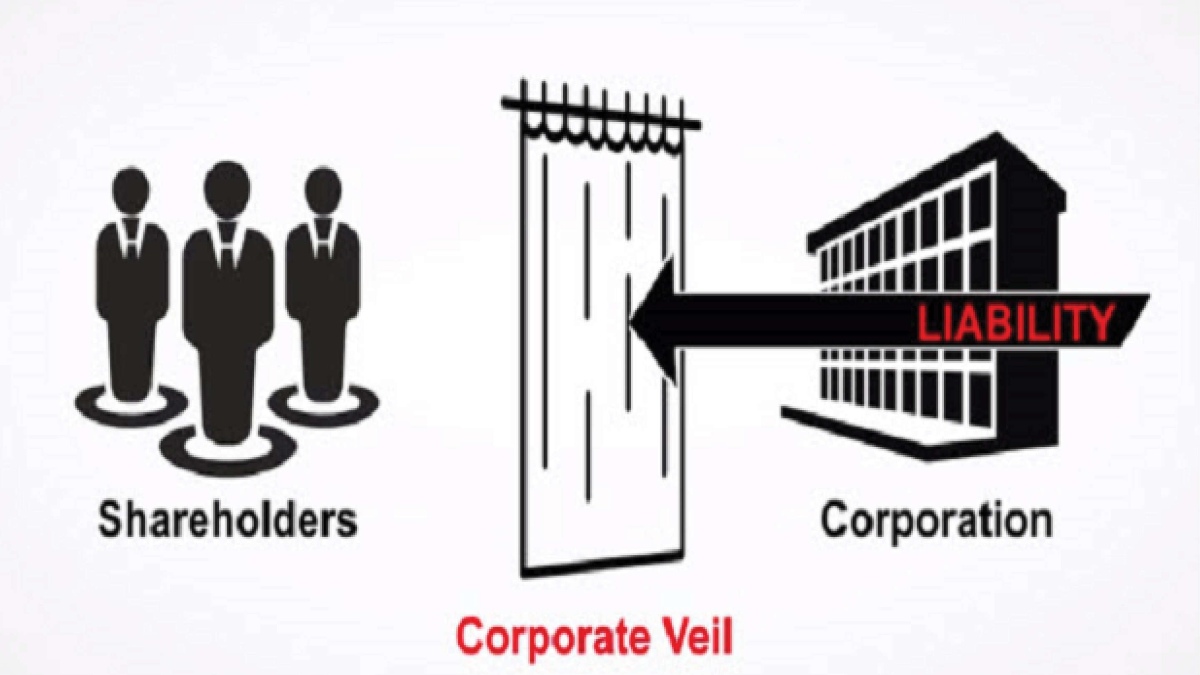

The philosophy of a corporate personality states that as soon as the incorporation takes place, the company and its members become two separate legal identities, & this principle of corporate personality is also known as corporate veil.

Veil means a thin blanket, which acts as a curtain between the members and the company. If we lift the veil, we could see the natural person behind it.

In actual reality a company is dependent on its members, directors or partners for its better functioning. So, the philosophy of corporate personality states that, the members can use the corporate veil theory for the legitimate work functioning of the company. But, at the origin, it has been found that the promoters, members, director & partners use the principle of corporate veil to get rid of their personal liability such as fraud and illegal activities.

LIFTING OF THE CORPORATE VEIL

Before we start discussing about the concept of “Lifting of the Corporate Veil” we have to take into account the concept of “Separate Legal Entity”.

After incorporation, company and its members become “separate legal identity”, and this concept of separation is known as “Corporate Personality” or “Corporate Veil”.

A company to function, depends upon its members or directors, So the principal of “Corporate Veil” says that, “For all the legitimate purposes, the members/directors/promoters of a company can defend themselves by the use of “Corporate Veil” or “Corporate Personality”.

Now recent trends have shown that these members and/or directors, to prevent them from any liability and to conduct fraud, illegal activities, make the wrong use of “Corporate Veil”.

So, to prevent these fraud, illegal activities and misuse, the concept of “Lifting of Corporate Veil” comes into action.

Now one thing we have to understand is that if anyone misuses their Corporate Personality to do fraud or illegal activities, then our Courts can lift up this “Veil” and look into the matter that who particular “Person” has done this Act and can make the individual responsible.

So, to prevent the misuse of “Corporate Personality” we have the principle of “Lifting of Corporate Veil”.

NOW LET’S UNDERSTAND THE CIRCUMSTANCES UNDER WHICH THE CORPORATE VEIL CAN BE LIFTED

Fraud or Improper Conduct – If the corporate personality is used for conducting fraud or improper conduct, then in these circumstances the courts have the power to lift up the corporate veil and hold any person liable for such activities, be it director, manager or any other officer of the company. The purpose here is to find the real culprit disguising behind the curtain of corporate personality or separate legal entity.

Case Law – Jones v. Lipman – Lipman enters into a contract with Jones that Lipman will sell his property to Jones, but then again after sometime Lipman changes his decision, and to prevent himself from specific performance of the contract, he sells his property to his company. When Jones demands the property in order to fulfil the contract, Lipman says that the property is not with him, and that he had sold it to his company.

Held – The court held that there are only 2 members of this company Lipman, and a Clerk. The court observed that Lipman used his own company, as a mask to prevent the specific performance of the contract, and thus this is a fraudulent activity.

Hence, Lipman has to perform his contract.

2. When company is a Cloak or Sham – Lets understand this concept through a case law:

Gilford Motor Co. Ltd v. Horne – Horne is an employee at the said company, the company enters into a contract with Horne that, “Apart from our business, you’ll not solicit our customers into a different transaction”. Horne signs the contract, but to escape from this condition, Horne builds his own company which works exactly like Gilford Co. and he then starts approaching the customers of Gilford Motor.

Held – The court herein applied the principle of Corporate Veil and held that the sham company of Horne was built only for the purpose of conducting illegal activity, and thus, it is not valid.

The court applied Injunction on both Horne and his company.

Evasion of tax – If a company for the sole aim of tax evasion, builds 3-4 new companies to transfer the assets of the principal company into the new companies, then it’s not legitimate use. For example, Case law – Workmen of Associated Rubber Industries Ltd. v. Associated Rubber Industries Ltd.

War – If India goes into war with any country then the citizens of that country will become India’s Alien Enemies. And normal laws don’t apply to alien enemies.

CASE LAW: DAMLER CO LTD VS CONTINENTAL TYRE & RUBBER CO LTD

Some German Citizens form a tyre company to manufacture rubber and tyres. These German Citizens incorporate a company in England namely – “Damler Co. Ltd.”. Only one shareholder of this new company was English, and all others were Germans. The sole purpose of this Damler company was to sell the tyre and rubbers manufactured by the Tyre & Rubber Company of Germany. And in conducting the business, Damler Company was doing some transactions with “Continental Tyre and Rubber Co. Ltd”. Now World War 1 happens in which Germany and England become enemies and go into war. Damler Company already did many transactions with Continental Company and demanded payment for the same. Now, Continental Tyre Company said that during the WW1 if I give any money to Damler Company then it will be inferred that I am giving money to an enemy of the country, which is an offence. After that Damler Company approaches the courts and submits that our company is incorporated in England then what is its relation with the German Company.

Held – To which courts applied the principle of, “Corporate Veil” and held that all the administration and management of the company is being done by the German Company, and all its transactions are related with Germany, and Continental Tyres company has no need to do transactions with this company in the time of war.

Statutory provisions – The Companies Act, 2013 has been mixed with numerous provisions to point out the persons who are liable for any improper/illegal activity. The Companies Act. 2013 consists of various sections and rules for this purpose.

Judicial Pronouncements – We have separate statutes but still the judiciary plays a vital role through setting up of precedents and ensures that no guilty person walks free merely because of some technicality.

Mis-statement in Prospectus – Prospectus is the heart and soul of a company. Pursuant to Section 26 (3), Section 34 and Section 35 of the Companies Act, 2013, furnishing untrue or false statements in prospectus is punishable.Failure to return application money – According to the Section 39(3) of the Act, against the allotment of securities, if the already stated minimum amount has not been subscribed and the sum due on application is not received within the deadline of 30 days.

Misdescription of Company’s name – As the company does many transactions and contracts it is important that the name of the company is prior approved by Section 4 and is printed under Section 12 of the act.For investigation of ownership of the company – The Central Government under Section 216 of the act is authorized to appoint inspectors to investigate and report on matters of the company, its membership to determine the true persons who are financially interested in the company.

Furnishing false statements – If any person furnishes false statements, financial statement, prospectus or any other document then he/she shall be liable under Section 447 of the Act.

Repeated defaults – Section 449 – If any company or an officer commits this offence then he/she will be punishable either with fine or with imprisonment.Liability for Ultra Vires Acts – Every company is bound to comply with its memorandum of association, articles of associations and Companies Act, 2013.

This concept was evolved in the case of – Ashbury Railway Carriage & Iron Company Ltd. v. Hector Riche – Herein, the company entered into contract for financing construction of railway lines, and this operation was not mentioned in the memorandum. The House of Lords held that this action is “Ultra-Vires” and the contract is null and void.Public interest/Public policy – If the conduct of the company is in conflict with the larger public interest or public policy then the Court can lift the corporate veil and personally hold that person liable.

CONCLUSION

After reading the basics of Company Law and the relatively unique concept of “Lifting of the Corporate Veil” we learnt about how no one can take advantage of “Corporate Personality” and do improper/illegal conduct.

We can infer that the courts along with the legislature are quite active in this aspect of company law and they work on the principle that no guilty person should be set free just because of some technicality.

We all know that Company has a separate legal entity, thus has a corporate personality. But this “Corporate Personality” should not become the means of doing fraud/illegal activities, it is like a cloak that is covering the company for all legal purposes, but if the same cloak is used as a defence for committing fraud/illegal activities then the cloak will be lifted, either by the statutory provisions, as read already or by the various judicial pronouncements.

Thus, if a company is created only for the purpose of committing frauds then then the promoters/directors/members cannot be saved from the action of law. It will be deemed that it was not a company as per The Companies Act, 2013 and the person whoever did the fraud will be accountable. An important concept herein is that the company will be deemed to have not been existed. Its whole existence will be scrapped off.

After reading the basics of Company Law and the relatively unique concept of “Lifting of the Corporate Veil” we learnt about how no one can take advantage of “Corporate Personality” and do improper/illegal conduct.