The FICCI-IBA Bankers’ survey, conducted from July to December 2023, marked its eighteenth iteration, with participation from a comprehensive array of 23 banks encompassing public sector, private sector, and foreign banks. These banking entities collectively constitute a significant portion, approximately 77%, of the banking industry, categorized based on asset size.

NPAs AND RESTRUCTURING OF ADVANCES

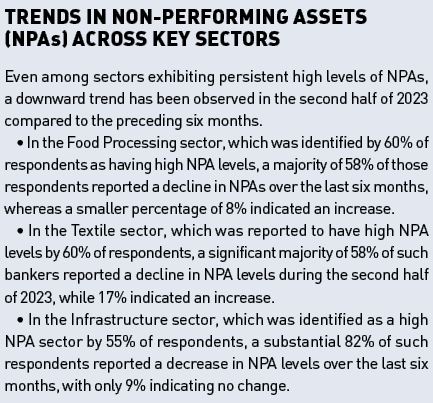

Continuing the pattern observed in the prior round, a significant majority (77%) of the respondent banks noted a decline in Non-Performing Asset (NPA) levels over the last six months. All public sector banks (PSBs) participating in the survey reported a reduction in NPA levels, while among the private sector banks, 67% cited a decrease. Conversely, none of the respondent PSBs and foreign banks indicated an increase in NPA levels during the specified period, while 22% of private banks reported a rise.

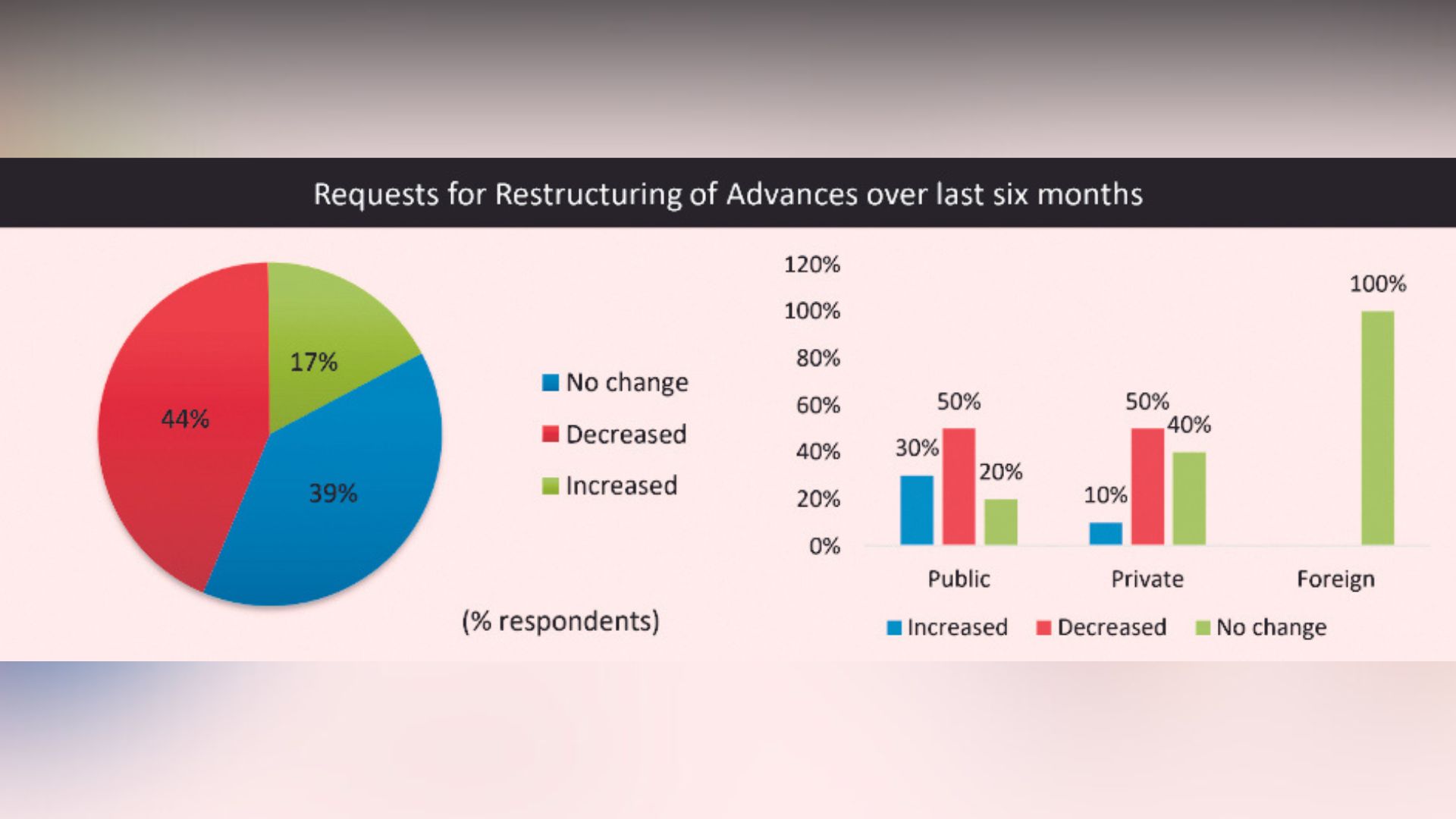

In the latest round of the survey, approximately 44% of respondents noted a decline in requests for the restructuring of advances, compared to 54% in the previous round. Conversely, the percentage of respondent banks reporting an increase in restructuring requests remained stable at 17%, consistent with the previous round. Further analysis by bank type revealed that among participating Public Sector Banks (PSBs), 50% observed a decrease in restructuring requests, while 30% reported an increase. Meanwhile, among participating Private Sector Banks, half of the respondent banks reported a decrease, with only 10% indicating an increase in restructuring requests over the past six months. Notably, all participating Foreign banks reported no change in the volume of restructuring requests.

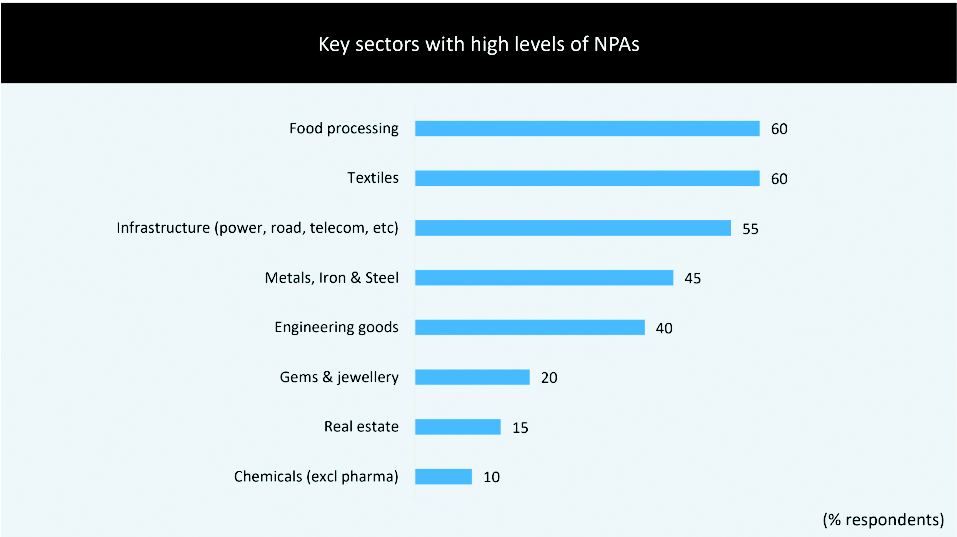

Among the sectors persistently exhibiting elevated levels of Non-Performing Assets (NPAs), the majority of participating bankers highlighted industries such as Food Processing, Textiles, and Infrastructure. Additionally, sectors identified as prone to high NPAs encompass Metals, Iron & Steel, and Engineering Goods.

OUTLOOK ON NPAs

According to the RBI Financial Stability Report, Indian banks have seen a positive trend in asset quality, reaching a new low in the gross non-performing asset ratio at 3.2% as of September 2023, down from 3.9% in March 2023. Respondent banks in the survey expressed optimism about asset quality prospects, attributed to policy and regulatory support, which was evident in the survey results.

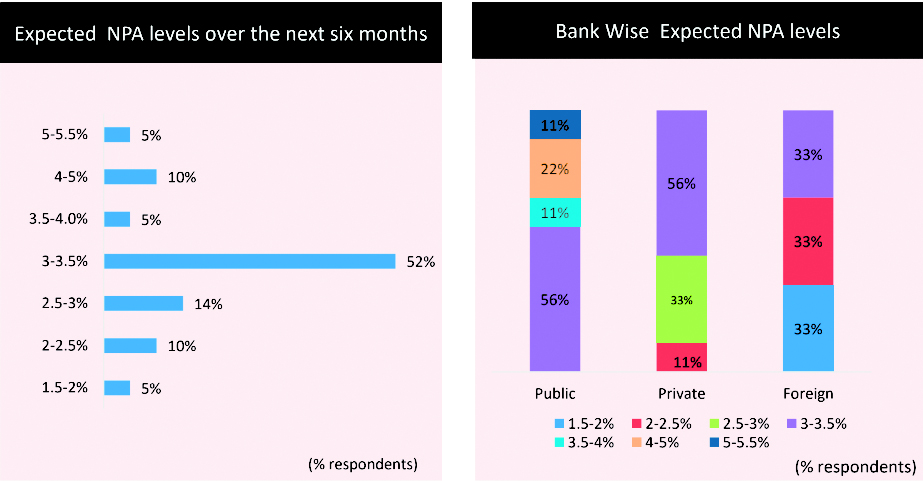

Over half of the respondent banks anticipate gross NPAs to be in the range of 3% to 3.5% over the next six months, while 14% expect NPA levels to be in the range of 2.5% to 3%. A majority of both Public Sector and Private Sector Bank respondents (56% each) foresee gross NPAs to be in the range of 3% to 3.5%, whereas only 33% of responding foreign banks expect NPA levels to be in this range.

Respondent bankers identified several key factors contributing to the expected improvement in asset quality over the next six months, including a resilient domestic economy, increased credit growth supported by government capital expenditure, a rising provision coverage ratio, restructuring and rehabilitation of eligible stressed units, mobilization of One Time Settlement (OTS) proposals, robust recovery mechanisms, and timely initiation of SARFAESI action in eligible cases.

However, respondents also anticipate certain sectors to continue experiencing NPAs over the next six months, including Textiles and Garments, MSME, Agriculture, and Gems & Jewellery.

OUTLOOK ON NPAs SECTOR-WISE

Respondent bankers highlighted several factors driving the anticipated enhancement in asset quality over the upcoming six months. These factors encompass a robust domestic economy, augmented credit expansion backed by government capital investments, a growing provision coverage ratio, restructuring and revitalization efforts for eligible stressed units, facilitation of the One-Time Settlement (OTS) proposals, effective recovery mechanisms, and prompt initiation of SARFAESI action in eligible cases. Nonetheless, respondents foresee persistent NPAs in specific sectors over the same period, notably Textiles and Garments, MSME, Agriculture, and Gems & Jewellery.