Expects Nifty 50 to reach the range of 30,000-35,000 points in the next three years.

According to an analysis by FidelFolio, the current general election and its outcome would not have any major long-term effect on the equity markets. Apart from few exceptions, the Nifty Indices have often demonstrated an upward trajectory around elections period, according to the report “Deciphering Market Trends: Navigating Pre-Election Dynamics and Global Turbulence” by FidelFolio. It says that Nifty 50 is expected to be between 30,000 and 35,000 points in 3 years.

Despite all of the difficulties and market volatility during the previous 30 years, the Nifty index has provided a CAGR return of ~13% when examining market returns for the period.

Despite the weakest coalition government in office from 1996 to 1998, the index managed to provide slightly positive returns following a period of significant volatility.

Kislay Upadhyay, smallcase manager & Founder of FidelFolio stated, “As the country gears up for another crucial election, investors are keenly eyeing the market’s performance, wondering whether it will witness a pre-election rally or correction. However, the global scenario paints a contrasting picture. The growing turbulences in the Middle East, the Russia-Ukraine conflict, and the poor economic indicators from the major economies could impact the Indian stock market. Subsequently, the customary three- to six-month post-election review may not be as applicable this time around since global issues could soon eclipse the consequences of the election outcomes.”

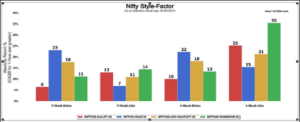

In 2014, as illustrated in the graph below, anticipation of a new government and its potential influence on the economic growth spurred a pre-election rally. Indices such as Nifty 100 Quality 30 (13% & 25% from 6% & 10% after 3 & 6 months respectively) and Nifty 200 Momentum (14% & 35% from 11% &13%) saw significant improvements, thus reflecting positive sentiments.

However, in 2019, while expectations of the reigning government remained high, the lack of anticipation of any significant changes in economic policies led to a slight negative trend in indices (shown in graph below) across almost all sectors.

Looking ahead to the 2024 election there’s a general consensus that the current government will retain power. While this may provide stability and continuity, expectations for major shifts in government policies or thrust areas is miniscule.

Sectoral Predictions

During the past two elections it was observed that the performance within various sectors differed significantly. While Nifty Healthcare witnessed a substantial upward trend (20% & 42% from 2% & 8% after 3 & 6 months respectively), the Nifty Energy saw a negative trend (0% & -1% from 27% & 25%).

Expressing his optimism about how his portfolio will be impacted by the elections, Mr. Upadhyay further added, “We firmly believe that this time quality stocks with strong fundamentals (companies with high capital efficiency and growth) will be attractive and will gain market share. In the recent past, quality stocks have not performed and will perform now. Shivalik compounder, a portfolio of FidelFolio Investment consists of quality stocks filtered with specified criteria, will benefit.”

Although, this year, it is expected that quality stocks will do well in banking and financial services, diagnostic, and the consumer discretionary segment. However, investors should remain vigilant and adaptable in response to the ever-evolving global dynamics.