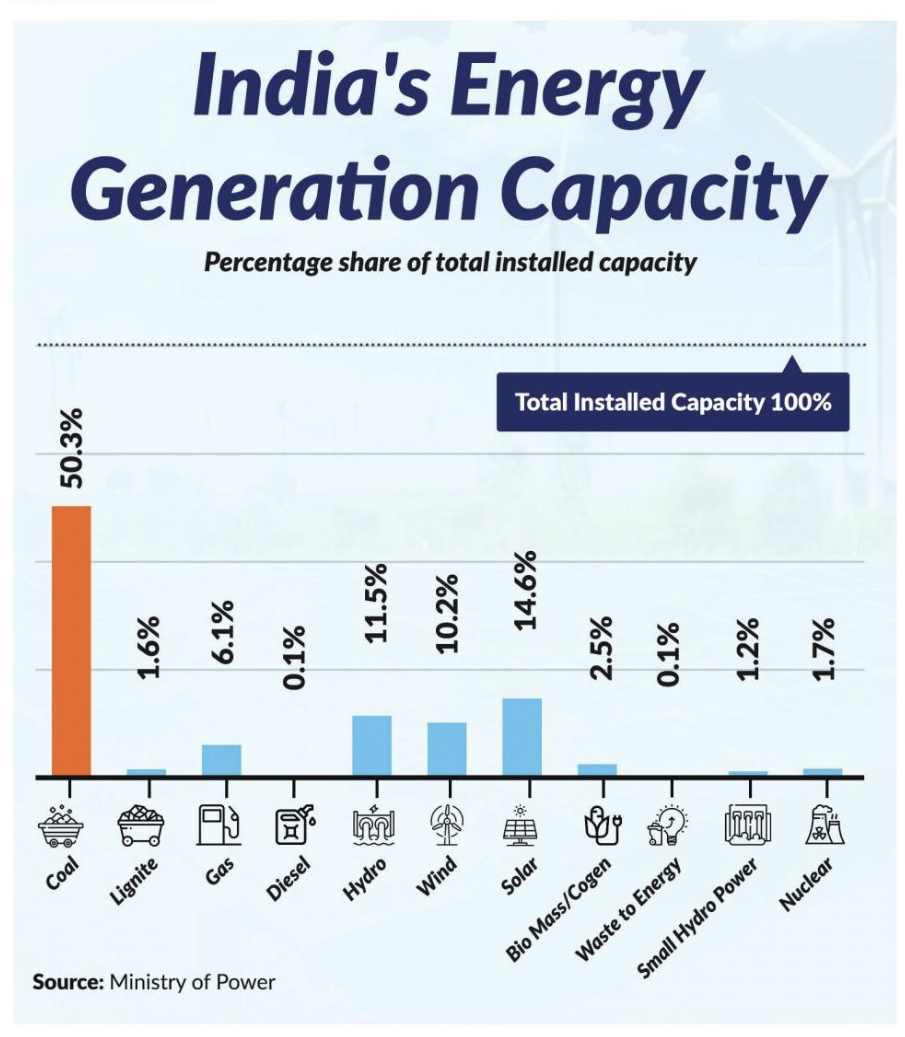

Even as India moves towards a cleaner economy with non-fossil fuels, or renewable sources of energy becoming more widely used, coal remains the mainstay of India’s energy needs. It accounts for 50.3 per cent of the country’s energy needs and is the most abundant fossil fuel in India. However, its abundance has often belied the supply and availability of solid fuel, which is one of the most polluting. According to a recent report by the Global Energy Monitor (GEM) based on data from the Global Coal Mine Tracker, of the total capacity of coal mines currently operational in India, nearly 36 per cent remain unused. The report’s assessment of this underutilisation comes on the back of several instances of coal shortages that the country has witnessed over the past year. We take a look at the country’s coal reserves, the report’s findings, and the measures the government has taken to improve its coal generation capacity and production while staying on the path of its green fuel targets under the Paris Climate Agreement.

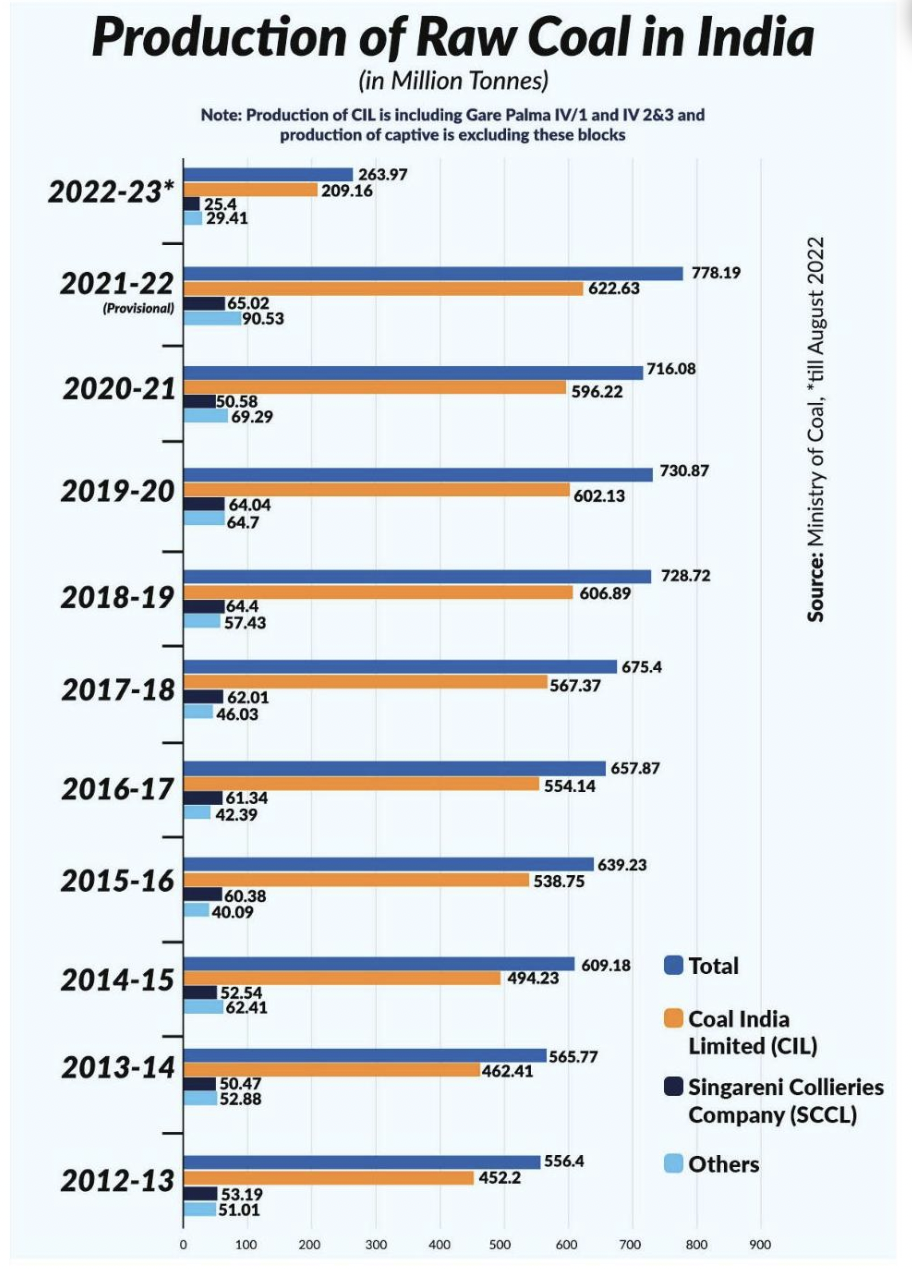

India is the world’s second-largest consumer, producer, and importer of coal, which accounts for nearly 75 per cent (coal thermal power plant) of its annual electricity generation. India also has the world’s fourth largest coal reserves with a current coal production capacity of 433 million tonnes (MT) per annum. From the start of the Financial Year (FY) 2022-23 till 31st May 2022, India produced a total of 137.85 MT of coal, up by 28.6 per cent from 104.83 MT in the same period in 2021. In October 2022 Union Coal Minister Pralhad Joshi said that India had enough coal reserves to last 50 years. While there are enough coal reserves to support India’s growing energy demands in coming decades, poor management of coal production and manufacturing and supply chain bottlenecks limit the availability of the fuel.

Bouts of Coal Shortages

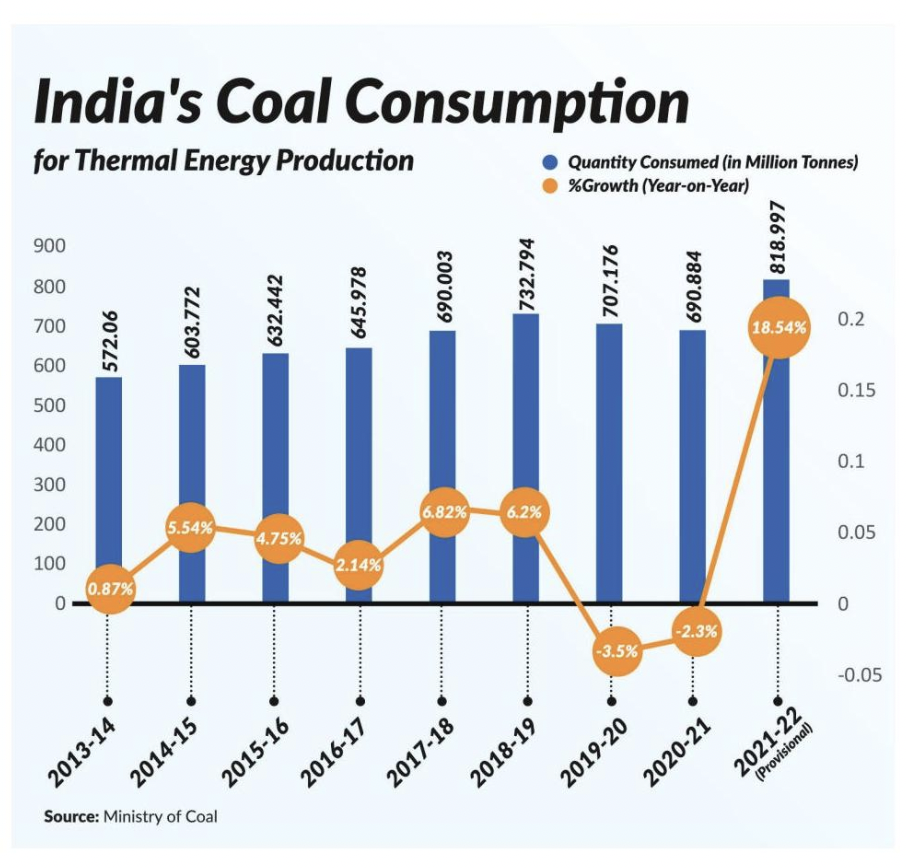

According to the Central Electricity Authority, as the country opened up the economy to greater movement and trade after consecutive COVID-19 pandemic shutdowns, the demand for coal jumped from 106.6 billion units (BU) per month in 2019 to 124.2 BU per month in 2021. In 2022, the demand further increased to 132 BU, driven primarily by prolonged heatwave conditions across several parts of the country. At the time, increased power demand due to restarting economic activity was the main reason cited for the shortage of coal. However, Coal India Limited’s (CIL) production, accounting for 80 per cent of the country’s domestic output, has also stagnated at around 600 MT for the last three years.

Poor management of coal reserves, compromised supply prior to the monsoon, and inadequate maintenance of stocks had reportedly exacerbated the coal shortage the country witnessed in October 2021. According to the Centre’s Core Management Team (CMT), the shortage in coal supply was a result of heavy rains in Gujarat, Punjab, Rajasthan, Delhi, and Tamil Nadu, resulting in lesser coal production. More recently, in April 2022, coal stocks in more than 100 thermal plants had fallen below 25 per cent. In over 50 thermal plants, the stocks fell below the 10 per cent mark, with states seeking additional coal supply from CIL. To deal with the reduced supply and increased demand for electricity faced in March-April 2022, some power producers paid premiums of up to 300 per cent to secure coal supplies in the domestic spot market. To cover up the shortage in supply, CIL raised the supply of coal to thermal stations by 14.2 per cent during the first half of April 2022 as compared to the period in 2021. In spite of several efforts to increase the output and supply of coal to thermal power plants, there remains a huge gap between the demand and supply of solid fossil fuel, leading to depleting coal stocks in generating stations.

New Coal Mines and Increasing Imports amidst Unused Capacity

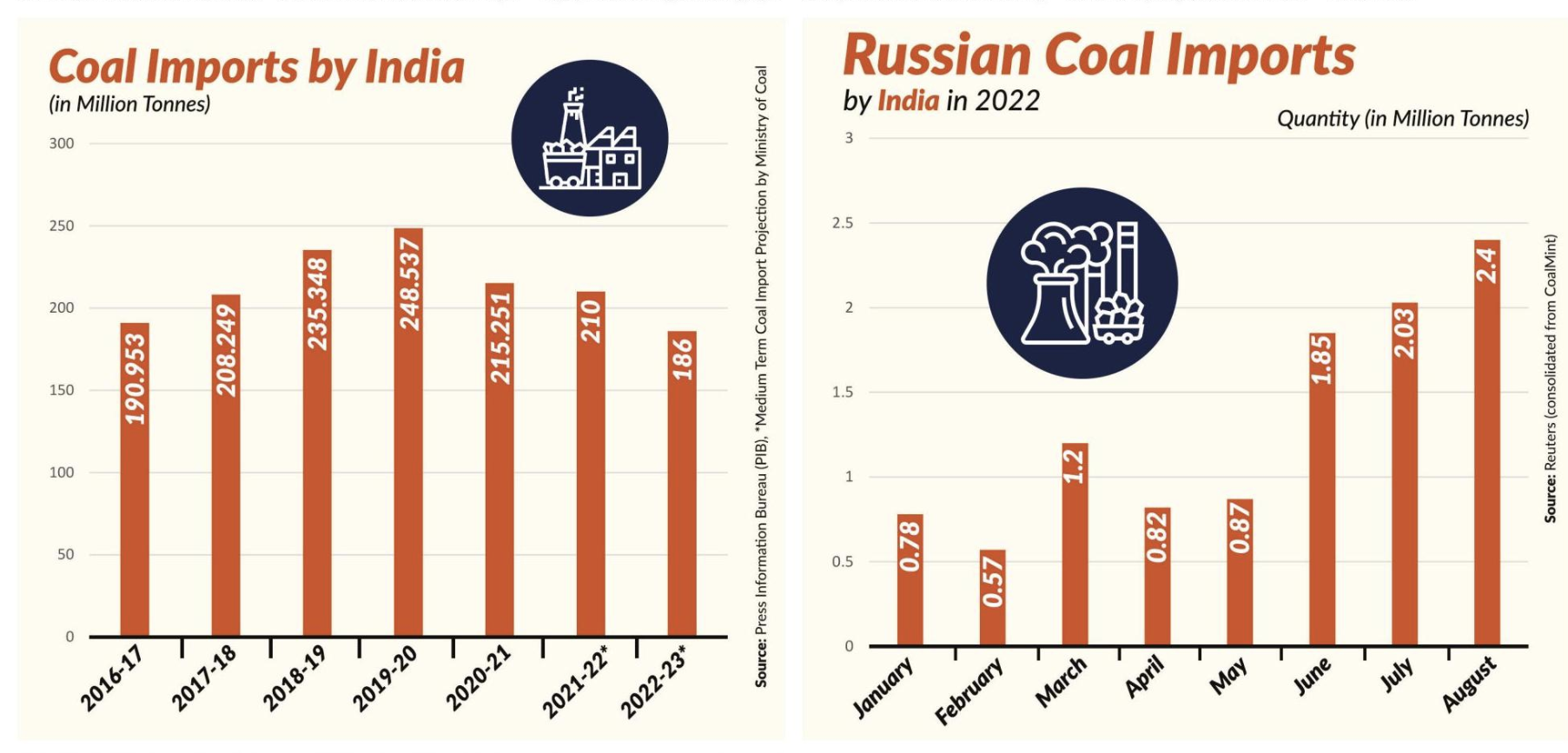

India’s coal mines remain underutilised, and according to the GEM, India has increasingly relied on importing more coal to meet its needs. In the past, the Power Ministry has blamed declining coal imports for the current crisis in fuel stocks. From 21.4 MT of coal imported in 2018-19, the import of fuel fell to 8.3 MT in 2021-22. The Russia-Ukraine conflict has also had an impact on India’s coal imports due to the disruption of the international coal supply. Coal imports have become more expensive and the cost of India’s coal imports is expected to rise by 35 per cent in the fiscal year 2022-23. It is to be noted that India’s coal supplies from Russia have seen an exponential increase since the start of the Russia-Ukraine conflict. In January 2022, India imported 7,89,500 MT of coal from Russia which rose to 24,00,000 MT in August 2022.

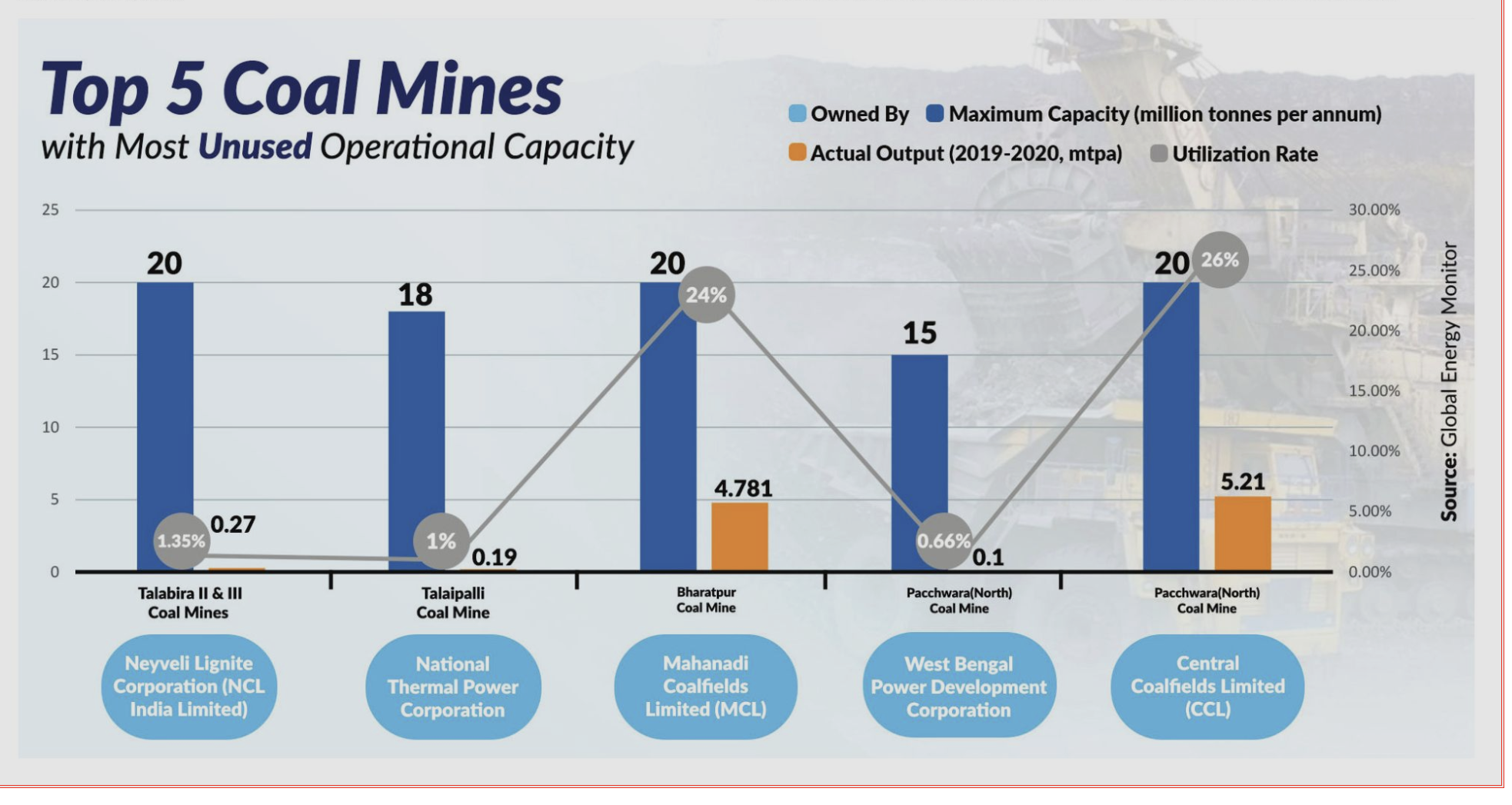

The GEM report lays special emphasis on the 99 new coal mines planned by the Government of India even as more than a third of the capacity at its current coal mines remains unused. According to the report, India’s existing coal mining capacity of 433 MT per annum (mtpa) is greater than the projected capacity of 427 mtpa from the 99 new coal mines. The findings highlight the adverse impact of the new mines on ecology and indigenous lives and livelihoods. Of the 427 mtpa new capacity, 159 mtpa (37 per cent) will be located in high-risk water zones, while 230 mtpa or 54 per cent will be located in extremely high-risk water zones. The location of the new mines can worsen water shortages in the region increasing demand to 1,68,041 kiloliters per day as 77 per cent or 329 mtpa of the planned capacity is located in the low-income states of Jharkhand (115 mtpa), Odisha (130 mtpa), and Chhattisgarh (84 mtpa). The report states that over 100 MT of capacity lies unused at active mine sites in Jharkhand and Odisha, the major mining regions of India. This adds up to 40 per cent of unused mining capacity in these states. Interestingly, according to GEM’s analysis of CIL’s Annual Reports, competition from renewable sources of energy, infrastructure impasses, and land-use concerns hinder the output of active coal mines.

Reducing Coal’s Share in power supply: Shifting to Cleaner Fuels

Even as India moves towards achieving net zero emissions by 2070 under its international obligations to deal with climate change, a need to reduce coal’s share in India’s power supply does not appear to receive the required attention. To avert coal shortages, the government has pushed to increase production and rationing of coal supply to non-power sectors and to lean on captive producers for more output. Coal generation by CIL reached a high of 1.64 MT per day in April 2022 from 1.43 MT per day in April 2021. In April 2022, it reported an increase of 27.2 per cent in its output compared to the same period a year ago. The government is also taking steps to phase out the use of imported coal in India’s thermal power plants. Recently, at the ‘Mincon 2022’ Mines-Mineral-Metals event organised on 15th October 2022, Union coal minister Pralhad Joshi said that the country will stop the import of thermal coal by 2024-25.

According to the International Energy Agency’s Coal Report 2021, India’s coal consumption is expected to rise at an average annual rate of 3.9 per cent to 1.18 billion tonnes in 2024, a signal towards the Indian economy’s expanding energy demands which will be fuelled partially by coal. While India’s expanding energy demands need to be diverted towards cleaner sources of energy such as solar and wind, coal’s role in India’s energy needs cannot be dispensed in the short or medium term. Improving capacity utilisation in existing coal mines and plants will help improve cost efficiency and prevent damage to the environment and local livelihoods. It will also help cut down on India’s import bill for coal, already under strain due to rising international coal prices. It will further open up government funds for investment in renewable energy sources to phase out coal in the long term and move the country closer to its target of replacing 30GW of thermal power generation capacity with renewable energy by 2026, a move aimed at reducing emissions from coal-fired power plants.