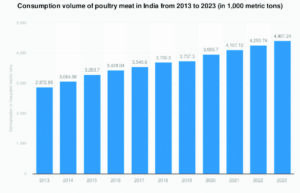

The Indian poultry industry’s revenue is expected to grow by 8-10 per cent in 2023-24, mainly driven by healthy volume growth and improvement in realisations, a report said.

The revenue growth expectations of the domestic poultry industry are likely to be at 8-10 per cent in FY24, which will be led by significant volume expansion and improving share of organised players, rating agency Icra said in a report.

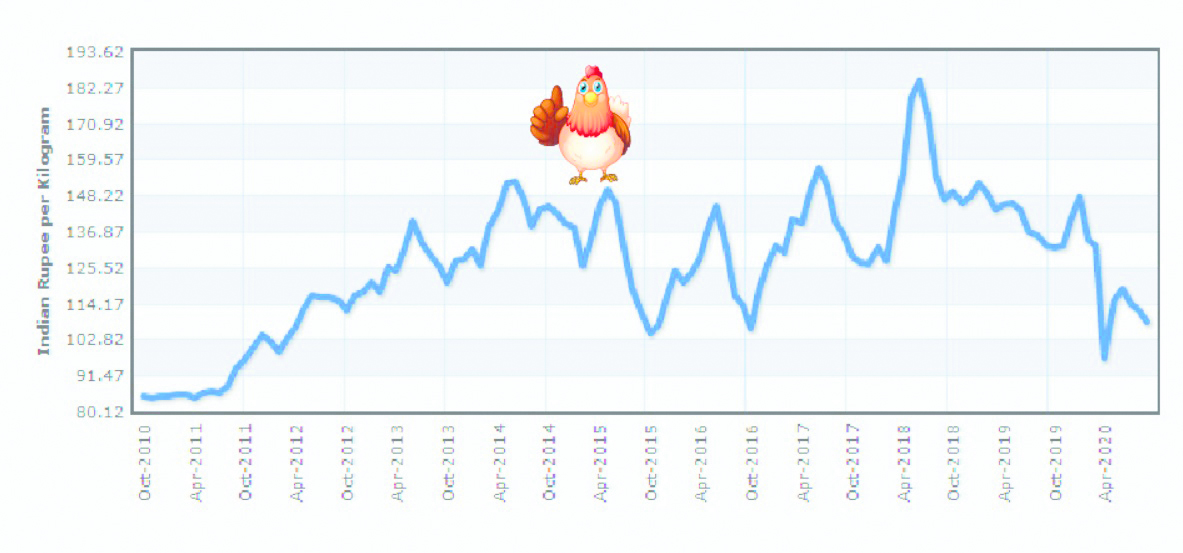

While realisations were strong in H1 FY23, they started tapering afterwards due to excess supply, said the report.

Subsequently, the pick-up in demand in the current fiscal resulted in improvement of average realisations to Rs 107 per kg in H1 FY24 compared to Rs 101 per kg in FY23, said the report adding that the festive season and cold weather will support demand and realisations in the remaining fiscal year.

“While realisations improved in H1 FY24, following controlled supply and healthy demand, players’ earnings were further supported by softened feed costs. Maize, which comprises 60-65 per cent of the feed cost, prices declined by 9 per cent over H1 FY23 and those for soyabean (comprising 30-35 per cent of feed cost) reduced by 21 per cent over H1 FY23,” Icra Vice President and Sector Head Sheetal Sharad said.

While the raw material pricing has been favourable so far, substantial contraction in soybean harvest during the kharif season and delayed sowing of maize raise concerns on the potential spike in feed costs, which is likely to exert pressure on the margins of poultry companies, she added.

Meanwhile, the report noted that there have been limited occurrences of avian influenza or bird flu across the country in the current fiscal.

Localised incidences of bird flu were reported in Kerala and Jharkhand in the fourth quarter of FY23 and first quarter of FY24, which did not spread further.

Any major local outbreaks may have temporary effects on demand and realisations in the affected and nearby regions, the report stated.

Since winters are prone to disease outbreaks, the upcoming months will remain critical, nevertheless, in October 2023, the World Organisation for Animal Health (WOAH) approved India’s self-declaration of freedom from Highly Pathogenic Avian Influenza (HPAI), or the bird flu, in specific approved farms in Maharashtra, Tamil Nadu, Uttar Pradesh and Chhattisgarh.

This development is expected to provide new opportunities for Indian poultry companies in the global market in the medium to long term, it said.

In September 2023, India and the US jointly announced resolution of the long-standing poultry dispute pertaining to allowing US poultry products in the Indian market, which could open the Indian markets to US poultry products, thus increasing the competitive intensity and exerting pressure on realisations, it said.

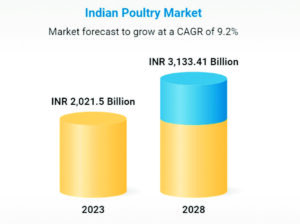

“Over the medium to long term, we expect the domestic demand to be favourable, supported by a rising urban population and changing eating habits.

To support the transition to higher margin value-added products, we expect poultry companies to invest in capacity additions towards feed mills and move towards forward integration into meat processing plants. The increased working capital requirements for feedstock amid expected rise in input costs, could keep debt at high levels,” Sharad added.