The global economy is experiencing a slowdown, with growth decelerating in several resilient economies and leading indicators signalling further moderation in the near term.

In India, the real GDP growth reached a six-quarter peak in Q3 of the fiscal year 2023-24, driven by robust momentum, strong indirect taxes, and reduced subsidies. The significant structural demand visibility and improved corporate and bank balance sheets are expected to serve as catalysts for future growth.

While inflation is declining, characterized by a broad-based softening of core inflation, persistent sporadic spikes in food prices impede a more rapid decline in headline inflation towards the targeted 4 per cent.

The global economy is experiencing a gradual loss of momentum, as evidenced by the slowdown in real gross domestic product (GDP) growth across several resilient economies, while others are witnessing a plateau or even slight contraction. Leading indicators suggest that this moderation is likely to persist in the foreseeable future.

Although there are slight improvements in business activity observed in both advanced and emerging economies, external demand remains subdued due to specific weaknesses in various countries, notably in the property sector, coupled with escalating levels of public debt.

While labour markets continue to demonstrate resilience, there are indications of a gradual easing, particularly in terms of wage growth. In certain emerging market economies (EMEs), there is a discernible uptick in unemployment rates, signalling potential challenges ahead.

Simultaneously, increased labour mobility, advancements in generative artificial intelligence (AI), and the adoption of machine learning technologies are driving improvements in labour productivity and facilitating the establishment of new businesses.

These developments were reflected in the February 29, 2024, Chair’s Summary of the first G20 Finance Ministers and Central Bank Governors meeting in Sao Paulo, Brazil which noted “that the likelihood of a soft landing in the global economy has increased, with growth showing resilience, despite divergences across countries and regions.”

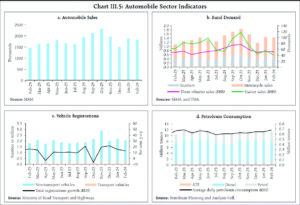

AUTOMOBILE SALES GROWTH

In February 2024, automobile sales surged by 24.3 per cent year-on-year, driven by notable increases in both two-wheeler and passenger vehicle sales. Although tractor exports demonstrated robust growth, domestic sales remained relatively subdued. Notably, vehicle registration maintained a consistent year-on-year growth trend throughout February.

Average daily petroleum consumption witnessed a 2.1 per cent year-on-year increase, primarily fueled by sustained momentum in industrial and transport activities.

RETAIL SALES GROWTH

The retail sector is currently undergoing a significant transformation, with domestic brands rapidly expanding their operations. In 2023, retail leasing activity in India’s top eight cities reached 7.1 million square feet, with domestic brands contributing to 70 per cent of the total leasing volume. The operational retail space in grade A malls stood at 68.3 million square feet, with a 10 per cent increase observed in capacity under construction.

Furthermore, the resurgence of global capability centres (GCCs) has played a pivotal role in driving demand for grade-A office spaces, leading to a robust expansion in this segment. The heightened leasing activity across various sectors has positively impacted the performance of listed companies operating in this domain.

In January 2024, retail sales growth showed improvement compared to December 2023, as indicated by the latest business survey conducted by the Retailers Association of India. This uptick was largely driven by increased sales in quick-service restaurants, sports goods, personal care products, jewellery, and food and groceries segments. However, retail demand for consumer durables and electronics remained subdued during this period.‑