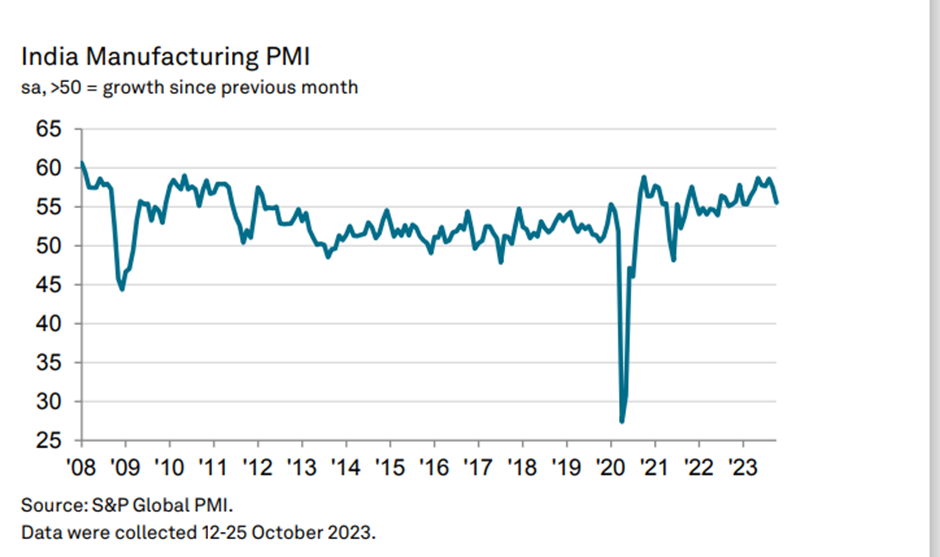

The Indian manufacturing industry signalled the slowest rate of expansion since February as the seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index slipped from 57.5 in September to 55.5 in October 2023 as growth of several measures subsided with fading demand for certain types of products. There were substantial, albeit slower, increases in total new orders, production, exports, buying levels and stocks of purchases.

Business confidence slipped to a five-month low amidst higher cost pressures, while output price inflation receded, Pollyanna De Lima, Economics Associate Director at S&P Global Market Intelligence suggests that India’s manufacturing sector generated substantial growth in October, despite a challenging global economic environment. “Still, insights from surveyed purchasing managers pointed to the deceleration of several measures. The survey’s new orders index slipped to a one-year low, as some firms raised concerns about the current demand picture for their products,” says De Lima.

Output increased further at the start of the third fiscal quarter, stretching the current sequence of expansion to over two years. The upturn was linked by firms to positive market conditions and healthy intakes of new work. Growth eased to an eight-month low, however, weighed by competitive pressures and weak demand at some plants.

Granular data highlighted a particularly marked slowdown in the consumer goods sub-sector. Consumer goods recorded considerably softer increases in sales, production, exports, input inventories and buying levels.

Growth of all of the aforementioned variables was led by capital goods makers which, with the exception of new orders, registered accelerated rates of expansion. A further increase in new orders was a positive development. As was the case for total new orders, growth of international sales remained historically strong despite losing momentum in October. The rise was the weakest in four months. Those firms that experienced an increase in new orders from abroad reported gains from Asia, Europe, the Middle East and the US. Ongoing increases in new business continued to spur recruitment efforts among goods producers in India.

Lima sees further indication of broadly stable inflationary forces across the manufacturing industry. “It appears that a moderate increase in input costs was simply passed on to clients. Nonetheless, qualitative evidence from the future output question revealed an interesting finding, as reports of rising inflation expectations were expected to dent demand and subsequently production growth over the course of the coming 12 months,” De Lima adds.

Goods producers sought to add to their inventories and meet production schedules by purchasing additional materials in October. The rate of input buying growth was sharp, though the slowest in eight months. As has been observed since mid-2021, stock trends diverged in October as growth of input inventories contrasted with another fall in holdings of finished goods. The former saw a softer uptick and the latter a quicker reduction.

Price trends were also mixed. Both input costs and output charges increased, but inflation of the former accelerated while factory gate charges rose to a weaker extent. When listing materials that had increased in price, firms mentioned aluminium, chemicals, leather, paper, rubber and steel. Business sentiment remained firmly inside positive territory, but slipped to a five-month low amid concerns surrounding the path for inflation and demand.