Recently, a report of the US investment research firm Hindenburg (the name, inspired by the Nazi Zeppelin that exploded over New Jersey prior to World War II) has caused share prices of Adani group companies to nosedive. It has been done through a method called “shorting”. There may be some legitimate cause for these shares to drop or simply correct in value. In fact, a top financial journalist, James Crabtree, has documented years ago warnings by Indian government officials of the high debt of some firms. All added with Indian regulators pulling in various firms’ horns due to certain corporate irregularities. If only the US regulators had been as efficient, whose lack of oversight caused one of the biggest crashes in 2007 to 2008 and in the history of global finance. Wall Street, including Hindenburg, has likely a few lessons to teach on how India financially regulates. But all regulators, whoever they are, need to do their homework in the ever-complex world of global finance and risk.

But this “piling on of shorts”, a kind of speculative investment to drive down the value of a company, has been thoroughly applied and promoted by Hindenburg as its principal method of making money. This includes the massive profits it has made by besmirching various Adani companies. An approach that seems to be more characteristic of certain western Wall Street investor predators, aggressively content to make giant investment “killings” sometimes by distorted or exaggerated, incomplete research or by pure malicious rumour mongering.

Nevertheless, Indians should be also aware that this attack on one of India’s most prestigious industrial groups attached to hundreds of thousands of jobs of regular workers is timed almost coincidentally with the airing of a BBC documentary characterized as a “hit job” by those with an objective knowledge of Prime Minister Narendra Modi. It is not only a scurrilous attack on him, but on those Indians who have a respect for his national and global leadership.

Yet, let us not forget there are many in the West of goodwill to India and well placed. This includes among the Indian diaspora rooting for the country as opposed to those who want to see it routed. Also, there are many who do not want to cripple its national and industrial leadership from making this fast-advancing nation more competitive with the West. And they are certainly against trying to make it bow down to those countries that colonized it before or more recently, have tried to dominate it by neo-imperialism-and still, are trying.

Indeed, there are worries that certain western hegemonic forces appear to be especially rearing their ugly heads as the Indian national elections begin to approach. Preferring others to be put in power more malleable to foreign interests? All at the same time as Indian businesses gain high ranking internationally.

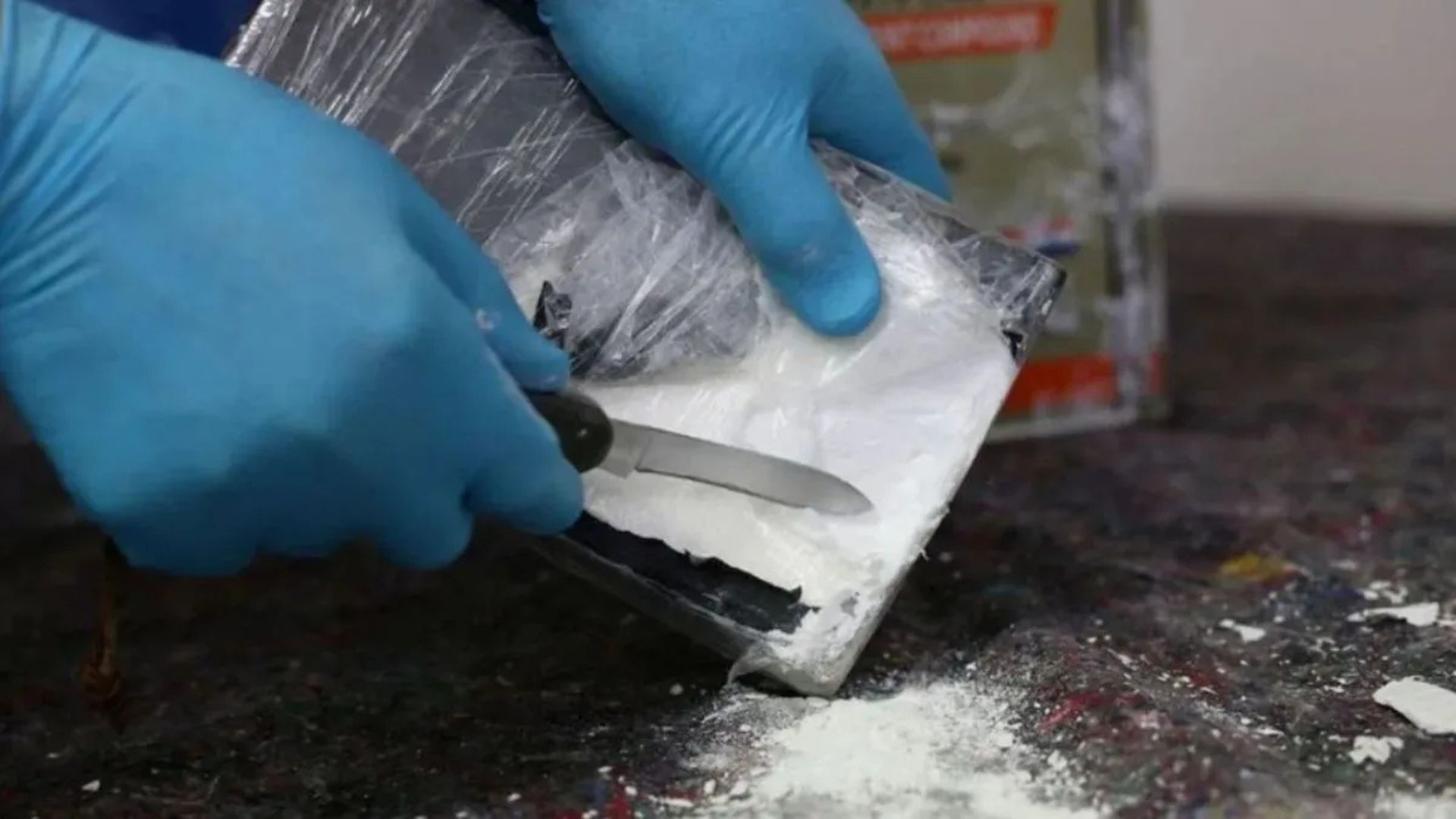

So, what is this short approach? And used so devastatingly by Hindenburg? To simplify, an investor borrows someone’s or an institution’s shares, an ownership stake in a company and bets that the price will go down. If it does, they make a profit between the difference of the value of the shares when it borrowed them and the lower price. An extreme type of this investment called naked shorting, spun with exaggerations can cause panic in the markets, excessively and a herd behaviour to mass selling.

Another reason for recent attacks against key Indian business and leaders may be because India has boldly carved out an independent foreign policy. It has not only avoided taking sides in the Ukraine war, but rather it has stepped up its purchases of discounted Russian energy, especially important to a country a lot less wealthy than countries like Germany. A country that can better afford high priced liquefied natural gas from the US, especially needing to do so after Nord Stream II and part of Nord Stream I pipelines were blown up. India has taken note of such aggressive tactics and wants to immunize itself from such explosions, financially, too. Rather, India wishes peace and a sense of inclusiveness for citizens throughout the world, being fundamentally considered as equal brothers and sisters and treated well. I doubt if this is foremost on the minds of enough Wall Street or London investment bankers, as well as Hindenburg.

A more recent worry by the West is about countries like India trading more in their own and non-major reserve currencies. The US, the EU and the UK to a lesser degree have great advantage by so many countries using their currencies. It allows them to print a lot more money than say India and have much larger deficits, even to more easily crowd out borrowing from countries of the South. By India having to deal with so much of the US based dollar market to pay for imports or to borrow, it exposes the country more to the risk of having its own currency, the rupee to short selling.

India, therefore, now smartly like China, Russia and Saudi Arabia, is increasingly sharply doing a lot more commercial transactions in their own currencies to counter this in part currency speculation against the rupee. That of course would be unwise as America and Europe, including Britain, need India as a friend. This is especially so as India rises and is becoming, evermore, a major strategic nation and economic powerhouse. If some of the elites in the West cannot understand these facts enough, then New Delhi must ensure it stands up fully to make them aware—even beginning to counter such shorting by wiping out speculators, ill-gotten profits?

Unsafe, high-flying investments can “burn up” and crash to the ground. Surely, Hindenburg named after that big “balloon” that fell out of the sky to pieces knows this and others like the BBC, figuratively. Betting against India is a bad idea. Those trying to stop it rising to its deserved place in the world and profiting need to know that it will not work. Period.

Peter Dash is an educator, former professor and ex-associate of Harvard University’s Center for International Affairs.