-

India’s Income Tax Overhaul: Government Launches Revamp Process

-

Record-Breaking Income Tax Returns Filed This Year, Over 7.28 crore ITRs Filed, 72% Opt For New Tax Regime

-

![Income Tax-Free Havens: Explore The World’s Top Tax-Free Countries]()

Income Tax-Free Havens: Explore The World’s Top Tax-Free Countries

-

ITR Filing Deadline: Will The July 31 Income Tax Return Date Be Extended?

-

Over 5 Crore ITRs Filed As Deadline Nears: Income Tax Dept’s Update

-

![TAX FREE LIFE : COUNTRIES WITH ZERO INCOME TAX]()

TAX FREE LIFE : COUNTRIES WITH ZERO INCOME TAX

-

100% Income Tax-Saving Trick? Karnataka Man’s Humorous Video For Salaried Class Goes Viral

-

Old vs New Income Tax Regime: What Will Be Beneficial For Whom?

-

![Income Tax Regime 2024]()

Income Tax Regime 2024

-

Budget 2024: Major Revisions in Income Tax Slabs, Standard Deduction Increased to Rs 75,000

-

![A Quick Guide: File Income Tax Return Online For Free]()

A Quick Guide: File Income Tax Return Online For Free

-

Budget 2024: Six Key Income Tax Benefits for Taxpayers to Watch Out For

-

Income tax Budget 2024 Expectations: 5 Key Demands Salaried Taxpayers Have for FM Nirmala Sitharaman on July 23

-

Delhi Man Pays Rs. 50,000 CA Fee For Income Tax Notice Over 1 Rupee Dispute

-

Union Budget To Be Presented On July 23, Here’s What Taxpayers Can Expect In Potential Income Tax Adjustments

-

ITR Filing 2024: What Documents Are Required At The Time Of Filing An Income Tax Return?

-

![Income Tax ITR Filing 2024 : Step-By-Step Guide To Register Online For E-Filing]()

Income Tax ITR Filing 2024 : Step-By-Step Guide To Register Online For E-Filing

-

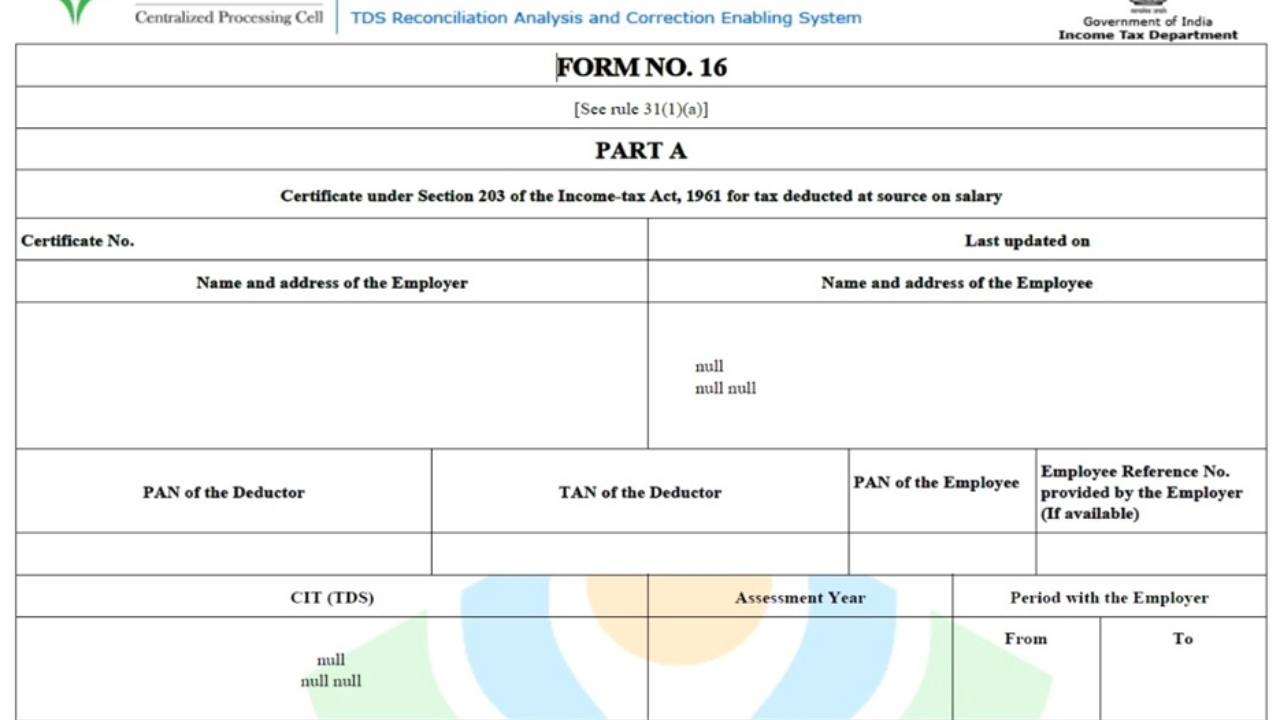

Form 16: Are You Checking These Top Points Before Filing Your Income Tax Return?

-

![ITR 2023-2024: Scared Of Errors? Tips For Filing Income Tax Returns]()

ITR 2023-2024: Scared Of Errors? Tips For Filing Income Tax Returns

-

Income Tax Refund Delays: Reasons And Solutions For Awaited Refunds

-

US Elections 2024: Donald Trump To Abolish Income Tax. Read Here

-

ITR Filing 2024: Steer Clear Of These Mistakes When Filing Your Income Tax Return

-

What Are The Alternatives To Form 16 For Filing Income Tax Returns?

-

Income Tax Return 2024: Deadlines For ITR Filing

-

Income Tax Return Filing: 60 Days Left! Explore Tax Filing Options

-

Salaried Individuals Advised to Delay Income Tax Return e-Filing; Here’s Reason

-

![NIA special court orders transfer of seized cash to income tax department]()

NIA special court orders transfer of seized cash to income tax department

-

Income tax department informs SC, ‘It will not take any coercive steps to recover ₹1700 crore against Congress’

-

DG Income Tax (Inv.) sets up 24×7 control rooms for election vigilance in North West Region

-

Income tax update: Complete these tax-related duties by March 31 to avoid penalties

-

![Income tax raids in Panipat, documents seized]()

Income tax raids in Panipat, documents seized

-

Green initiative: GCE and Income Tax department host Swachhta Pakhwada

-

Avoid Penalties: Income Tax Warning – Dec 31 Last Date for ITR!

-

Delhi High Court Upholds The Constitutional Validity Of Section 115BBE Of Income Tax Act

-

MCC hosts seminar on Income Tax-TDS/TCS awareness

-

Delhi HC rejects NewsClick’s challenge against income Tax Orders

-

Income Tax Raids Conclude at Congress MP Dheeraj Sahu’s Premises in Odisha

-

Delhi HC dismisses news portal plea challenging Income tax orders

-

Income Tax Dept raids Ganpati Plaza, recovers cash, gold

-

What prompted the abrupt Income Tax raids on Congress candidates?

-

Why do so few file income tax returns in India?

-

Kishida plans an income tax cut for households and corporate tax breaks

-

Supreme Court: Double Taxation Avoidance Agreement Cannot Be Enforced Unless Notified By Centre Under Section 90 Of Income Tax Act

-

Income Tax raids in Mumbai locations linked to BMC oxygen supply scam

-

![Income Tax raids premises linked to RJD Rajya Sabha MP in Bihar]()

Income Tax raids premises linked to RJD Rajya Sabha MP in Bihar

-

![Income Tax teams swarm Vishal Bansal Group]()

Income Tax teams swarm Vishal Bansal Group

-

Income Tax raids on SP leader Azam Khan’s residence in Rampur continue for 3rd day

-

Income Tax raids target Azam Khan and associates

LOAD MORE

No More

Advertisement

Advertisement