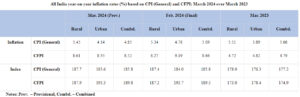

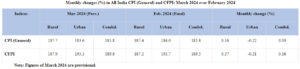

Days after RBI kept its policy rates in abeyance, India’s consumer price index led retail inflation moderated to 4.85 per cent in March 2024 even as food inflation softened marginally and core inflation remained steady at 3.5 per cent. The CPI stood at 5.1 per cent in January and February, according to data from the Ministry of Statistics and Programme Implementation, released on Friday.

Retail inflation averaged 5.4 per cent yoy in the first eleven months of FY24 (April ‘23 to Feb ‘24), with the trend marked by a higher first half at 5.5 per cent and moderation in second half on a pullback in food and core price pressures. “The evolving trend is close to our forecast of 5.3 per cent for the year, from 6.4 per cent the year before. We discuss relevant catalysts for the year ahead, with our forecast of 4.5% yoy in line with the central bank’s economic assessment,” Radhika Rao, Senior Economist DBS Group Research.

Economists expect food and beverages inflation to remain above the 7.0 per cent mark in April 2024. An intensification of the impending heatwave may worsen the seasonal uptick in prices of perishables, heightening the criticality of a favourable monsoon in 2024 to keep food inflation in check and inflationary expectations well-anchored, as per ICRA estimates, notes Aditi Nayar, Chief Economist ICRA.

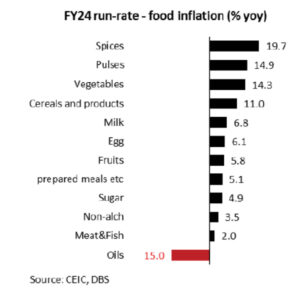

Yet far in FY24, food inflation is still elevated in contrast to the global indices, with 11 out of 12 sub-segments posting growth on the year (see chart). Barring edible oil prices which have benefited from stabilising supply issues, all the other segments stay elevated, necessitating the authorities’ close attention. This suggests that domestic steps to control price rise is likely to continue, marking a continuation for export restrictions (wheat and rice already in place), cut in stockholding limits, cut in import duties, and improving inter-state procurement arrangements, amongst others.

The RBI has retained its FY25 CPI inflation outlook of 4.5 per cent even as the MPC remains cautious on food price uncertainties, but optimistic on expectations of record rabi wheat production and early indications of normal monsoons this year. It also sees continued deflation in the fuel basket after the cut in LPG prices, but sees upside risks from rising costs faced by firms, geopolitical tensions, financial market volatility and the recent rise in global crude oil prices.

Nayar suggests that the ongoing uptrend in international crude oil prices could also pose a risk to the CPI inflation outlook in the near term, although the extent of the impact would depend on the pass-through to retail fuel prices. Monetary easing is likely to be quite back-ended in 2024, pending clarity on various factors such as the turnout of the monsoon, evolution of crude oil prices as well as rate action from the US Fed.