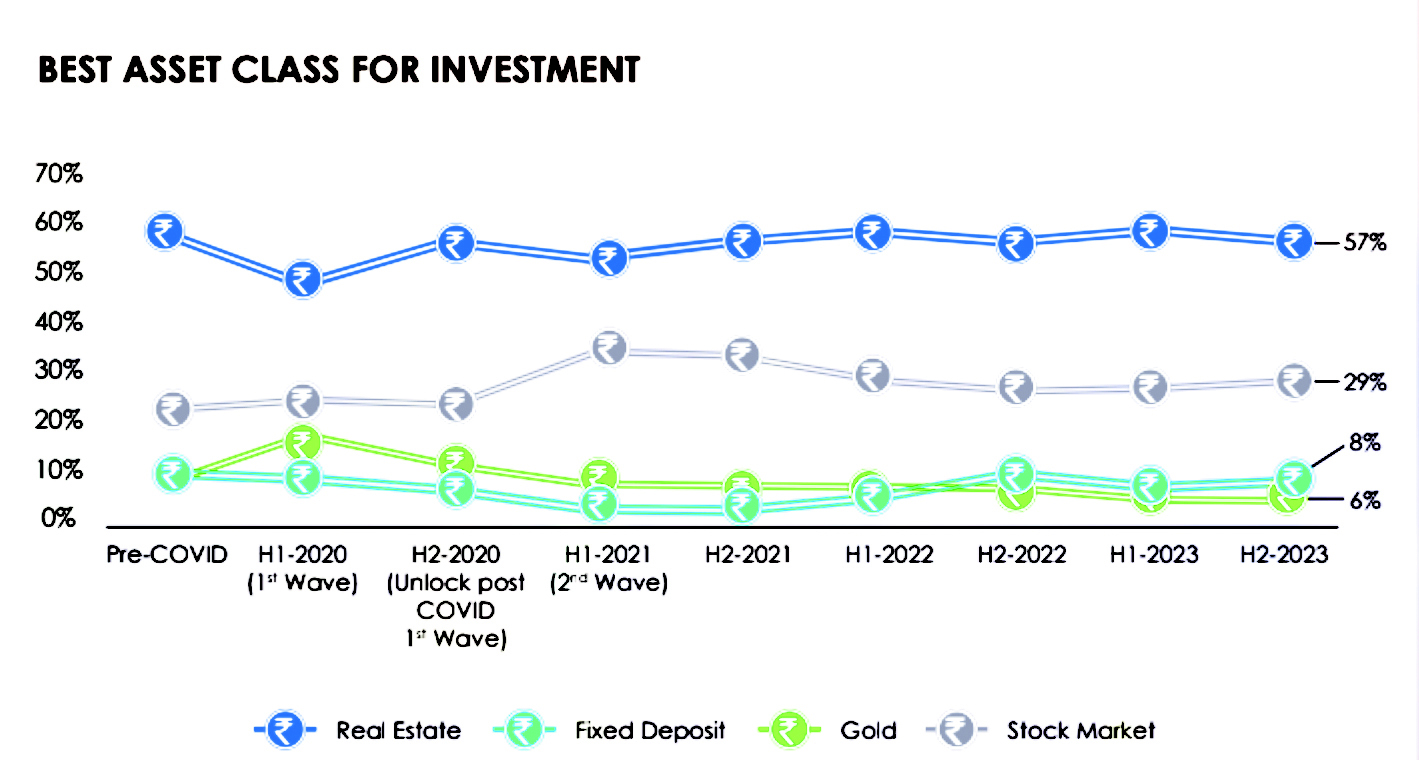

In the current investment landscape, determining the optimal asset class is crucial. Real estate maintains its prominence as the preferred choice for investment, with over 57% of respondents expressing a preference, marking a 3% decline from the preceding survey. While real estate remains the top choice, there is a slight decrease in its favorability, and the stock market emerges as the second-best option, garnering 29% of respondents’ favour.

Despite a surge in gold rates, there is only a marginal uptick in its preference, securing the bottom rank with a mere 6% of respondents considering it their favoured investment. Conversely, Fixed Deposits (FDs) are gaining positive traction due to the surge in interest rates offered by banks. Over the past two years, FDs have experienced a notable surge in preference among respondents, with 8% now viewing them favourably as an asset class.

It’s noteworthy that the current interest rates for FDs can reach as high as 7% or more, depending on various factors such as the choice of banks, senior citizen status, and tenure. This surge in interest rates has significantly influenced investors, contributing to the growing appeal of FDs as a reliable and secure investment option.

Investors on their future plans for their investments

Real estate has become a significant component within the portfolios of the majority of investors, playing a crucial role in portfolio diversification. According to recent survey results, there is a notable trend among investors, with a substantial portion (31%) of respondents currently diversifying their capital across various assets, ultimately finding themselves inclined towards real estate.

As they accumulate capital gains from alternative investment options, the enticing prospect of acquiring property becomes an appealing choice, offering long-term stability and growth.

The second most substantial reason for investing, as indicated by 25% of respondents, is to utilize the capital gains for initiating a business in the future. Following closely behind, 17% of respondents are motivated by the goal of saving for retirement, while 15% have prioritized building an emergency fund.

Additionally, 12% of respondents allocate their investment gains towards fulfilling their dream vacation. These results underscore the diverse financial goals and aspirations of investors, emphasizing the importance of tailor-made investment strategies to achieve their specific objectives.

Who prefers what?

Among these, 58% of Millennials and 39% of Generation-X respondents intend to use the maximum amount of their investment returns on buying a home in future. Meanwhile, 36% of the Generation-Z respondents seem to be prioritising vacation and 35% in the same category want to start their own business by utilising their investment gains.

On the other hand, the Baby Boomers want to utilize their investment gains on emergency funds and retirement.

End use or investment?

The Indian residential market remains predominantly influenced by end-users, with 64% of survey participants opting to purchase properties for self-use. This trend is anticipated to persist in 2024, emphasizing that homeownership continues to offer substantial satisfaction and security, particularly in uncertain times and emergencies.

However, there has been a noticeable shift recently, with investors re-entering the real estate arena. Compared to the H2 2022 survey, there is a 7% increase in the proportion of participants approaching property purchases from an investment perspective rather than for self-use. Presently, a significant 36% of prospective buyers intend to acquire a property with an investment outlook. This shift highlights the growing trend of perceiving real estate as a lucrative investment avenue, attracting individuals looking to capitalize on the potential returns offered by the property market. Furthermore, the substantial influx of new supply from large and listed developers has renewed the confidence of investors.

Interestingly, over 86% of investors are exploring investment opportunities in peripheral and suburban areas, while the majority of end-users favour a budget range between INR 45 lakh to INR 90 lakh. This dynamic showcases the evolving preferences and strategies of both investors and end-users in the current real estate landscape.