Today, the Reserve Bank released the results of 27th round of its quarterly Bank Lending Survey1, which captures qualitative assessment and expectations of major scheduled commercial banks on credit parameters (viz., loan demand as well as terms and conditions of loans) for major economic sectors2. The latest round of the survey, which was conducted during Q4:2023-24, collected senior loan officers’ assessment of credit parameters for Q4:2023-24 and their expectations for Q1, Q2 and Q3 of 2024-25.

Highlights:

A. Assessment for Q4:2023-24

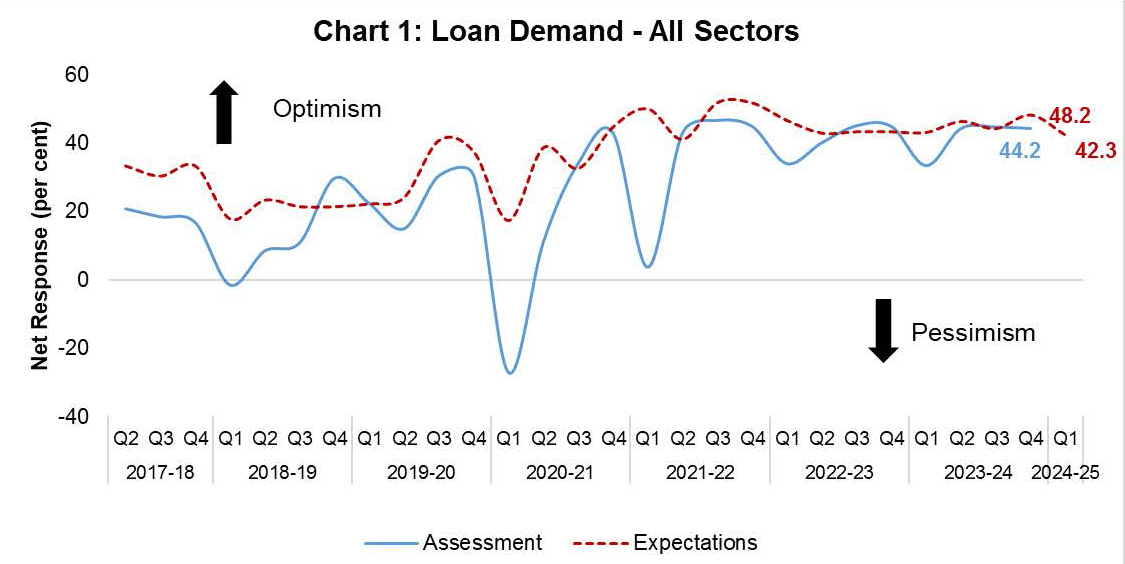

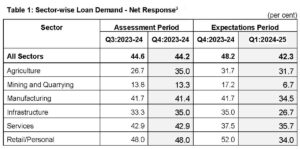

• Bankers assessed sustained loan demand across major sectors during Q4:2023-24 (Chart 1 and Table 1).

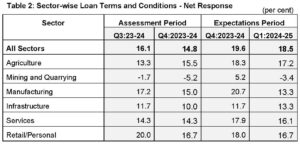

• Respondents reported continuation of easy loan terms and conditions in Q4:2023-24, though they assessed relative prudence for retail/personal loans (Table 2).

B. Expectations for Q1:2024-25

• Bankers expressed continued optimism on overall loan demand conditions during

Q1:2024-25, albeit a tad below that in the previous quarter, which was a seasonal peak (Table 1).

• Overall, easy loan terms and conditions are expected to prevail during the quarter (Table 2).

C. Expectations for Q2 and Q3:2024-25

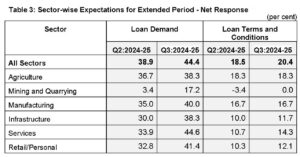

• Bankers remain upbeat on loan demand across major sectors up to end- 2024 (Table 3).

• On a net basis, easy terms and conditions for loans are expected to continue over the next three quarters, with a majority of bankers anticipating ‘no change’.