The Economic Research Department of the State Bank of India (SBI) has released a detailed research report authored projecting a significant boost in India’s economic growth, driven by a recovering global economy. The report anticipates that India’s GDP growth could touch 8 per cent in FY24, supported by strong per formance across various economic indicators and fa vorable monsoon conditions.

The report also highlights the potential impact of global economic resilience on In dia’s growth trajectory. Despite the challenges faced by the global economy, in cluding geopolitical tensions and extreme weather events, global growth remains resil ient, supported by easing inflationary pressures and strong employment condi tions. The International Mone tary Fund (IMF) in its April 2024 World Economic Out look (WEO) raised the global growth forecast for 2024 to 3.2 per cent, an improvement from its earlier projections.

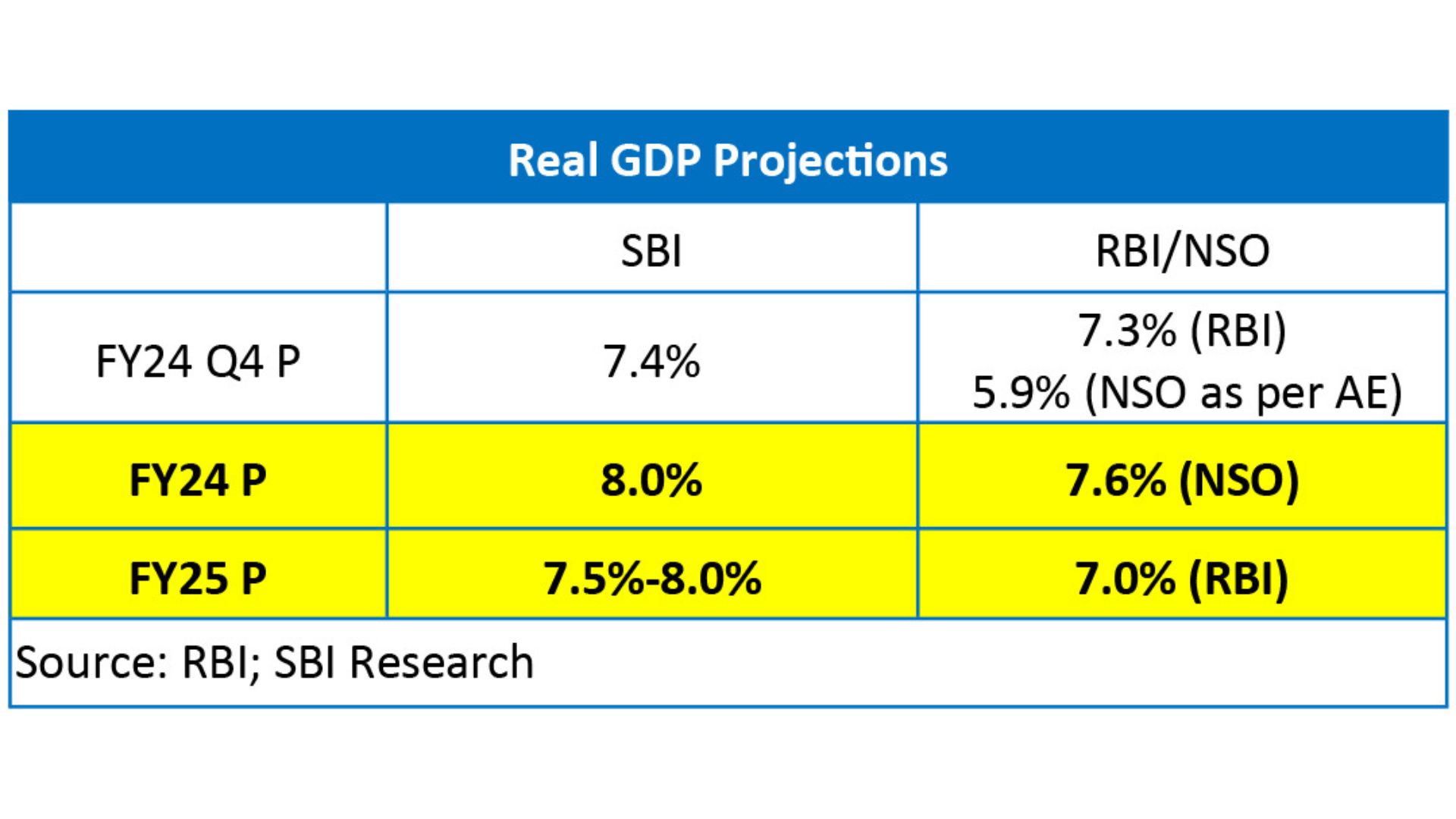

Global headline inflation is expected to decline from an annual average of 6.8 per cent in 2023 to 5.9 per cent in 2024, and further to 4.5 per cent in 2025, according to IMF estimates. This reduction in inflation is expected to prompt some central banks, particularly the European Central Bank (ECB), to reinvigorate growth efforts. The Reserve Bank of India (RBI) has projected Q4 FY24 Real GDP growth at 7.3 per cent, with Q1 FY25 expected to reach 7.5 per cent. For the full year FY25, GDP growth is anticipated to be 7.0 per cent. SBI’s in-house developed Artificial Neural Network (ANN) model, using 30 high frequency indicators, fore casts Q4 FY24 GDP growth at 7.4 per cent.

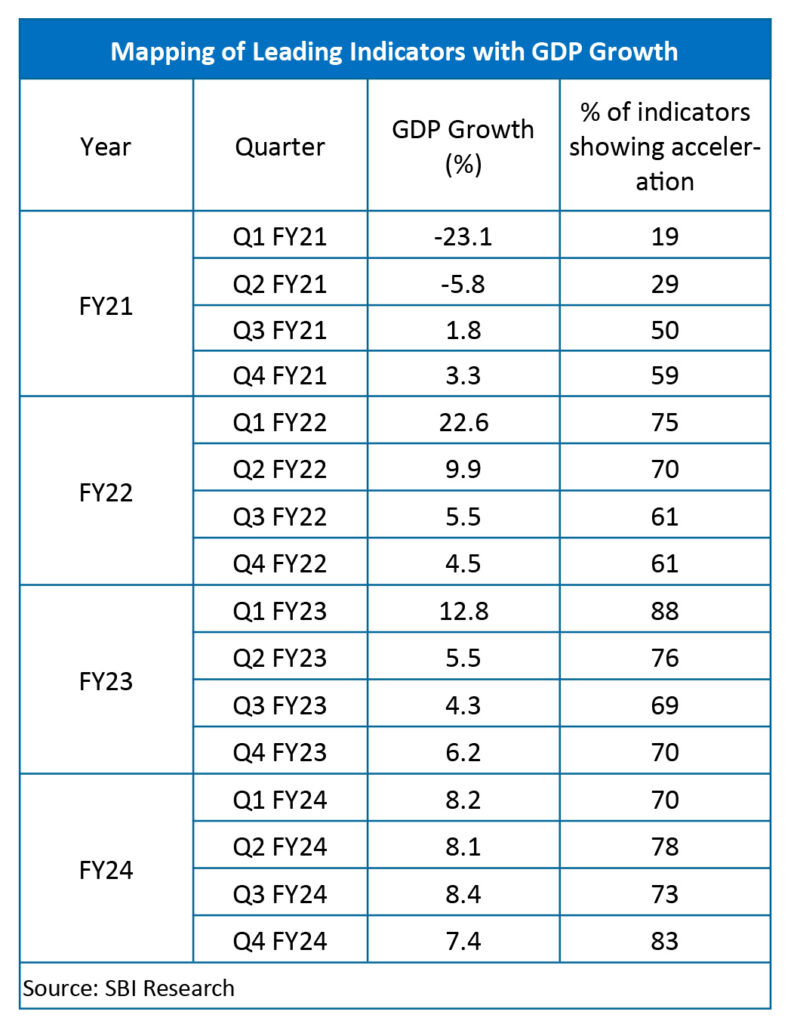

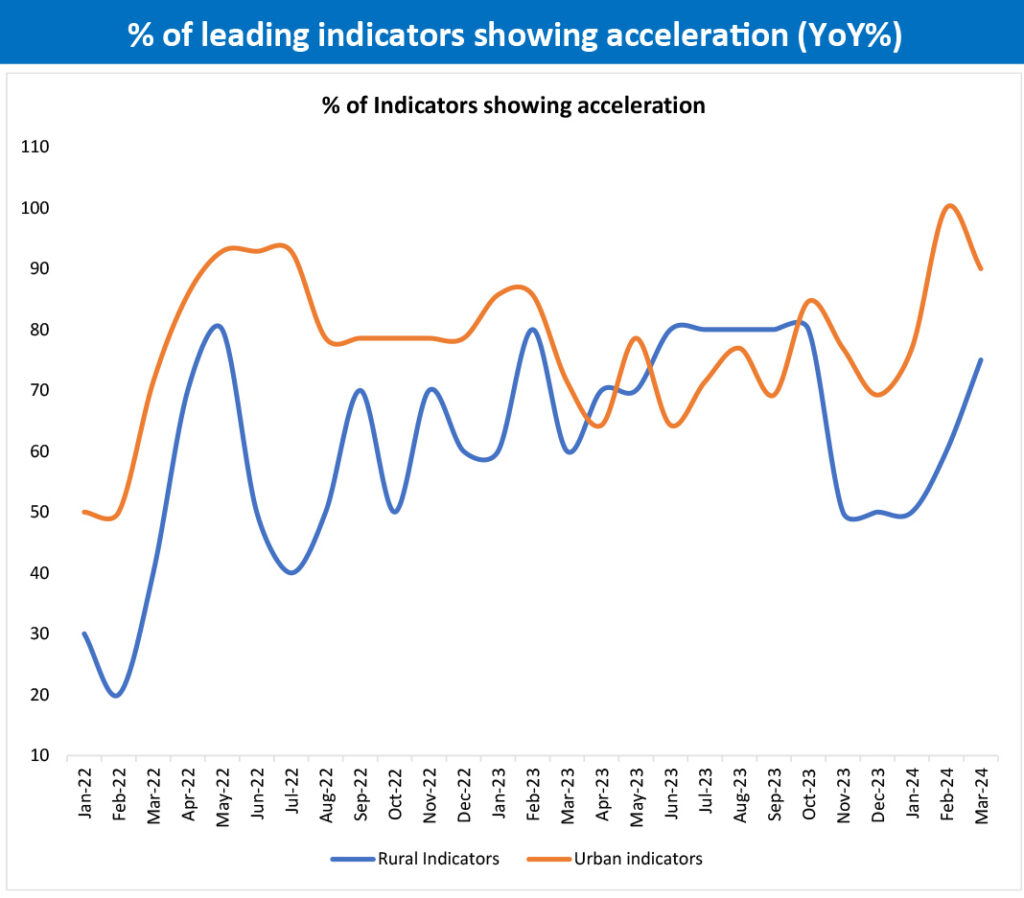

The report identifies a con sistent growth trend across both urban and rural sectors in India. Urban economic momentum is indicated by strong performance in pas senger vehicle sales, airport passenger traffic, GST col lections, credit card transac tions, petroleum consump tion, and toll collection. Rural economic indicators also show a positive trend, with diesel consumption and two-wheeler sales increasing.

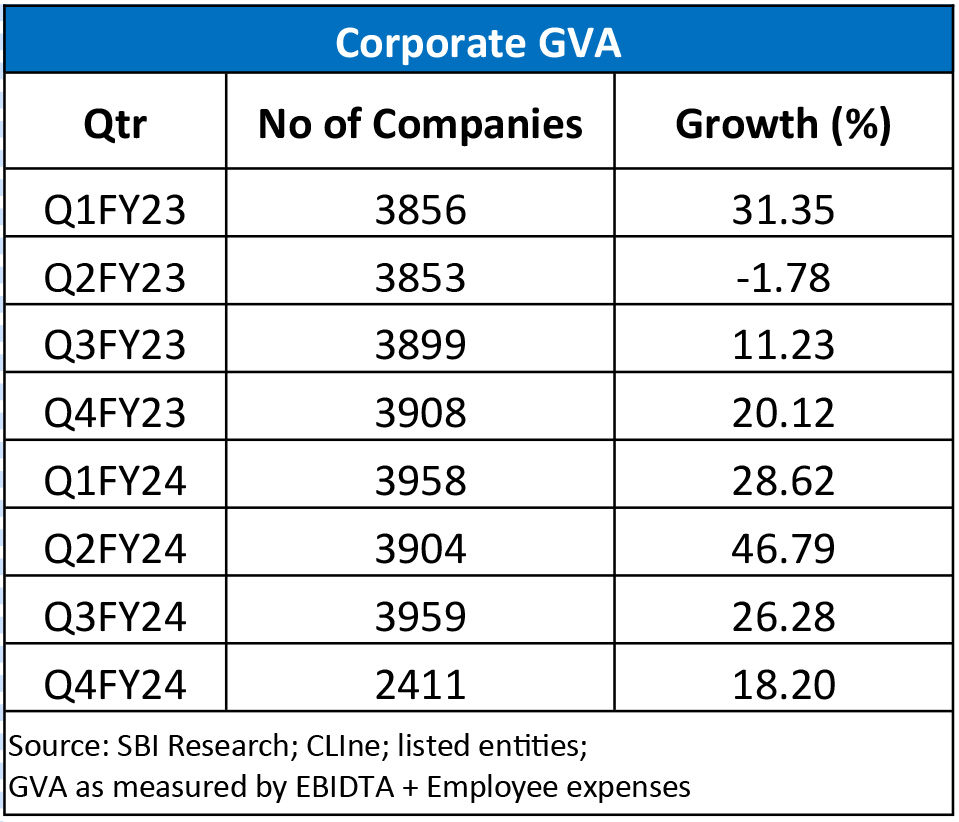

An ‘above normal’ mon soon forecast bodes well for the rural economy, enhanc ing the supply of essential commodities like pulses, oilseeds, and cereals. The India Meteorological Department (IMD) predicts favorable conditions with the development of La Nina and a positive Indian Ocean Dipole (IOD), suggesting a good monsoon season ahead. Corporate India continues to demonstrate resilience, with around 2,400 listed entities reporting strong numbers in Q4 FY24. While top-line growth stood at 9 per cent, EBIDTA increased by approximately 21 per cent.

However, there was some pressure on prof itability, with PAT growth declining to around 12 per cent from 42 per cent in the previous two quarters. Corporate Gross Value Added (GVA) grew by around 18 per cent in Q4 FY24, showing a slight reduction from previous quarters. With the global economy showing signs of recovery and easing inflationary pressures, India is well positioned to achieve robust growth