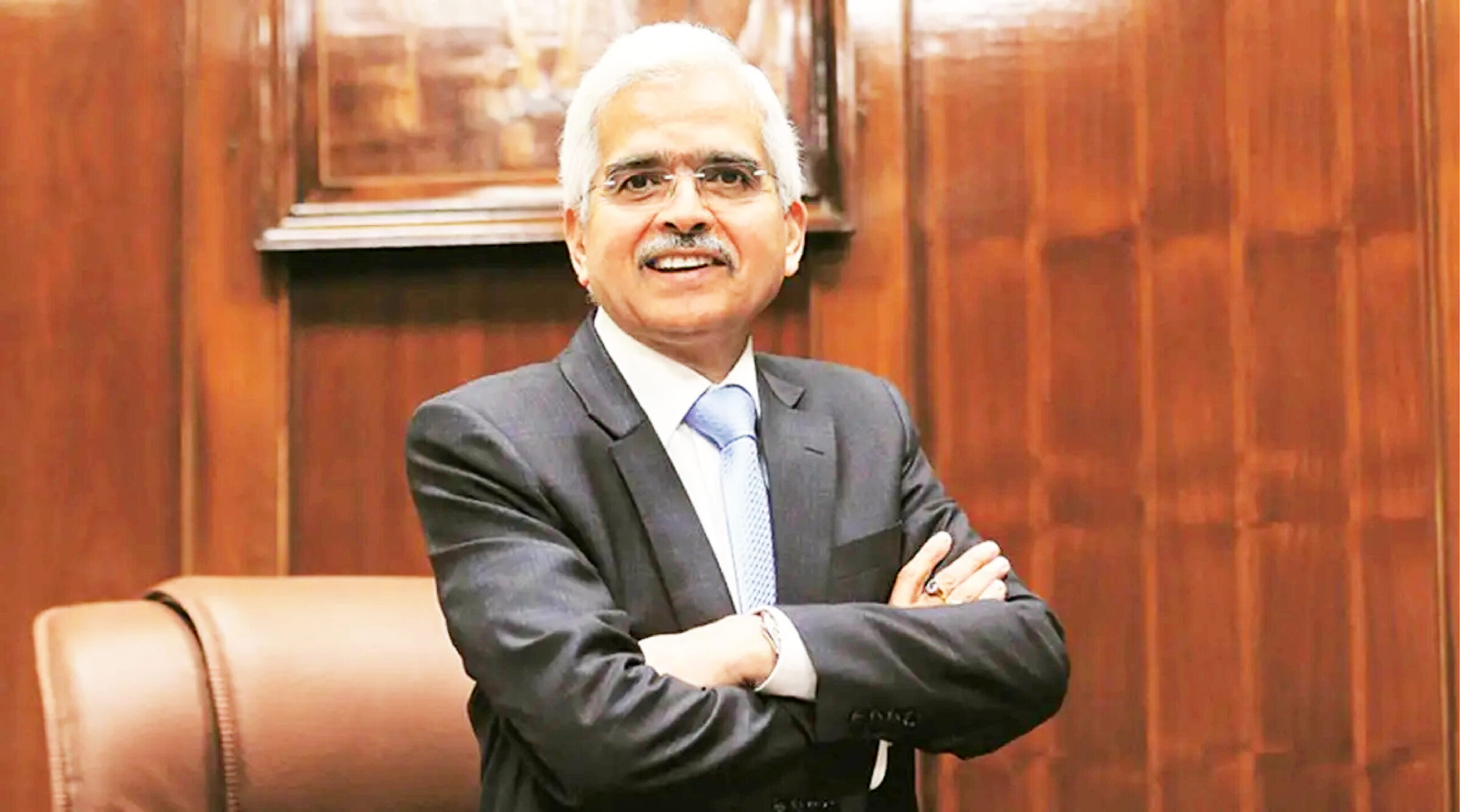

Reserve Bank of India (RBI) Governor Shaktikanta Das feels that digital currency or Central Bank Digital Currency (CBDC) will make cross-border payments more efficient and fast, in addition to being cost-effective.

The digital currency was launched in India on a pilot basis, both in the wholesale and retail categories, in November-December 2022.

“The greatest advantage of CBDC will be cross-border payments internationally. International cross-border payments will become far more efficient, faster, and very very cost-effective. As and when other countries adopt this digital currency, international payment systems will gain in efficiency, speed, and cost. And ultimately, it’s a new technology which is developing and I think it’s going to be the future of money,” said Das

The Governor of India’s central bank was addressing a session at the ongoing World Economic Forum in Davos, Switzerland. The RBI Governor said that the countrywide launch will depend on the success, the learnings, and the fine-tuning of the pilot version. “So that is the distance we have to cover,” Das said. “But we have no target date…We are not in any undue hurry or rush to implement it full scale because after it is a currency, its safety, integrity, and efficiency have to be ensured.”

In the retail segment, there are at present about 4 million users and 0.4 million merchants who have been onboarded.

He also apprised the Davos forum that the UPI payment mechanism and the CBDC have been made interoperable.

“The QR code which is used for the E-rupee is the same QR code that is used in UPI. In other words, CBDC and the UPI payment systems have been made interoperable,” he said.

“The advantage of CBDC vis-a-vis the UPI is that it’s not one versus the other. UPI is a payment system, and CBDC is a currency. CBDC can operate in completely dark zones (meaning where the internet is not available). Offline payments will become much easier because I can directly from my CBDC wallet to your wallet. In UPI also, we are trying to facilitate that by introducing certain new products,” he said.

The eRs-R is in the form of a digital token that represents legal tender.

It is being issued in the same denominations that paper currency and coins are currently issued. It is being distributed through financial intermediaries — banks. The eRs-R offers features of physical cash like trust, safety and settlement finality.

As in the case of cash, it will not earn any interest and can be converted to other forms of money, like deposits with banks. (ANI)