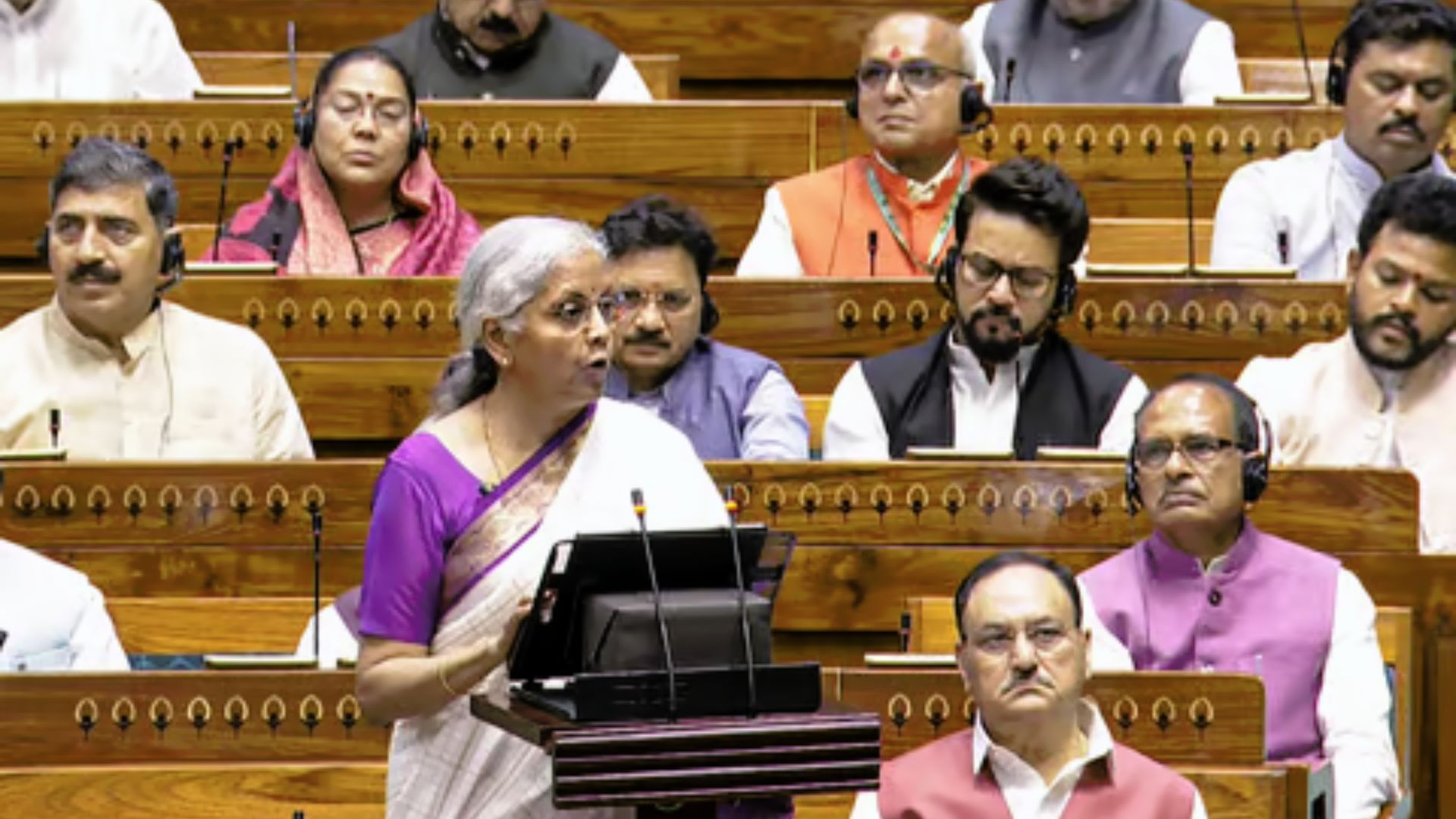

Finance Minister Nirmala Sitharaman presented the Union Budget 2024 on Tuesday, highlighting a focus on four key groups: the poor, women, youth, and farmers. She also unveiled the Prime Minister’s package, comprising five schemes with a total outlay of Rs 2 lakh crore aimed at employment, skilling, and other opportunities. There are some revisions in Income Tax slabs in new budget 2024 presentation.

Income Tax Reforms

Sitharaman announced several revisions to the Income Tax Act:

Two tax incentive regimes for the charity sector will be merged.

TDS rate on e-commerce operators will be reduced from 1% to 0.1%.

Long-term capital gains on all financial and non-financial instruments will attract 12.5%.

Short-term gains on certain assets will attract 20%.

The exemption limit for long-term capital gains will be increased to Rs 1.25 lakh from Rs 1 lakh.

Listed financial assets held for more than a year will be considered long-term.

Long-term capital gains tax will increase from 10% to 12.5%.

Short-term capital gains tax will rise from 15% to 20%.

No angel tax on all classes of assets.

Security transaction tax on futures and options (F&O) will increase to 0.02% and 0.1%, respectively.

Corporate tax for foreign companies will be reduced to 35%.

Personal Income Tax Changes

Standard deduction limit increased to Rs 75,000 from Rs 50,000.

Lowest slab in the new tax regime raised to Rs 3 lakh from Rs 2.5 lakh.

The new Income Tax Slab under the revised regime will be:

0-3 lakh: Nil

3-7 lakh: 5%

7-10 lakh: 10%

10-12 lakh: 15%

12-15 lakh: 20%

Above 15 lakh: 30%

Customs Duty Proposals

To aid cancer patients, Sitharaman announced that three additional medicines will be exempt from customs duties. Changes were also made to the BCD for X-ray tubes and flat panel detectors for X-ray medicines under the phased manufacturing program. The customs duty on gold and silver has been cut to 6%, and there is a proposed reduction in customs duty for manufacturing leather and footwear.

Major Employment Initiatives

Sitharaman outlined significant measures for job creation and support for first-time job seekers:

One month’s wages will be provided to all individuals newly entering the formal workforce.

The government will incentivize employees and employers in the manufacturing sector through EPFO contributions.

Other Key Announcements

A Rs 10 lakh crore allocation for the Prime Minister’s urban housing plan.

The introduction of the PM Suryaghar Muft Bijli Yojana for 1 crore houses.

Encouragement for states to reduce stamp duties.

Flood relief assistance for Assam, Himachal Pradesh, and Uttarakhand.

Economic Survey Highlights

Ahead of the budget presentation, the Finance Minister tabled the Economic Survey 2023-24 in Parliament on Monday. The survey projected a positive outlook for India’s growth and macroeconomic stability, estimating GDP growth for FY25 at 6.5-7% and inflation at 4.5%. It also highlighted the need to create 7.85 million jobs annually in the non-farm sector until 2030.Ahead of presenting the budget, Sitharaman arrived at Parliament with the traditional Bahi Khata, dressed in a white and magenta silk sari. Earlier, she met President Droupadi Murmu to seek approval for the budget, following the tradition where the person undertaking an important task is given curd and sugar.