Let’s recap my earlier thoughts and facts on the US oligopoly/hegemony Even top academic studies by Northwestern and Princeton university professors declare the United States is not a democracy, but is controlled by a limited number of people and institutions. Their lobbies are Washington pervasive, including on foreign relations and pushing US interests aggressively abroad, as well as financial ones.

A good core of it, no doubt, comes from US finance with its huge global ambitions that understands that grabbing the Indian financial market, or oversized presence in it would.be a major jewel in its crown to borrow an analogy of how the British Empire viewed India.

The multinational western media outlets often owned by Wall Street equity funds are not to be underestimated for their bidding directly or indirectly for these financial interests. Ex president Jimmy Carter talked of such influencers exercising “political bribery” on and through the electoral process. Major US government funding to mainstream US media is also influenced by Wall Street and oligarchs mostly pushing a global liberal to neo-liberal agenda. This should give Indians worry if a weak government in New Delhi were put in power.

The financial side of this massive US controlled power block is likely the most dangerous part in many ways to India, potentially.Just as an introduction, one might recall Wall Street’s Hindenburg fund that tried seriously, though unsuccessfully to ruin one of India’s champion companies to make huge profits against the interests of Indian employment and global competitiveness.

Coincidentally, this was around the same time Western media, including the BBC was going way overboard on the Modi government on domestic rights issues. So ask this: Are rights issues, even on certain terrorism views expressly brought up by the West against India, somehow (partly) tied to soften up the government to be more pliant to western financial and other economic interests? It is an interesting question.

However, the continuous potential threat to India of this dark side to the globalists’ financial power is well beyond but inclusive of the George Soroses and needs specific attention. According to Patrick Bet-David, a highly successful entrepreneur with billions of views to his podcasts (googlebooks.com) only a handful of Wall Street based financial institutions control or have strong leverage through the S and P stock exchange over 88 percent of listed companies.

That is much of corporate America. (YouTube, Patrick Bet-David.) That means one of those few companies he mentioned including BlackRock can significantly affect who leads those companies and what their policies are on ESG. ESG means environment, social responsibilities and corporate governance.

The big Wall Street funds are evermore pushing these values, even internationally in their investment decisions. Being pro-ESG may seem innocuous and all good. However, such western liberal, post-modern based concepts essentially may not rhyme enough with eastern values and other civilizations outside the western, US NATO led one. In other words, ESG and related seem very much to be in parallel to George Soros type globalist values.

Thus, they can act as another forceful way of supporting US exceptionalism and interventionism but through western financial hegemony. And speaking of devasted Ukraine, which financial institution is putting itself in prime position to mop up profitably from all the destruction and carnage from the Ukraine war?

That is right, BlackRock with around 30 trillion dollars of managed funds based on Wall Street. In fact, its leaders fairly recently had a meeting with Ukraine’s president Zelenskyy. I am not going to overly make some moral stand and call Larry Fink, its head and his pliant board financial vultures to the war.

My point with much of this is that countries can put themselves too easily in the hands of foreign financial interests often in bed with political hegemony pushing their values and interests too much undermining local culture and control. Going to war can be one of the worst ways to turn into a financial beggar to be too highly influenced by Wall Street and global finance, eventually if not immediately. And globalist finance knows this.The book, “Confessions of an Economic Hit Man” by John Perkins is instructive how big Western/globalist finance can ruin countries.

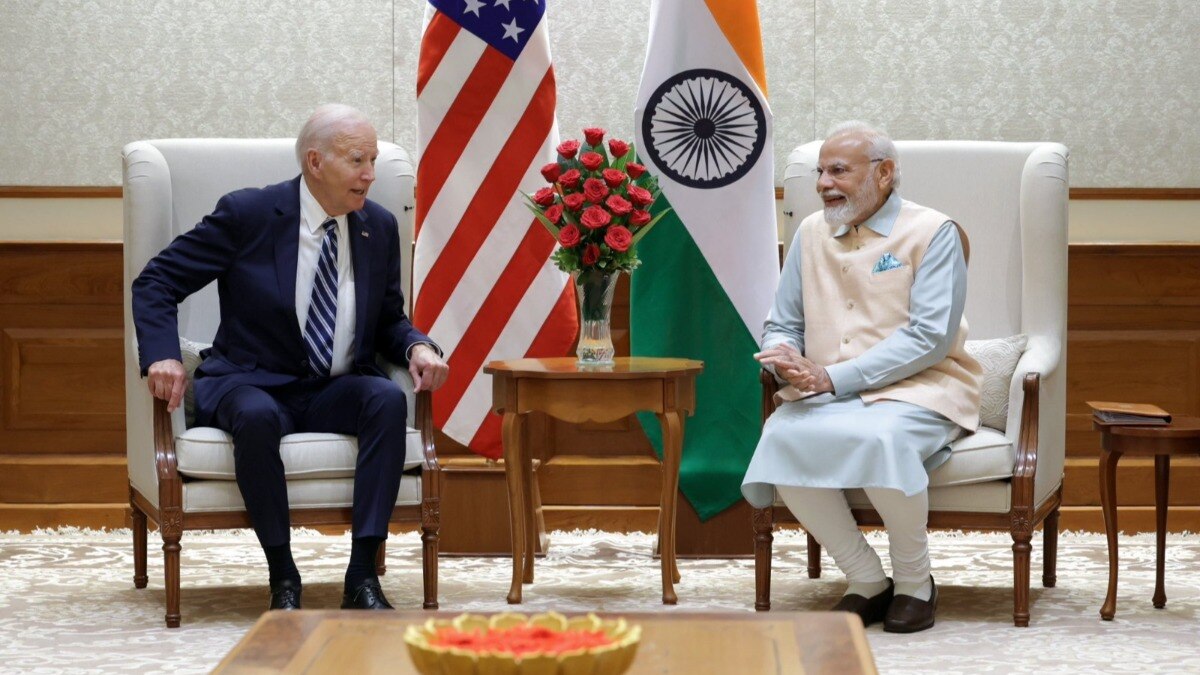

The good news: Fortunately, I believe India is well placed not to let the global financial hegemony including the Larry Finks and George Soroses from gobbling up India by financial control or culturally into a “US, Asia South”, 51st state. Rather, India well-managed economically and financially is so strong under the current government that it is “Fortress India” against global hegemonic finance intertwined with outside forces looking to culturally dominate It.

But on the other hand, India is an extremely welcoming country to constructive foreign investment. That is proven by its record levels of foreign direct investment and positive, mutually respectful relations with Washington. Wall Street, whose investments in China dwarf those it has made in India, a stable democracy should know this. Its money is indeed welcomed and can be profitable for it. But it must play by India’s rules and not act as a financial and cultural hegemony walking over New Delhi as it has run roughshod over many countries in the Global South.

For many in terms of fans of multipolarity, they may see there needs to be more focus on the West’s efforts to batter Russia down as a prelude to a plan to undermine China through global finance. But Wall Street megaliths are already significantly present in China and working for it, so-to-speak. That is why ex-Goldman Sachs, a huge Wall Street investment bank had their “spokespersons” talk up China recently to prevent further erosion of Beijing-Washington relations. I am talking of the Fareed Zakaria interview on CNN of ex Goldman heads and ex US Treasury heads, Tim Geithner and Hank Paulson.

So even as China seems in some economic meltdown, the question is will it eventually have to turn more to the western financial hegemony. It sure seems that Goldman and the likes hope so. Certainly, India can learn from not putting itself in such financial precariousness. The wise economic management of the country currently gives hope.

For Indians, who do not want to find themselves in the iron grips of these powerful financial forces that lead countries astray to becoming western assimilated and controlled, they will indeed need something special. That special is the continuous leadership of the Narendra Modi led government. Given the massive wealth of the Wall Street led financial hegemony, the wrong leadership in New Delhi could be silly-putty to the Larry Finks. I should know I went to school with one of them.

Peter Dash, a teacher is a graduate of Lower Canada College, UBC and the University of Southern Queensland and a former Harvard Associate. He did graduate business studies and resides in the South.