Net direct tax collection in the eight months of the current fiscal touched 58.34 per cent of Budget Estimates (BE) at Rs 10.64 lakh crore.

The net tax collection for April-November stood at Rs 10.64 lakh crore, which is 23.4 per cent higher than the corresponding period of last year, the Ministry of Finance said.

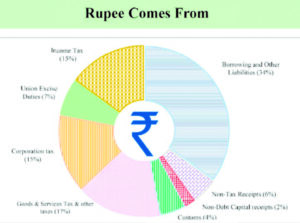

Gross collections, before issuing refunds, grew 17.7 per cent to Rs 12.67 lakh crore in the April-November period. Refunds amounting to Rs 2.03 lakh crore issued from April to November of the current fiscal. Special initiative was taken for cases where refunds had failed initially and subsequently issued to validated bank accounts, the ministry said. In the current fiscal, Rs 18.23 lakh crore is expected to be collected in direct taxes (personal income tax and corporate tax), and Rs 15.38 lakh crore from indirect taxes (GST, customs, excise).

Earlier this week, a senior finance ministry official said that the government is likely to stick to the budgeted estimate of a total tax collection target of Rs 33.61 lakh crore for the current fiscal in the revised estimates.

So far, direct tax collection is up by about 20 per cent and indirect tax is higher by 5 per cent.

DIRECT TAX

A type of tax where the impact and the incidence fall under the same category can be defined as a Direct Tax. The tax is paid directly by the organisation or an individual to the entity that has imposed the payment. The tax must be paid directly to the government and cannot be paid to anyone else.

TYPES OF DIRECT TAXES

The various types of direct tax that are imposed in India are mentioned below:

Income Tax: Depending on an individual’s age and earnings, income tax must be paid. Various tax slabs are determined by the Government of India which determines the amount of Income Tax that must be paid. The taxpayer must file Income Tax Returns (ITR) on a yearly basis. Individuals may receive a refund or might have to pay a tax depending on their ITR. Huge penalties are levied in case individuals do not file ITR.

Wealth Tax: The tax must be paid on a yearly basis and depends on the ownership of properties and the market value of the property. In case an individual owns a property, wealth tax must be paid and does not depend on whether the property generates an income or not. Corporate taxpayers, Hindu Undivided Families (HUFs), and individuals must pay wealth tax depending on their residential status. Payment of wealth tax is exempt for assets like gold deposit bonds, stock holdings, house property, commercial property that have been rented for more than 300 days, and if the house property is owned for business and professional use.

Estate Tax: It is also called as Inheritance Tax and is paid based on the value of the estate or the money that an individual has left after his/her death.

Corporate Tax: Domestic companies, apart from shareholders, will have to pay corporate tax. Foreign corporations who make an income in India will also have to pay corporate tax.

Income earned via selling assets, technical service fees, dividends, royalties, or interest that is based in India are taxable. The below-mentioned taxes are also included under Corporate Tax:

Securities Transaction Tax (STT): The tax must be paid for any income that is earned via security transactions that are taxable.

Dividend Distribution Tax (DDT): In case any domestic companies declare, distribute, or are paid any amounts as dividends by shareholders, DDT is levied on them. However, DDT is not levied on foreign companies.

Fringe Benefits Tax: Companies that provide fringe benefits for maids, drivers, etc., Fringe Benefits Tax is levied on them.