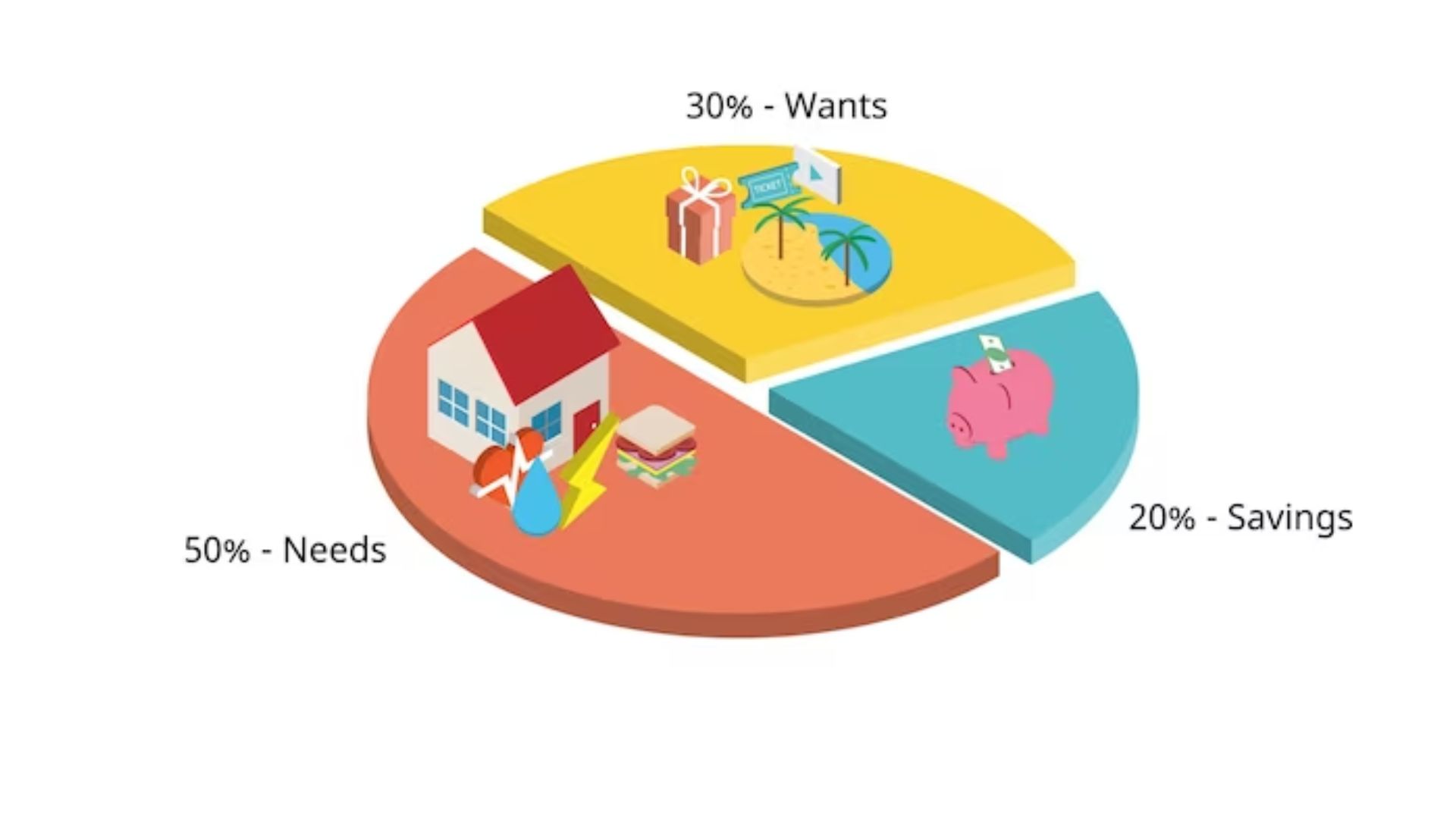

The 50-30-20 rule, also known as the budgeting rule, divides your after-tax income into three distinct categories: essentials, lifestyle choices, and savings/investments. It has gained popularity by helping numerous people by providing a blueprint as a means to manage finances.

1. 50% for Essentials:

The first pillar of the 50-30-20 rule allocates 50% of your income towards essentials—those expenses that are necessary for daily living and maintaining a stable lifestyle. This includes:

By ensuring that no more than half of your income goes towards these essential expenses, you create a solid foundation for financial security and stability.

2. 30% for Lifestyle Choices:

The second component of the 50-30-20 rule designates 30% of your income towards lifestyle choices—discretionary spending that enhances your quality of life and reflects your personal preferences and values. This category encompasses expenses such as,

While it’s important to enjoy life and indulge in occasional luxuries, maintaining a balanced approach to discretionary spending is key to staying within budget and avoiding unnecessary debt.

3. 20% for Savings and Investments:

The final segment of the 50-30-20 rule emphasizes the importance of saving and investing for the future. Allocating 20% of your income towards savings and investments allows you to build a financial safety net, prepare for emergencies, and work towards long-term goals such as retirement, homeownership, education, or wealth accumulation. This category includes:

The 50-30-20 rule serves as a practical and effective guide for achieving financial wellness and success. By allocating income wisely to essentials, lifestyle choices, and savings/investments, you lay the groundwork for a secure and prosperous future while enjoying the present moment to the fullest. Embrace the principles of budgeting, discipline, and foresight embodied by the 50-30-20 rule, and watch as your financial dreams transform into reality.