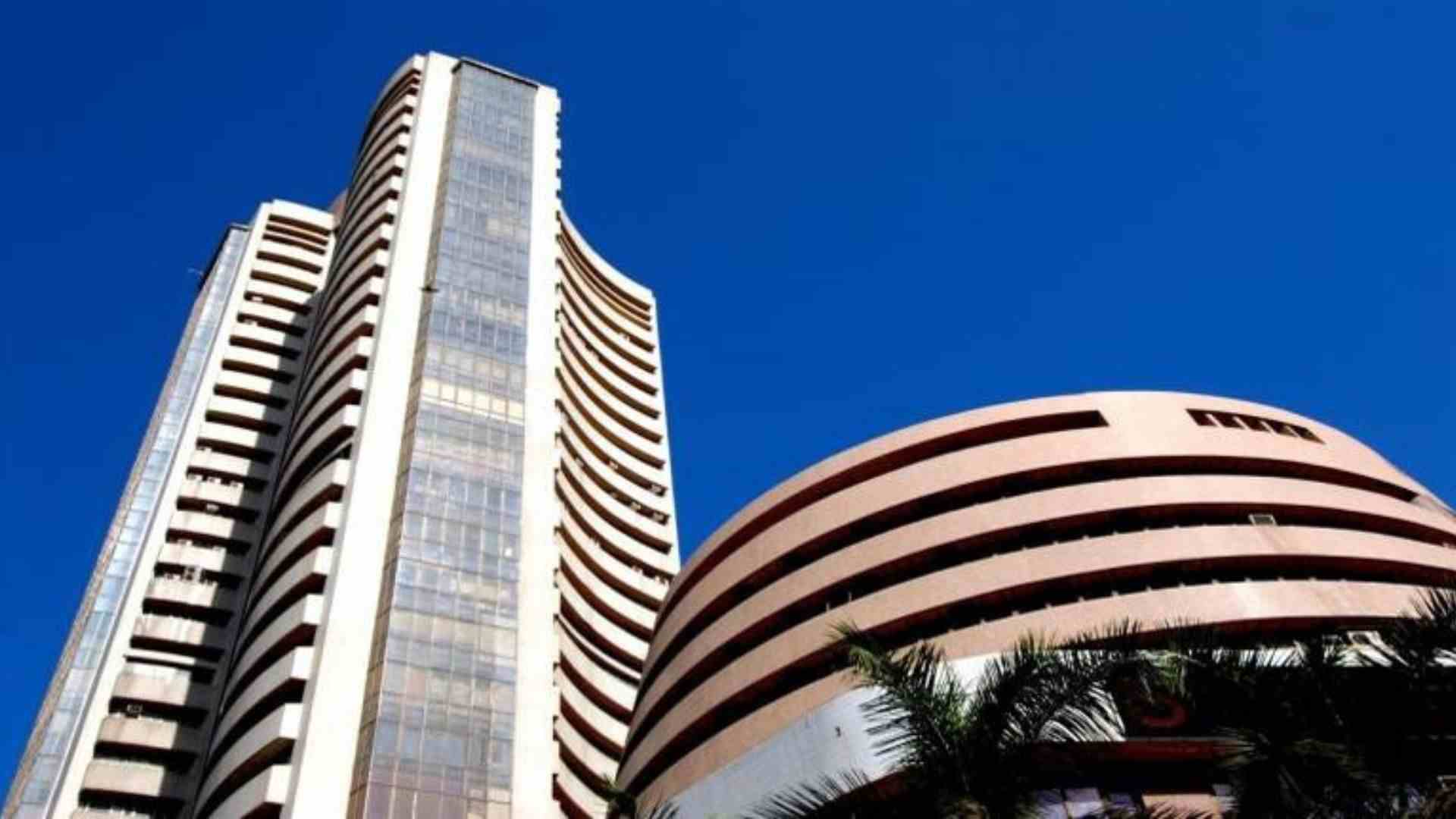

The Indian stock market entered the Lok Sabha election season of 2024, there was an expectation that the current government would stay in power. Consequently, the market has already accounted for policy continuity.

Various opinion polls have predicted that the NDA will win between 315 and 329 seats, while none have forecasted a return of the INDI Alliance, with their projected seat wins ranging from 93 to 156.

Analysts suggest that improvements in macroeconomic variables and the government’s concentrated efforts on infrastructure development, coupled with fiscal prudence, have attracted investor interest in recent years.

Domestic equities have experienced increased volatility, and concerns over low voter turnout initially unsettled the markets. Although voter turnout is not a reliable indicator, it is expected to influence the seat count for Prime Minister Narendra Modi’s party, the Bharatiya Janata Party (BJP).

However, brokerage firm JM Financial noted that it did not find a clear trend between voter turnout and election results in the past.

Voter behavior varies in each election, influenced by the prevailing narrative at the time. For example, the NDA retained power in 1999 despite lower voter turnout, but lost to the Congress-led United Progressive Alliance (UPA) in the subsequent 2004 election, which also saw lower turnout.

“Generally, it is seen that increased dissatisfaction with the incumbent government or higher level of connection with the issues raised by a political party (challenger) tend to raise voter interest / turnout, which increases the chances of a change in government. None of the above scenarios is playing out in the current election,” JM Financial said.

Meanwhile, with the start of the election season, volatility in the Indian share market increased significantly.

JM Financial’s analysis of previous election periods showed that volatility typically rises at the beginning of elections and drops around the date of the results as uncertainty decreases. In line with this pattern, the firm believes that the VIX has peaked in this cycle and will likely decline until the results are announced, eventually returning to normal levels.

Assuming policy continuity, the brokerage firm anticipates robust gains following the election results on June 4th and suggests that any market dips should be viewed as buying opportunities.

JM Financial’s analysis of market returns during the last five general elections shows that overall stock market returns tend to be positive three months after the results. Sectorally, positive returns are generally observed across most sectors six months post-election.

Small and Midcaps (SMIDs) have consistently outperformed large caps in every timeframe following the results in past cycles. The brokerage acknowledges that this approach might average out individual sector performance and might not be replicable in the future. Due to concerns around a global slowdown affecting market performance in August 2019, analyzing returns post-2019 elections might not provide an accurate picture. Therefore, the brokerage looks to periods with similar market conditions, such as the 2014 general elections when equities were already performing well leading up to the elections.

JM Financial observed that during previous election periods, sectors such as Auto, Consumer Durables, and Healthcare outperformed the benchmark index. On a broader level, Small and Midcaps (SMIDs) consistently outperformed large caps.

JM Financial anticipates that the Indian stock market will experience robust gains following the election results and suggests that any declines should be considered as buying opportunities.

“Policy continuity will ensure that the government’s main focus will remain on infrastructure development and manufacturing, which will benefit sectors in Defence and Capital goods space. However, unlike in past periods, in this cycle we prefer Large caps over SMIDs in 2024 as we look for valuation comfort,” it said.

At the sectoral level, the brokerage firm identifies Private Banks and the Consumption sector as offering favorable valuations, expected to surpass the benchmark in the short term.

Presently, the Nifty is trading at a forward PE ratio of 20x, approximately one standard deviation from the long-term mean, a valuation it deems reasonable.

Following the election results, market attention is expected to turn towards the Union Budget, which is anticipated to be presented in July.