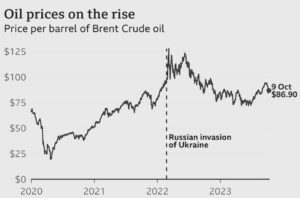

Oil prices surged by more than $4 a barrel in early Asian trade on Monday due to dramatic military clashes between Israeli and Hamas forces over the weekend, deepening political uncertainty across the Middle East. Brent crude rose by $4.18, or 4.94%, to reach $88.76 a barrel by 0120 GMT, while U.S. West Texas Intermediate crude was at $87.02 a barrel, up by $4.23, or 5.11%.

This surge in oil prices reversed last week’s downward trend, which marked the largest weekly decline since March. During this period, Brent fell about 11% and WTI retreated by more than 8% amid concerns about high interest rates and their impact on global demand.

The Palestinian Islamist group Hamas launched the largest military assault on Israel in decades on Saturday, resulting in the loss of hundreds of lives on both sides and triggering a wave of retaliatory Israeli air strikes on Gaza that continued through Sunday.

Analysts from ANZ Bank noted, “Increasing geopolitical risk in the Middle East should support oil prices… higher volatility can be expected.” The eruption of violence threatens to derail U.S. efforts to broker a rapprochement between Saudi Arabia and Israel, wherein the kingdom would normalize ties with Israel in return for a defense deal between Washington and Riyadh.

Saudi officials reportedly informed the White House on Friday of their willingness to increase output next year as part of the proposed Israel deal. Such an increase in Saudi output would have helped relieve supply tightness after months of cuts from key producers Saudi Arabia and Russia. Additionally, a normalization of Saudi-Israeli relations would likely halt recent moves toward detente between Saudi Arabia and Iran.

The attacks drew condemnation from Western nations but received open praise from Iran and Hezbollah, Iran’s allies in Lebanon. Market attention has shifted to the possibility of Iranian involvement in the attacks, an allegation already made by Israeli authorities.

Vivek Dhar, an analyst at Commonwealth Bank of Australia, stated, “For this conflict to have a lasting and meaningful impact on oil markets, there must be a sustained reduction in oil supply or transport. If Western countries officially link Iranian intelligence to the Hamas attack, then Iran’s oil supply and exports face imminent downside risks,” Dhar added.

As clashes between Israel and the Palestinian Islamist group Hamas fueled worries that the conflict could spread beyond Gaza, oil prices edged down slightly on Tuesday after gaining more than 4% in the previous session.