The GST Council, during its 53rd meeting on Saturday, announced the rollout of Pan-India biometric authentication. This measure aims to curb the rampant issue of fake invoicing, a concern that has plagued the system and led to substantial revenue losses.

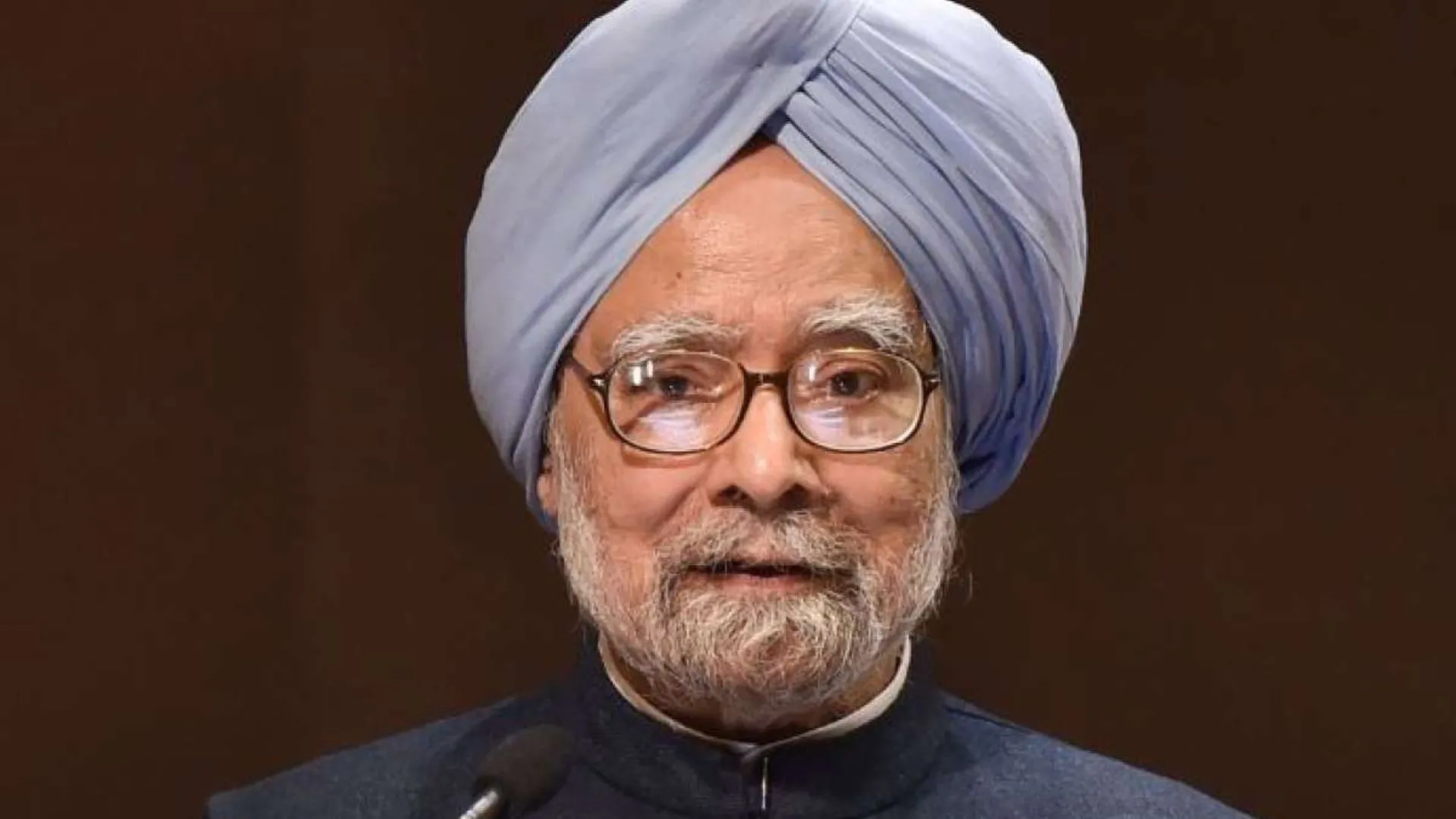

Union Finance Minister Nirmala Sitharaman, who chaired the meeting, briefed the press on the key decisions. “This initiative will help us combat fraudulent input tax credit claims made through fake invoices,” Sitharaman stated, emphasizing the Council’s commitment to enhancing the integrity of the GST system.

Post-Budget Session Meeting:

Sitharaman also mentioned that another GST Council meeting is scheduled to be held after the budget session, underscoring the Council’s proactive approach in addressing ongoing and emergent issues.

Retrospective Amendment For Input Tax Credit:

A notable decision was made regarding the time limit to avail input tax credit under section 16(4) of the CGST Act. The Council recommended that the time frame for financial years 2017-18, 2018-19, 2019-20, and 2020-21 be extended to November 30, 2021. This retrospective amendment will take effect from July 1, 2017.

First Meeting Of The New Government:

This was the first GST Council meeting following the formation of the new government, marking a pivotal moment in the administration’s fiscal agenda.

Exemptions And Tax Adjustments:

- Railway Services:

- Services provided by Indian Railways, including platform tickets, waiting room facilities, and battery-operated car services, have been exempted from GST. This exemption aims to reduce the financial burden on the common man.

- Aadhaar Biometric Authentication:

- The Council mandated Aadhaar biometric authentication for new GST registrations nationwide to streamline the registration process and enhance security.

- Waiver Of Interest and Penalties:

- A waiver of interest and penalties on demand notices issued under section 73 for FY 2017-18, 2018-19, and 2019-20 has been approved, applicable if the tax is fully paid by March 2025.

- Uniform GST Rates:

- The Council prescribed a uniform GST rate of 12% on all types of milk cans, irrespective of their material. This move is expected to simplify compliance and benefit the dairy industry. Additionally, a uniform 12% GST rate on carton boxes and cases, both corrugated and non-corrugated, was introduced to support apple growers in Himachal Pradesh and Jammu and Kashmir.

- Fire water sprinklers and other types of sprinklers will now attract a 12% GST rate, as clarified by the Council.

- Hostel Accommodation:

- Services by way of hostel accommodation outside educational institutions, up to Rs 20,000 per person per month, have been exempted from GST, providing relief to students and working professionals.

Additional Functionalities And Sectoral Recommendations:

- The Council recommended the insertion of functionality via form GSTR-1A to add particulars of the current tax period if missed in reporting.

- The fertiliser sector saw a significant discussion, with the Council referring the recommendation to exempt fertilisers from the current 5% GST rate to the Group of Ministers on rate rationalization. This follows earlier discussions in the 45th and 47th GST Council meetings.

Appeal And Filing Adjustments:

- The time limit for availing input tax credit for invoices or debit notes filed up to November 30, 2021, has been reiterated.

- The monetary threshold for filing an appeal by the tax department has been set at Rs 20 lakh for GSTAT, Rs 1 crore for High Court, and Rs 2 crore for the Supreme Court.

- The maximum pre-deposit amount for filing appeals before the appellate authority has been reduced from Rs 25 crore to Rs 20 crore for both CGST and SGST.

- The time limit for filing GSTR-4 has been extended to June 30.

These decisions reflect the GST Council‘s ongoing efforts to streamline tax administration, reduce litigation, and provide relief to various sectors while maintaining a robust and fair tax regime.