A recent survey conducted on the homebuyer sentiment revealed interesting details in the growing real estate industry.

PREFERRED STAGE OF CONSTRUCTION

The inclination towards ready homes has experienced a decline and currently resides at the bottom of the preference hierarchy. A noticeable shift has occurred in the preferences between ready properties and new launches across various cities. As of H2 2023, the ratio of ready homes to new launches is 23:24, indicating a complete reversal of the trend observed in H1 2020 when the ratio stood at 46:18.

One key factor contributing to this shift is the increased supply of new projects from large and reputable developers. These established developers have instilled greater confidence among potential homebuyers, thanks to their track record of delivering projects on time. In the past, new launches were predominantly led by smaller players, resulting in numerous project delays that eroded buyer confidence. As a result, buyers leaned towards ready homes.

The current landscape has transformed. With renowned and well-established developers entering the market, their new projects are experiencing significant growth in housing sales. This renewed trust in the capabilities of established developers has sparked increased interest in new launches, narrowing the preference gap between ready homes and new projects in the real estate market.

IDEAL BUDGET RANGE

As per the survey findings, while the budget range of INR 45 lakh to INR 90 lakh maintains its status as the most preferred budget for over 33% of potential homebuyers, there is an evident rise in the popularity of premium and luxury homes. Approximately 26% of respondents now express a preference for homes in the range of INR 90 lakh to INR 1.5 crore. Over the past three years, a substantial shift in housing demand has been observed, marked by a notable 19% decrease in the proportion of homebuyers opting for affordable homes. Those interested in affordable homes seem to be adopting a ‘wait and watch’ approach, prompting developers to curtail new supply in this budget category.

ANAROCK data further illustrates a significant contraction in the new supply share in the affordable category over the last two years across the top 7 cities. This share has dwindled from 26% in 2021 to a mere 18% in 2023. In comparison, back in 2019, the affordable category constituted 40% of the total new launches.

BHK PREFERENCE

According to the survey findings, the budget range of INR 45 lakh to INR 90 lakh remains the most favoured for over 33% of potential homebuyers, while there is a noticeable increase in the preference for premium and luxury homes, with around 26% of respondents now leaning towards homes in the INR 90 lakh to INR 1.5 crore range. Over the past three years, there has been a significant shift in housing demand, with a notable 19% decrease in the proportion of homebuyers opting for affordable homes. Those interested in affordable homes appear to be adopting a ‘wait and watch’ approach, leading developers to reduce new supply in this budget category.

ANAROCK data further highlights a substantial contraction in the new supply share in the affordable category over the last two years across the top 7 cities. This share has decreased from 26% in 2021 to a mere 18% in 2023. In comparison, back in 2019, the affordable category constituted 40% of the total new launches.

There is a significant demand for 3BHK apartments, especially in cities like Bengaluru, Chennai, Hyderabad, and Delhi-NCR. The majority of survey respondents in these cities express a preference for 3BHK units over other BHK types. On the contrary, in the Mumbai Metropolitan Region (MMR), a majority of respondents (44%) favour 2BHK apartments as their most preferred BHK typology.

Remarkably, 1BHK units are predominantly in demand in the western markets of MMR and Pune, where 17% and 10% of the survey respondents, respectively, voted in favour of this option. This data underscores the diverse preferences for apartment sizes observed in different cities across the country.

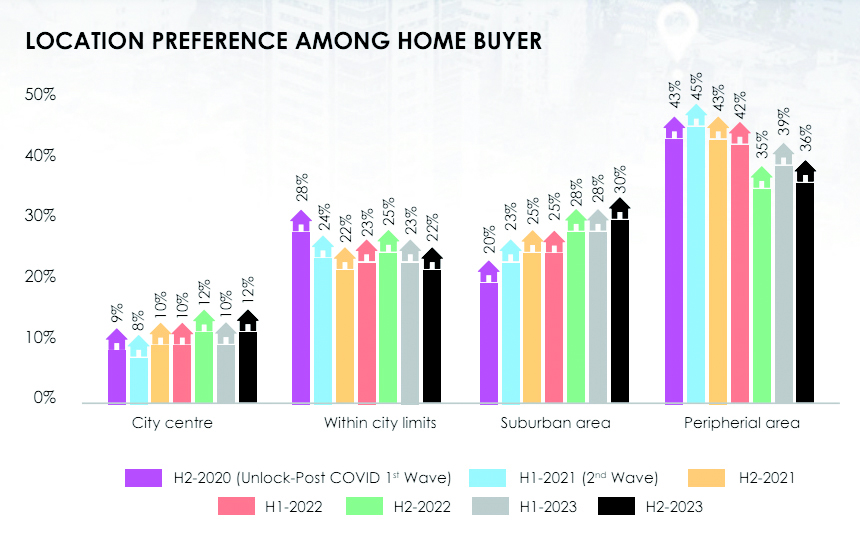

LOCATION PREFERENCE

The demand for homes in city peripheries remains robust, with a significant 36% of survey respondents expressing a preference for these areas over others. The appeal of peripheries lies in the availability of more extensive homes at relatively affordable prices, enhanced connectivity, and developing infrastructure.

The ongoing influence of the hybrid work model plays a crucial role in sustaining this trend. The adoption of the hybrid work model by many offices, necessitating employees to work from the office for a few days each week, allows individuals the flexibility to consider residing in the peripheries while maintaining the option to commute to work when required.

However, it’s noteworthy that the inclination to purchase homes in peripheral areas has declined over the last two years. In H2 2021, 43% of respondents favoured peripheries, but this figure decreased to 36% in H2 2023. Consequently, there has been a shift in preference back towards suburban areas, given that many of these regions are now well-developed and still relatively affordable compared to city centres. In the current survey (H2 2023), 30% of respondents selected suburban areas as their primary choice for purchasing a home, a slight increase from the 25% recorded in H2 2021.

TOP 3 HOMEBUYER DEMANDS

In recent years, there has been a significant shift in homebuyers’ preferences, influenced by new realities. The following are the top demands of homebuyers:

Construction quality: Many now prioritize risk-free investments, even if they come at a premium. Consequently, a major demand from homebuyers (74%) is an enhancement in construction quality.

Large and leading developers are currently experiencing robust sales, primarily because they instil confidence and assurance in buyers regarding timely project delivery and high-quality products.

Balcony availability: A considerable 75% of property seekers express a desire for balconies in their homes to create a sense of more open spaces within the living area.

Office/study room/corner availability: An interesting demand observed among 31% of prospective buyers is the need for a small office space or a separate study room. This demand is primarily attributed to the influence of the hybrid work model.