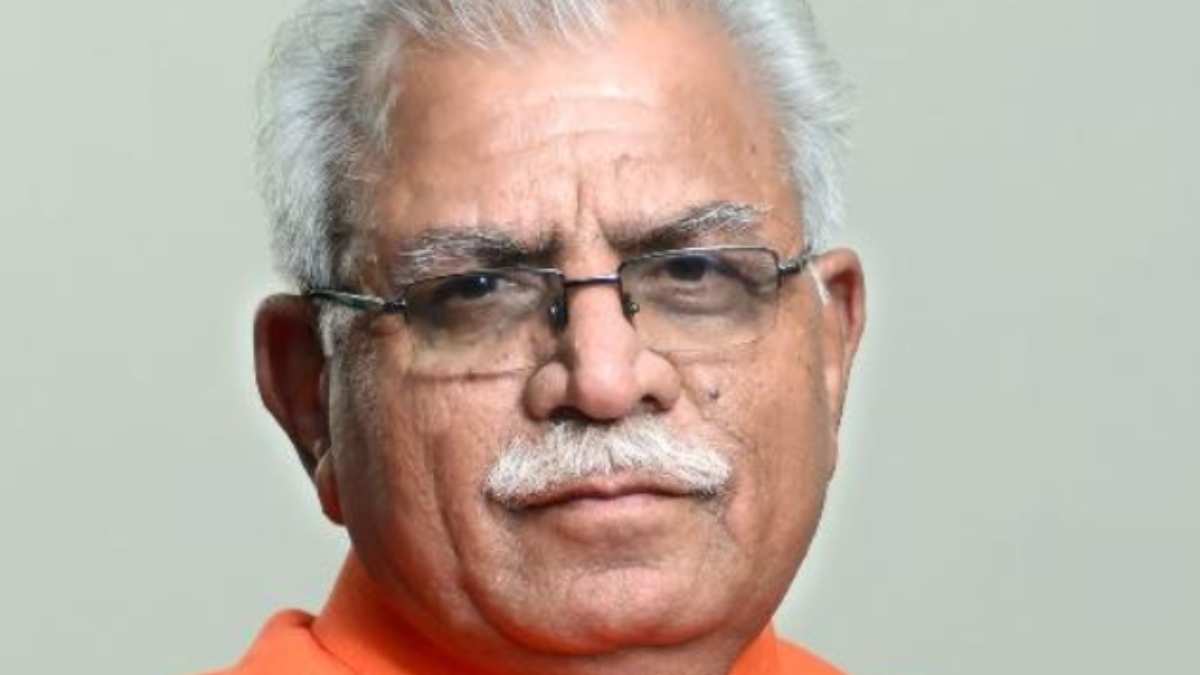

On the eve of Independence Day, Haryana Chief Minister Manohar Lal approved a slew of relief measures for the people of Haryana. The government announced 100% exemption in property tax for the charitable educational institutions, charitable hospitals and schools for children with special needs.

Keeping in view the hardships caused by Covid-19 pandemic, the Haryana government has decided to waive off the electricity bills of all religious places i.e. temples (including Buddhist & Jain temples), gurdwaras, churches and masjids in the state from April to June along with corresponding surcharge amount provided that they would clear their pending dues up to March 2020, if any by 31 October 2020. Also, a rebate of 10% would be admissible to those assesses who pay their total property dues up to 31 October.

Moreover, the government will also give one time 50% rebate in property tax for residential properties situated in Lal Dora of villages under Municipal Bodies whose owners would clear pending arrears by 31 October 2020.

The spokesperson of the Haryana government said that many amendments have been carried out in the Urban Local Bodies Department Notifications dated 11 October 2013, to give effect to the measures relating to property tax and that DISCOMs would soon issue notifications in respect of electricity bills of temples, gurdwaras, churches and mosques.

The spokesman further added a one-time rebate of 25% would also be allowed for property tax dues or arrears for the year 2010-11 to 2016-17 to those property tax owners who clear all the property tax dues or arrears for the year 2010-11 to 2019-20 by 31 October 2020. In case of late payment, interest at the rate of 1.5% per month or part thereof would be charged provided that one-time waiver of interest on the dues and arrears of property tax pending since the year 2010-11 to 2019-20 would be allowed to all taxpayers, if their arrears are paid up to 31 October 2020.

An additional 5% rebate would be given to property owners who will pay the property tax by auto-debit system up to 31 July every year but for the current year that is 2020-21 the last date would be treated as 31 October 2020.

According to the spokesperson, the rates of property tax for activities allied to agriculture that are dairies and dhabas that were revised on 19 September 19, 2019, would be made applicable with effect from 11 October 2013.