The world is facing an urgent need to address climate change. Without urgency in action and emissions reductions across all sectors, limiting global warming to 1.5 degrees Celsius will not be possible, said Mona Haddad, Global Director for Trade, Investment, and Competitiveness.

According to a 2022 IPCC report, global greenhouse gas emissions need to stabilize before 2025, be reduced by 43 percent by 2030, and reach net-zero by 2050. Only through immediate and coordinated action can we limit the damages from climate change and minimize the adverse effects of rising temperatures on growth, poverty reduction, and conflict around the world. Climate action from both the public and private sectors is vital to meet this objective and accelerate the transition. In December 2015, 195 states signed the Paris Agreement.

This pact provides an international agreement on tackling climate change that sets out each country’s pledge to lower their emissions. While countries are increasingly taking steps to realize their commitments, there is a lack of consensus on how to translate global reduction targets into business-specific actions. Yet, private-sector engagement is critical to rapidly decarbonize existing supply chains and as a source of investment to accelerate the global energy transition, Haddad said.

The world today confronts an unprecedented climate crisis, and governments zealously seek solutions: multinational enterprises (MNEs) should play a central role. Climate change is a defining challenge of our time—posing serious threats to countries’ ability to secure past developments and sustainably achieve future improvements in living standards. So it is urgent that countries build the resilience of and be ready to adapt their people and economies to the effects of climate change in their development strategies, while also reducing greenhouse gas (GHG) emissions to mitigate damaging changes to the climate (World Bank Group 2021). The success of such strategies for global climate action will depend in part on the willingness of pivotal private actors to reform their behavior, ensuring widespread access to new technologies and increasing the global flow of investments. For each of these reasons, multinational enterprises should play a central role in climate change policy.

MNEs provide both a fundamental risk to and an opportunity for climate change mitigation. The climate ambitions of MNEs will affect the environmental performance of countries around the world. As a leading actor, proactive MNEs can impose sustainability standards or encourage green technology transfers that, in some cases, could affect millions of producers and accelerate the climate transition (Thorlakson, Zegher, and Lambin 2018). However, obstructive MNEs may equally hold back any progress to reduce a country’s emissions via inaction or by actively resisting, obstructing, or lobbying against change.

MNEs also offer an important source of finance for sustainable development by supplying countries with foreign direct investment (FDI). Fulfilling the global commitments made in the Paris Agreement on climate change and achieving the Sustainable Development Goals (SDGs)1 requires an acceleration in financing.

The United Nations Conference on Trade and Development estimates that between US$550 billion and US$850 billion in capital investment is needed in developing countries annually to meet goals related to climate mitigation, while another US$80 billion to US$120 billion is needed for adaptation (UNCTAD 2014). The United Nations (UN) estimated an average annual SDG funding gap of US$2.5 trillion in developing countries (UNEP 2018). Together with public and other private investments, the cross-border investments of MNEs offer an important source of finance for sustainable development (OECD 2022).

Three Key Channels

The Effect of Multinational Enterprises on Climate Change MNEs affect climate change via three channels: scale effects, technology effects, and composition effects. The climate change literature has often presented the activities of MNEs either as a risk to increase emissions in developing countries by shifting their polluting activities to locations with limited environmental regulation (pollution haven), or overview as an opportunity to reduce emissions in developing countries by attracting cleaner technologies (pollution halo). However, this binary view is too simplistic.

New analysis using micro- and macro-data on GHG emissions showcases that MNEs and FDI can simultaneously bring with them challenges and opportunities for climate change mitigation through these three key channels (OECD 2022):

Scale effect: MNEs are major drivers of emissions. As they increase their production, their host country would likely also increase their total emissions.

Technology effect: MNEs can diffuse low-carbon knowledge and technologies to domestic firms, which can thereby reduce a sector’s average carbon intensity and reduce emissions.

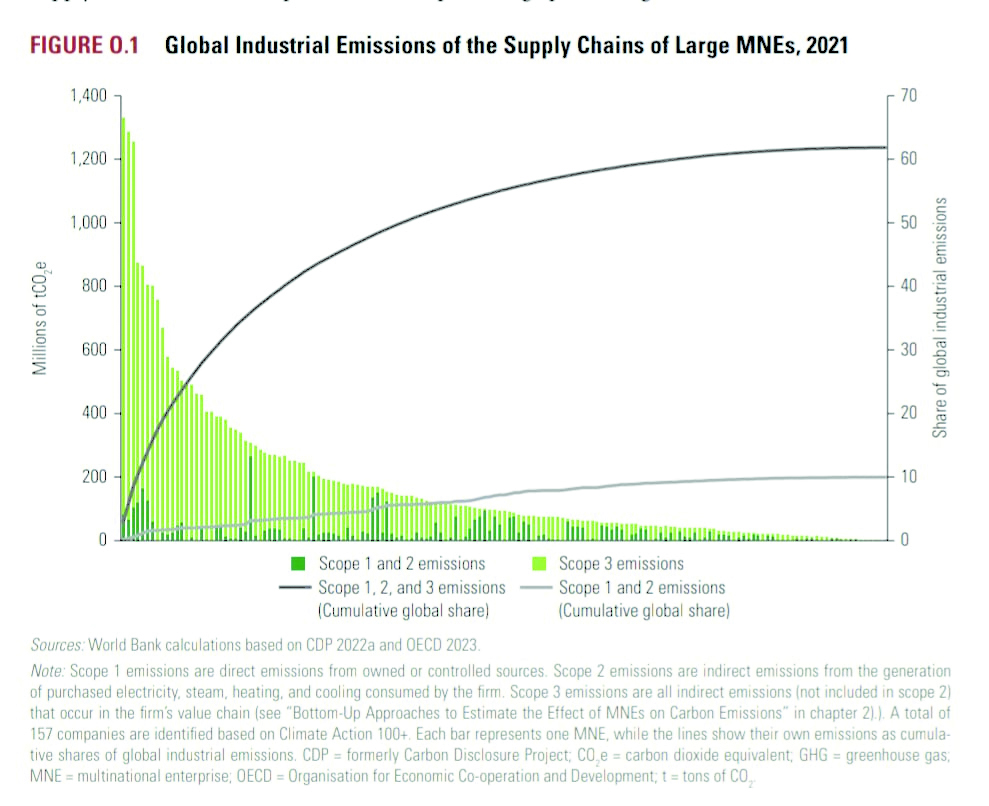

Composition effect: MNEs’ FDI also changes industrial structure. This has an ambiguous effect on emissions, as FDI could shift resources toward low- or highcarbon intensity activities. Related to the scale effect, this report finds that a small number of MNEs are a major driver of global GHG emissions (Figure 1). The total emissions of 157 large MNEs jointly account for up to 60 percent of total industrial emissions. While their own activities jointly account for (only) 10 percentage points of global industrial emissions, their supply chains could add up to another 50 percentage point points of global emissions.

Affiliates of MNEs

The affiliates of these 157 large MNEs make up a large share of emissions for many countries, while the most polluting sectors differ. We consider the network of MNE affiliates associated with these 157 large MNEs using Bureau Van Dijk’s Orbis database. Our estimates suggest that their activities account for 1–25 percent of emissions in 85 countries, 25–50 percent of emissions in 9 countries, 50–75 percent in 8 countries, 75–100 percent in 9 countries, and over 100 percent of emissions in 25 countries (map O.1, panel a).9 The energy sector tends to be the biggest polluter (via oil and gas, utility companies, or coal), but some regions dominate in transport, industrials, or consumer goods and services (map O.1, panel b). New evidence also supports the technology effect, by finding that MNEs are considerably less carbon intensive in their production than domestic firms. Data from the CDP (formerly the Carbon Disclosure Project) Full GHG (Greenhouse Gas) Emissions Dataset find that in the case of steel, MNEs considerably overperform vis-à-vis domestic firms, producing somewhere between 18 and 48 percent fewer emissions for the same output.

For cement, the results differ more significantly across product types. For clinkers, cement equivalent, and cementitious products, MNEs were able to produce the same goods for somewhere between 1 and 11 percent fewer emissions. Yet, in the case of low-carbon dioxide (CO2 ) material, the average MNE was found to produce goods with 84 percent fewer emissions than domestic firms. Hence, while MNEs generally have a reduced carbon intensity of production in steel, for cement their advantage comes from the use of more sophisticated low-CO2 products.10 Overall, we find the dissemination of production technologies used by MNEs has significant potential to reduce the emissions of domestic firms. FDI project announcements suggest that the composition effect of MNEs is improving, with FDI increasingly shifting out of polluting sectors and into green sectors. Greenfield FDI announcements for polluting sectors have gradually declined, while FDI is increasingly moving into green sectors (figure O.3, panel a). For international mergers and acquisitions, an increase in polluting sectors was followed by a significant decline. Firms in green sectors saw a substantial rise over time, so that in 2021 the value of green sector mergers and acquisitions (M&As) overtook that of polluting sectors.

Global investment patterns have likely shifted for three main reasons. First, investors are reacting to rapidly declining costs and significant growth potential in renewable energy generation and low-carbon manufacturing methods (IRENA 2020). Second, companies are also responding to the rising pressures brought upon them by governments and investors and shareholders to engage in lower-carbon activities (World Bank, forthcoming). Third, shareholders have started to add a carbon risk premium at the firm level, which increases the cost of capital and raises the hurdle rates on new polluting investments (Bolton, Halem, and Kacperczyk 2022; Chava 2014). Jointly, this helps explain a growing number of green and slowing number of polluting greenfield FDI and cross-border M&A announcements over time.

The Climate Commitments of MNEs

In most countries, MNEs have not formally committed to transition to net-zero GHG emissions by 2050 (map O.2). In only eight countries have over 75 percent of large MNEs committed to transition to net-zero emissions by 2050, and these are all based in Europe. Another seven countries in Europe and East Asia have between 25 and 50 percent of large MNEs committed to net-zero. Most large MNEs headquartered in other regions, such as North America, South America, Africa, or the rest of Asia are all still uncommitted to net-zero by 2050.