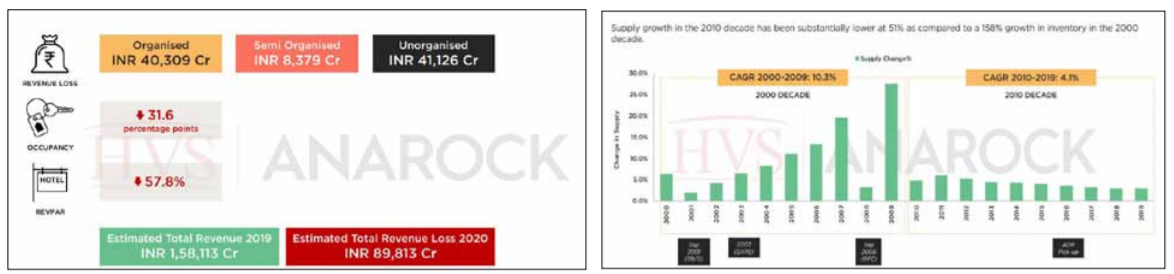

The hotel industry may struggle for reclaiming the lost occupancy in the near future as corporates are Corporates are expected to put restrictions on non-essential employee travel. Occupancy and may reach Pre-COVID levels by 2022 and 2023 respectively, with supply growth expected to remain dormant

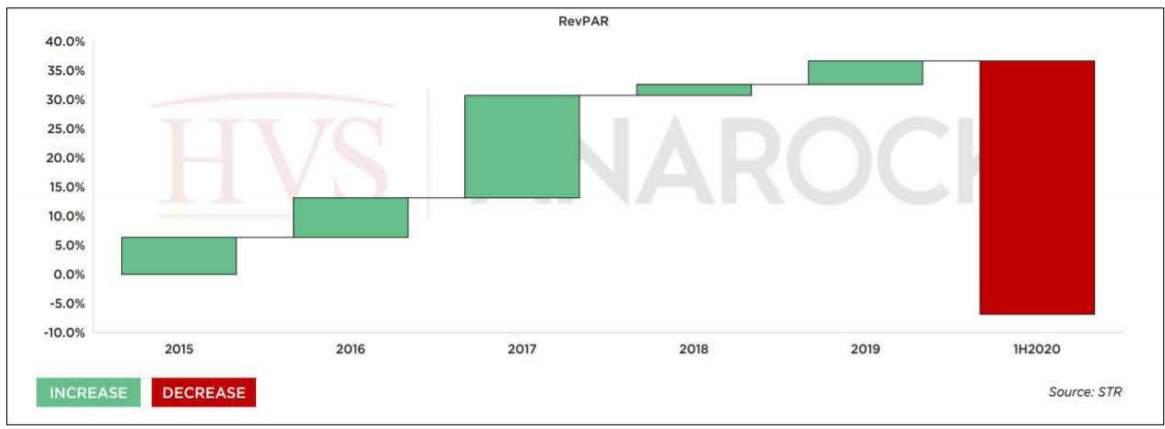

The onslaught of COVID-19 has had a terrible impact from the hotel industry, which is staring at a loss of Rs. 90,000 crore. The industry had seen a good two months of January and February in 2020, and was on its path to recovery after struggling for achieving revenue targets in 2018 and 2019, says a report prepared by HVS India & ANAROCK.

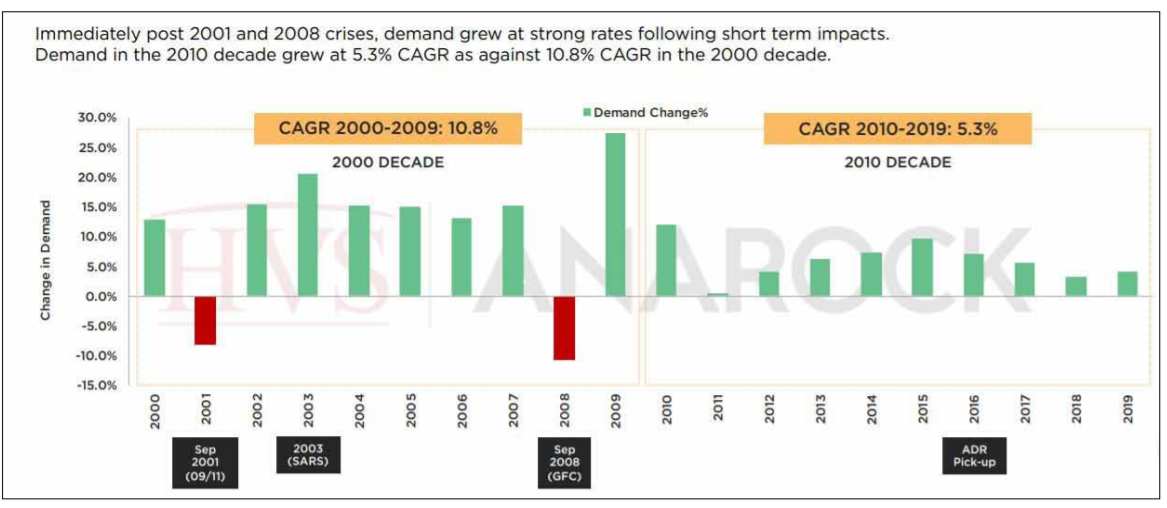

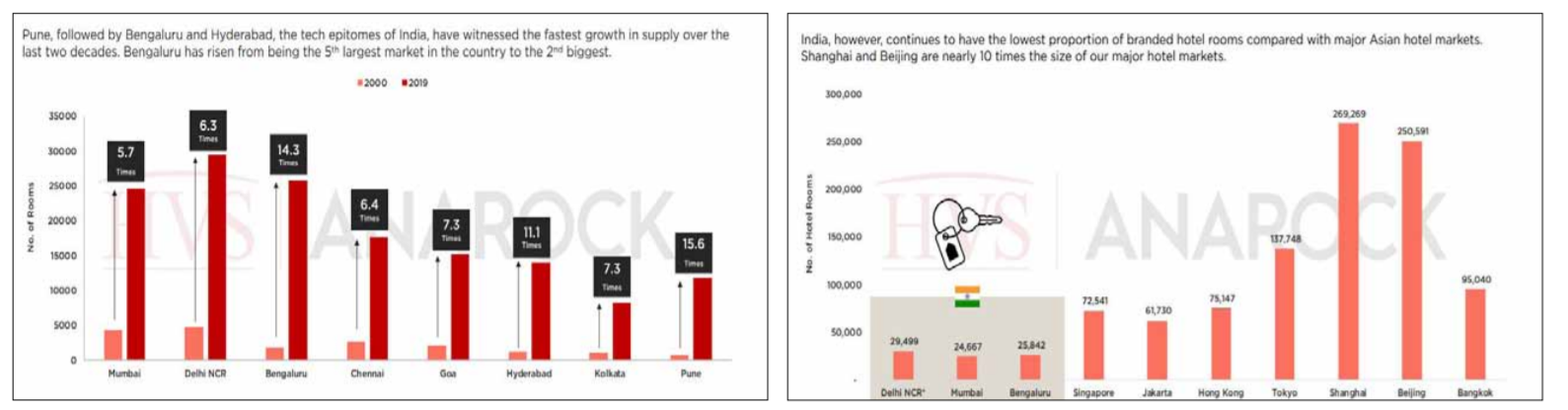

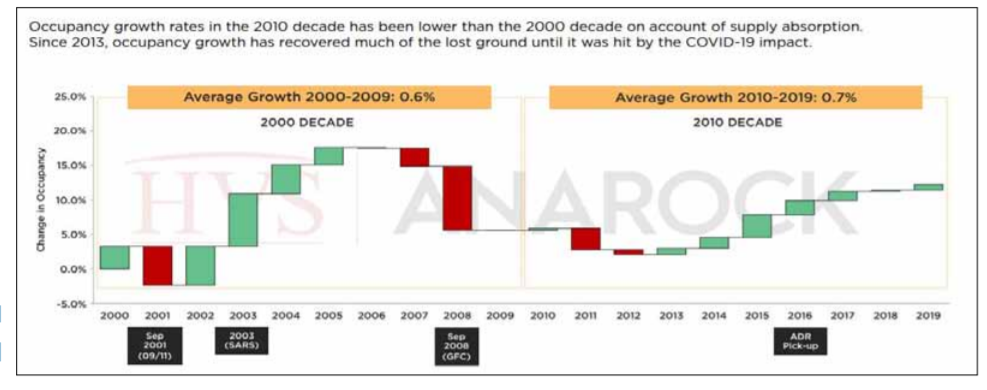

The report says that the decade starting the year 2000 was substantially better for the hotel industry as compared to the year starting 2010. Supply growth in the 2010 decade has been substantially lower at 51% as compared to a 158% growth in inventory in the 2000 decade. Pune, followed by Bengaluru and Hyderabad, the tech epitomes of India, have witnessed the fastest growth in supply over the last two decades. Bengaluru has risen from being the 5th largest market in the country to the 2nd biggest, the report, a copy which was accessed by this writer, says.

Despite two decades of growth, India, continues to have the lowest proportion of branded hotel rooms compared with major Asian hotel markets. Shanghai and Beijing are nearly 10 times the size of our major hotel markets.

The hotel industry may struggle for reclaiming the lost occupancy in the near future as corporates are Corporates are expected to put restrictions on nonessential employee travel. Even for the essential employee travel, allowance limits are likely to be reduced. Senior Management travel also expected to reduce in the short term.

New hotel launches may get delayed as Under-construction projects may face delays on account of labour shortages and issues pertaining to vendors and supply chain. Whereas muted market conditions will lead to delayed opening and financing challenges on account of negative sentiment will delay projects. In fact, some proposed hotel projects may be cancelled or changed altogether as the changed market conditions will render the projects unfeasible. Some hotel properties may be repurposed for new asset classes like hospital, student housing and Co-living projects.

Do see the attached analysis on this page to get a clear picture on the state of the hotel industry, the previous two decades and the road head.

Tarun Nangia is the host and producer of Policy&Politics.