Introduction

In our previous trend, we focused on the features of markets in the digital world with respect to high returns to scale and network externalities which went handin-hand with the rise in provision of free services. The exponential growth of this market is underscored by the fact that digital advertising has prevailed over traditional channels such as print and television advertising in many countries, to become the largest medium of advertisements. Targeted advertising is made possible only because of profiling of consumers based on search habits and insights gained from their data.

This data is an essential facet of advertising on the digital medium, as advertisers can choose to target advertisements based on based on browsing behaviour and interests (behavioural targeting), the theme and context of a website (contextual targeting); geographical location of an individual (geographical targeting); social, demographic and economic characteristics such as age, gender, income (sociodemographic targeting) or even based on time, day or week (time targeting). This wide array of options are available to advertisers because consumers increasingly rely on “free” services, such as maps, general search services, etc. in their daily lives, generating vast swathes of data in the process of doing so which allows for a rich development of targeting factors.

Digital Advertising: Establishing the trend

Since user data presents valuable behavioural insights, advertisers increasingly find spending on Digital Advertising gives higher returns on investments. While currently advertising revenues through traditional channels such as print and television advertising is still higher than digital advertising, market studies show that Digital Advertising revenues will eventually surpass print advertising revenues.

Google Story

If one must name a single enterprise that has revolutionised the internet, it must be Google. We cannot imagine a life without Google, and for this tech boom throughout the world, we all must thank Google. In 1995, Google began as a project of Larry Page who was later joined by Sergey Brin. While initially, it was only a search engine, Google family was to become much more than that in just two decades. Google has brought several innovations that has changed the world, such as Search Engine that has brought all the information on the fingertip of user, Android OS that eased access of smartphones to majority of population and making YouTube the streaming service that gave opportunity to creators to expand their reach globally.

Presently, Google is engaged in provision of number of product and services including Maps, YouTube, Chrome, Android, Play Store, Gmail, online advertisement services etc. which creates an ecosystem of Google around us. In fact, creating an ecosystem is one of the defining features of business model of Google, where integrating several services providers better consumer experience and that eventually eases expansion of the company. Google has established itself as the undisputed market leader in general search, as the global market share of the top 5 search engines across the last 10 years shows.

One of the factors that played a role in establishing Google as a market leader is their acquisition strategy. If one looks at the acquisition history of Google, Google has made close to USD 30 billion on its major acquisitions. Some of these acquisitions have converted into a huge success, such as Android, YouTube, Advertisement acquisitions and Waze for maps. Android has turned out to be cothe cheapest yet the most successful deal for Google. Consequently, such killer acquisitions also gives a strong market power to Google in several markets. Considering the same, there have been several competition law investigations against Google across multiple jurisdictions (EU, US, Turkey, Australia etc).

Google’s Story in India

Google started its operation in India in 2004 with five employees but now has become one of the largest Google office outside USA. Seeing the potential that Indian market has in terms of population, Google has customised its services for Indian population, like providing search services in regional languages, answering queries over phones (in collaboration with Vodafone) etc, thus pioneering and championing the role of innovation in India’s growth story. Additionally, it has also contributed to increase the reach of internet in India by providing free public WiFi (more than 400 stations), Google is already a success in India and with increase in internet penetration, India is likely to become one of the biggest market for Google. There is absolutely no doubt that Google’s contribution to the tech boom in India is paramount and cannot be denied and we must all be thankful to Google for ushering it this boom which has benefited all of us.

Google Advertising business model

Google’s story brings several competition concerns. However, herein, we bring our focus only to Google’s conduct in online advertisement industry. Google acquired Double Click and AdMob at early stage to grow their revenue in advertisement industry. It can be noticed that most of the services offered by Google are for free, therefore business model of Google is such that advertisement revenue is primary revenue source for them.

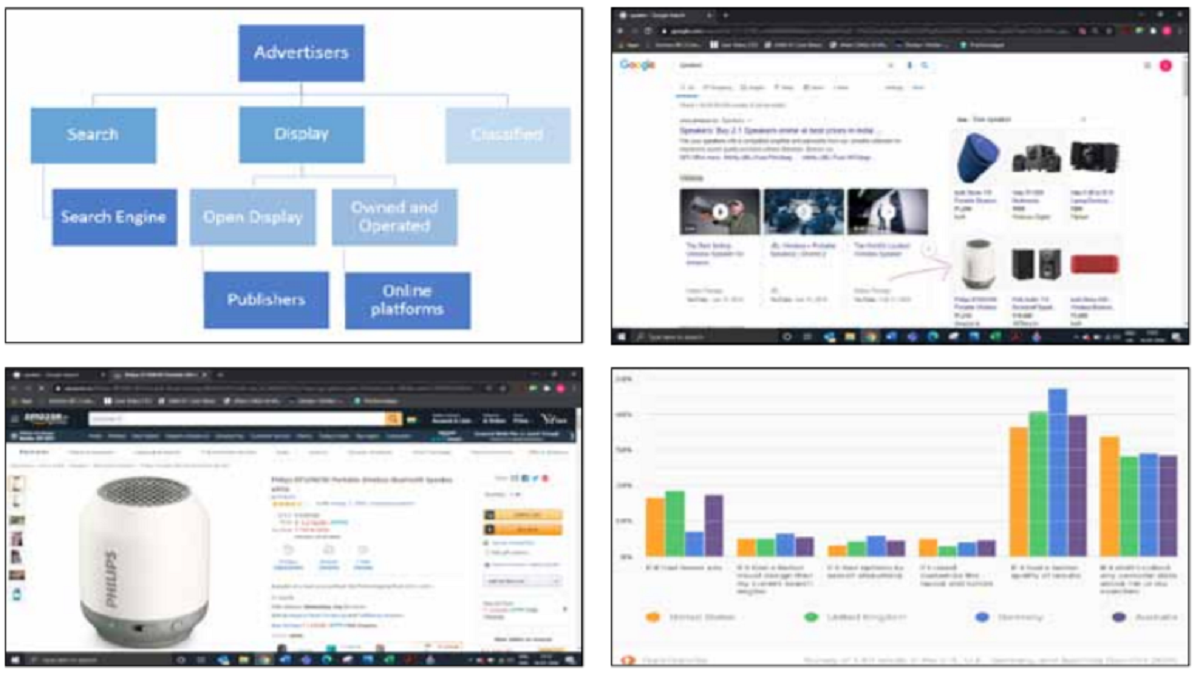

Difference between Search and Display Advertising

Search advertising and display advertising are two major forms of online advertising. While search advertising is used by advertisers to target consumers who have made a general decision about what they are looking for, display advertising is usually intended to be used for increasing brand awareness. Participants also highlighted that while display advertising is associated with demand generation for a product, search advertising leads to more conversions in terms of actual sales. On other parameters such as creativity in advertising, stakeholders submitted that search advertising being text-based, display advertising provided more avenues in terms of innovative ads that may capture user attention.

In terms of strategies employed by advertisers, the study also found that advertisers were not likely to substitute display advertising with search advertising, and vice-versa. This was also substantiated by the fact that budget allocation for the two types of advertising were kept distinct. However, it was also revealed that depending on what the advertisement campaign objective are, the two methods of digital advertising could often be used in complement to each other. For instance, display advertising may make the consumer aware of the product offering, nudging him/ her towards searching for the product and encountering search advertisements.

Following chart (based on CMA Report) would help in understanding online advertising;

Google works in both segments of digital advertising, a) search advertising and b) display advertising. In this trend, we focus on how Google’s search advertising works.

Google’s Search advertising

‘Google Ads’ is advertising system where advertisers bid on certain keywords for which clickable ads appear on every search and google is paid per click by advertisers. However, this does not work like a usual auction and position of advertiser depends on two factors, viz. advertiser’s bid and ad quality. Herein, ad quality is an important factor because Google as a search engine is determined to provide the most accurate result, which is defining feature of Google. Ad quality is determined through quality core which takes into consideration Google’s expected clock through rate, past performance, quality and relevance of keywords, landing page and Ad text. On basis of these two factors, Google ranks ads on the page of search result.

Why Google does not face competitive constraints

Google provides its general search service free of cost to consumers as monetization of the service occurs through targeted advertisements. The ability to target advertisements towards a group of users come from insights which can be gleaned from consumer data generated from the search service. The attractiveness of a platform, for advertisers, therefore, lies in the reach that the platform commands in terms of number of users to whom the advertisements can be displayed. Therefore, in order to attract advertisers to the platform and compete effectively, it is imperative for the search service provider to acquire a sufficiently large consumer base which uses its search service.

Consumers place a very high value on the relevancy / quality of search results while opting for a search service. Therefore, the ability of a search engine to provide relevant search results and improve the relevancy of search results is a vital factor for competing against Google.

A survey conducted by DuckDuckGo of factors based on which users would switch search engines.

This brings us to the first reason why Google does not face any meaningful competitive pressure for other search service providers:

Significant Barriers to Entry

The key inputs for achieving relevant results include (i) access to necessary data in order to improve the algorithm or framework that returns search results (the “click-and-query data), and (ii) an extensive and updated index of the world wide web. Both these inputs are highly subject to scale-effects.

Firstly, as Google’s market share in general search services above pointed out, Google gets search queries which are orders of magnitude higher than its closest rivals. Google, therefore, benefits from a self-reinforcing process where it receives so many more queries (which are an essential input for making potential improvements in the search algorithm) because it is able to return increasingly relevant search results to its users, who in turn return to google for their general search queries. Secondly, the maintenance of an updated index requires prohibitively high investments because of which even large incumbents in the space had to give way to Google.

It is worth noting that large incumbents such as Yahoo! and Ask.com have found it economically unfeasible to maintain independent search services. Yahoo had stopped investing in its general search technology, in 2009 and now relies on search service of Bing. Similarly, Ask.com also terminated investments in its general search technology in November 2010 and chose instead to adopt Google’s general search technology to power its search service.

Significant Barriers to Expansion

The second reason why Google does not face competitive threat is because of the significant barriers to expansion faced by its competitors in accessing customers and building into stronger competitors over time. This barrier to expansion comes from the default position Google has been able to secure on mobile devices. Mobile manufacturers choose Google as the default search application based on a mix of consumers’ perceived quality of service as well as the level of compensation that Google is able to pay due to its revenues generated from search advertising. This, coupled with the fact that consumers show very strong preference for defaults, especially in mobile devices, acts as a very significant barrier to expansion for existing rivals.

Limited Competitive Constraints from Specialised Search (like Amazon) & other Competition law concerns

Results from the CMA’s market study have confirmed that a major proportion of specialised search providers rely on Google as a point of entry. The difference between general search and specialised search services had been considered by the EC in the Google Search (Shopping) decision, wherein it was noted that the two types of search services operated as complements rather than substitutes. Analysis of traffic data by the CMA in its report has also confirmed that a substantial number of consumers access specialised search portals via general search rather than accessing them independently.

The finding of complementarity in these markets suggest that specialised search, rather than being a competitor to general search, is in fact in a vertical relationship with general search providers like Google. This can be better understood by way of taking an example of how Google acts as a “gatekeeper” to specialised search service providers in majority of the cases.

As a part of our research, we undertook an exercise in India which also shows vertical agreement between Amazon and Google. Take the example of a consumer who is in the (virtual) market for speakers. For the purpose of this illustration, we consider this consumer to fall in the majority category of consumers who use general search services to move towards a specialised search service, such as Amazon, eBay, etc. Since the market for speakers is highly fragmented with a large number of sellers offering various kinds of speakers at diverse price ranges, the consumer enters a search query appropriate to his needs.

The top results that a consumer gets from his search query therefore points him to specialised search providers like Flipkart, Reliance Digital, Amazon, etc. These special search service providers, thus, rely on Google, which acts as a gatekeeper for most of the traffic to their own portals. Since most users do a general search and are then directed to special search services like Amazon, etc., from this page, the user clicks on the speaker that interests him.

Apart from this, users may also choose to use the comparison services that Google offers. Therefore, after entering the query, i.e., speaker, the user can compare the different speakers of offer. Clicking on one of the results on the shopping tab, once again takes user to Amazon’s page, as shown above.

This demonstrates that Google, as a dominant search service provider, becomes a necessary trading partner even for large platforms like Amazon, which are in a vertical relationship with Google and rely on it for majority of the traffic to their platforms and thus, a case may be there to look at their conduct under Section 3(4) of the Act, which deals with analysis of vertical agreements.

Below, we lay down some competition concerns that have already been observed or may come up in the future owing to the way the market is functioning.

Excessive Pricing- Google, being dominant in search advertisements, is in position to overcharge the advertisers. Since advertisement has been the primary source of revenue for Google, it gives it an incentive to increase its profit by charging more from advertisers. This is clubbed with Google’s market power, which is directly linked to access of consumer data, creates high entry barriers for competitors. The closest competitor Google is Bing, , average cost per click on Google is 30-40% more than that of Bing. Similarly, monthly average cost per click for mobile and desktop and average price bid ratio for top ad for Google is more than Bing.

Exclusionary practices-Google can engage in exclusionary practices by restricting its consumer base to engage with any other platform for advertisements. For example, there is always a possibility that Google may impose restrictive clauses in agreements with advertisers prohibiting them to engage with Microsoft Bing. This would, in turn, lead to denial of market access for competitors of Google.

Leveraging dominant position in search advertisement– Further, Google can leverage its dominant position in search advertisement market to expand their market power in open display advertising. Using strong customer base of search advertisements, Google can provide incentive to use Google’s services in another market of display advertisement. Further, as noted in CMA report, huge data collected by Google in search advertisement market may be used in open display advertisements to provide better targeted advertisements.

It may be another concern as Google puts itself in a position where it can always promote its own vertical product and services. There are several services of Google that may be promoted through advertisements, such as Google Pay, Google Meet or YouTube. This may affect the quality of organic search also.

Similarly, there may be products of Google in other markets for which there may be competitors like; in fintech services (Google Pay; competitors being PhonePe, PayTM, MobiKwik); social network (Google +, competitors being Twitter and FB); maps and navigation (Google Maps, competitors being Map Quest, Waze, Bing Maps, HereweGo, Maps.me etc), emailing (Gmail, competitors being Outlook, Zoho, Apple Mail etc.), calendar (Google Calendar; competitors being Outlook, iCal, Spike etc) and other products of Google for which there are competitors in the market. It must be seen as to whether Google is using their dominant position in the search advertising market to enter into or protect their position in the other market.

Tie-in agreement with manufacturers – It has bene noticed that Google has agreements with device manufactures that are exclusionary in nature. In order to make Google Chrome as default browser of such phones, Google offers some revenue share from search advertising. Thus, competitors of Google Chrome like Mozilla Firefox, Safari etc. may be foreclosed from entry and it has been seen that once a default setting has been adopted, consumers rarely change the same. Therefore, technically, Google uses its dominant position in search advertising to ensure that their browser remains a default in mobile devices.

Ad Ranking- It has been observed that Google essentially operates its ranking system in a “black-box” and does not completely disclose the way its algorithm operates. As noted earlier, ad ranking is completely dependent on the quality score of advertisers, the process which is substantially hidden. Therefore, it provides immense opportunity to Google to interfere with the Ad ranking list, and therefore, raising concerns for violation of Section 4(2)(a) (i) for advertisers.

In addition to the above, another concern of general import is the fact that Google’s super-dominance in search advertising presents a risk whereby Google may choose to start investing in creating barriers to entry and expansion rather than on innovating new and better products. In case of search advertisement, this may happen when excessive reliance on Google for advertising revenues comes to a point where Google may even impact the organic search results to the detriment of search quality where user may interact more with ads. This is important to consider because Google’s current position makes it immune to any competitive constraints. As a result of lack of effective competitors in the market., there would be no one to inflict competitive pressure on Google which may keep it on the path of innovation.

Adv. Abir Roy is Partner, Sarvada Legal.