The Indian stock market indexes began the new week steadily, with investors primarily waiting for this week’s release of the May inflation figures before making any decisions. Benchmark Sensex and Nifty were trading just 13 points and 3 points higher from their previous closing, respectively. Retail inflation for May will be released at 5.30 pm today. Retail inflation or (Consumer Price Index) in India peaked at 7.8 per cent in April 2022 to an 18-month low of 4.7 per cent in April 2023, driven by a reduction in food and core inflation. In some advanced countries, inflation had in fact touched a multi-decade high and even breached the 10 per cent mark.

RBI’s consistent monetary policy tightening since mid-2022 could be attributed to the substantial decline in inflation numbers in India.

“For a long time, Indian markets (Nifty) have been consolidating in the 18,475-18,800 zones. The entire week is packed with events, including the release of Consumer Price Index inflation figures in India as well as the Industrial Index of Industrial Production statistics. Global attention will be focused on the Federal Reserve’s meeting, where a rate hike or pause will be closely monitored,” said Deven Mehata, Equity Research Analyst, at Choice Broking.

Overall Indian stocks have been buoyant over the past fortnight or so due to the continued inflow of foreign investments, relatively lower crude oil prices, more than estimated GDP numbers, and a consistent decline in inflation.

Foreign investors have remained net buyers in Indian stock markets for the fourth straight month now, data from the National Securities Depository (NSDL) revealed. They bought Indian stocks worth Rs 7,936 crore, Rs 11,631 crore, and Rs 43,838 in March, April, and May, respectively. So far in June, they have already bought assets worth Rs 9,788 crore.

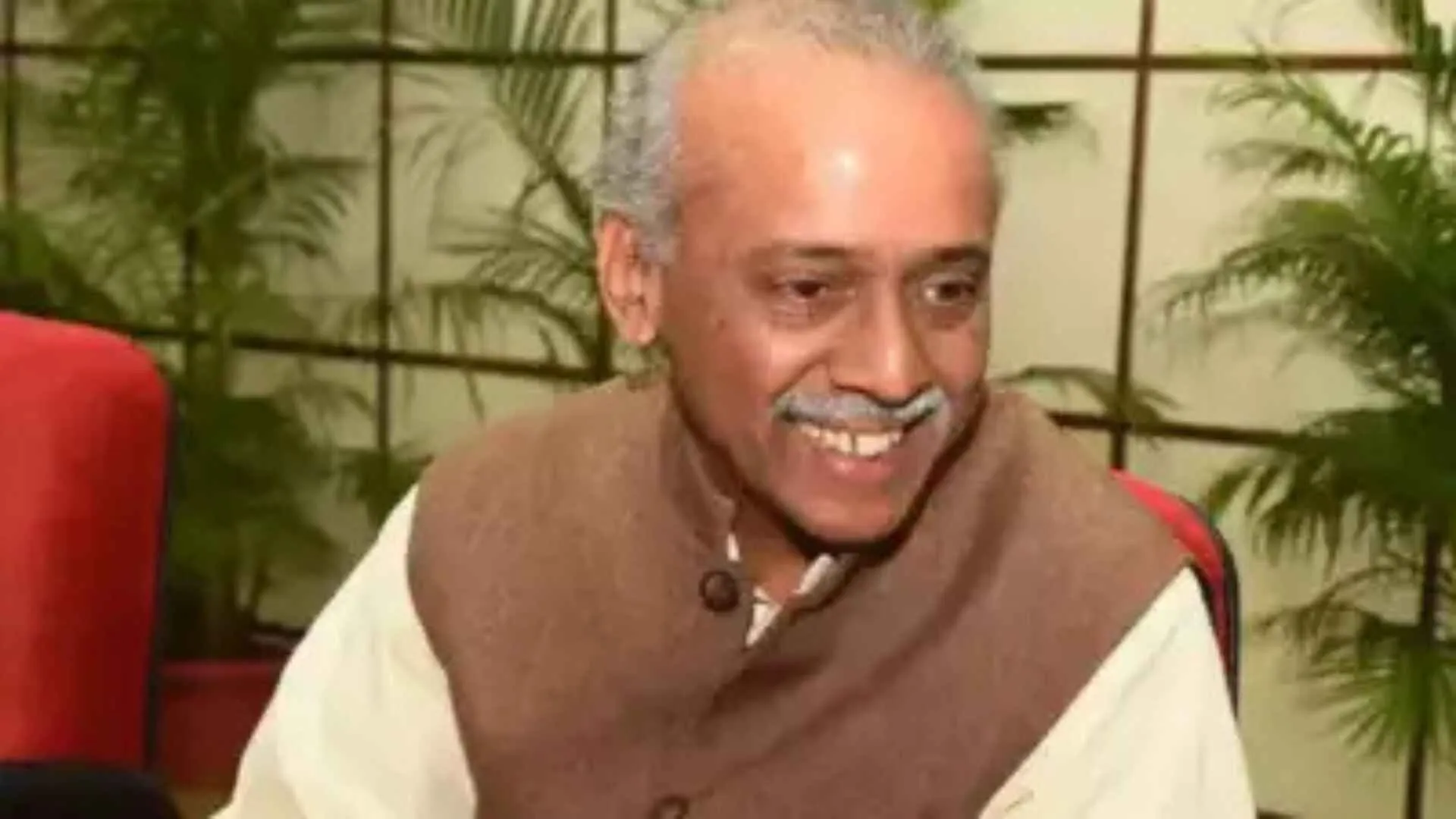

“In May, globally, FPIs were big buyers in Japan, South Korea, Taiwan and India and big sellers in China. This trend continues in June also,” said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

“Sustained buying by FPIs has lifted the Nifty by around 10 per cent from the March lows and consequently, valuations, viewed from the short-term perspective, have become challenging. Therefore, FPI is likely to slow down in the coming days. They are likely to continue buying in financials and autos since the prospects of these sectors look promising,” added Vijayakumar.

All eyes are now focused on the US Fed’s policy decision, which is set on June 14.

The US monetary policy committee increased the benchmark interest rate by another 25 basis points to 5.0–5.25% in an effort to achieve inflation of 2% over the long term.

The tenth consecutive rate rise took place in May and was the same amount as the rate increase in March.

Ajit Mishra, SVP – Technical Research, Religare Broking, stated, “We feel the current outperformance may continue in the broader indices so continue to add quality stocks from midcap and smallcap space.”