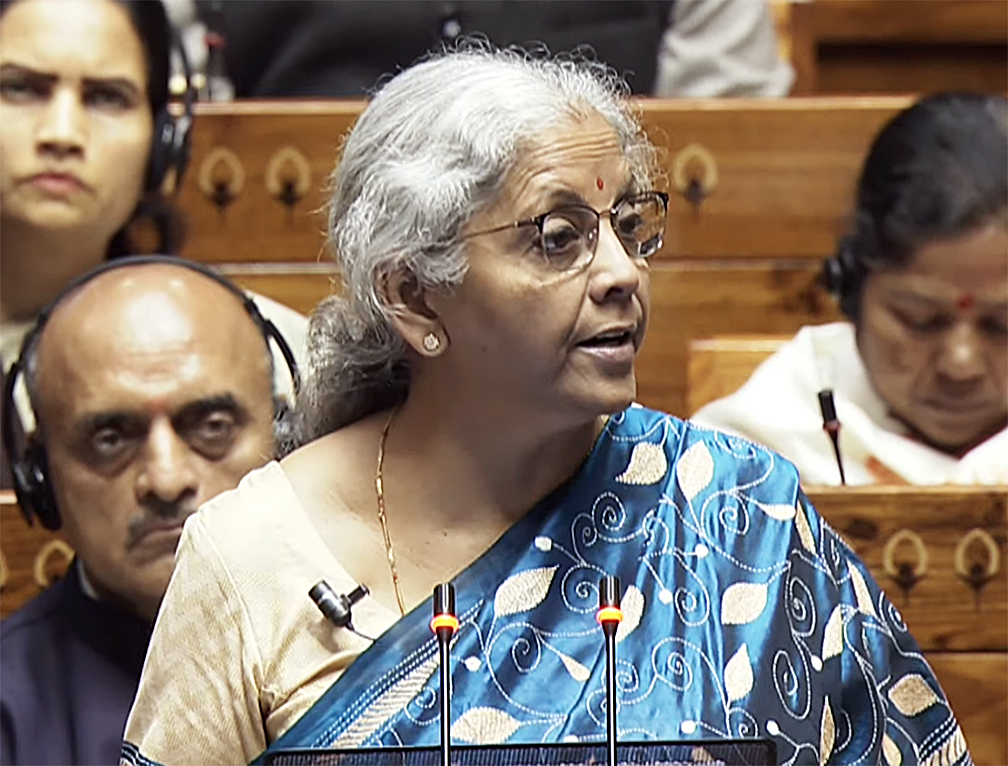

The central government, under the helm of Union Finance Minister Nirmala Sitharaman, presented the interim Budget for 2024-25 without introducing any alterations or additional tax burdens on citizens. In her Budget speech on Thursday, Sitharaman affirmed, “Keeping with the convention, I do not propose to make any changes relating to taxation and propose to retain the same tax rates for direct taxes and indirect taxes including import duties.”

Despite maintaining the existing tax rates, Sitharaman acknowledged certain impending expirations of tax benefits for start-ups, investments by sovereign wealth or pension funds, and tax exemptions on specific income of some International Financial Services Centre (IFSC) units, set to conclude in March 2024. To ensure continuity, she proposed an extension of the expiration date by another year.

Aligning with the government’s vision to enhance the ease of living and ease of doing business, Sitharaman announced initiatives to improve taxpayer services. Addressing longstanding concerns, she noted, “There are a large number of petty, non-verified, non-reconciled, or disputed direct tax demands… causing anxiety to honest taxpayers and hindering refunds of subsequent years.” To alleviate this, she proposed the withdrawal of outstanding direct tax demands up to Rs 25,000 for the period up to the financial year 2009-10 and up to Rs 10,000 for financial years 2010-11 to 2014-15, benefiting approximately a crore taxpayers.

Presenting the Union Budget 2023, Sitharaman set the fiscal deficit target for 2024-25 at 5.1 per cent of the Gross Domestic Product (GDP). In the preceding year, the fiscal deficit target for 2023-24 was initially projected at 5.9 per cent of GDP, with a downward revision to 5.8 per cent. The government aims to reduce the fiscal deficit below 4.5 per cent of GDP by the financial year 2025-26.

Highlighting the emphasis on capital expenditure (capex) as a means to foster growth potential and job creation, Sitharaman mentioned the government’s intent to bring fiscal deficit down and achieve a capex of 3.3 per cent of GDP in 2023-24. The interim budget, presented today, addresses the financial needs until a new government is formed after the Lok Sabha polls, after which a full budget will be presented in July.

With this Budget Presentation, Sitharaman matched the record set by former Prime Minister Morarji Desai, who, as finance minister, presented five annual budgets and one interim budget between 1959 and 1964. The Indian economy is anticipated to grow close to 7 per cent in the financial year 2024-25, following a growth of 7.2 per cent in 2022-23 and 8.7 per cent in 2021-22, making it the fastest-growing major economy.