‘Exact predictions of policy outcomes are routine. Expressions of uncertainty are rare. Predictions and estimates often are fragile, resting on unsupported assumptions. So the expressed certitude is incredible,” states Charles F. Manski, an eminent economist, renowned for his work on judgement and decisions, and policy analysis in an uncertain world.

The quote could guide the progress of the recently established National Asset Reconstruction Company Limited (NARCL) dubbed as “Bad Bank“. It is a potent mechanism for tackling the mounting Non-Performing Assets (NPAs) of commercial banks. Taking them off their balance sheets may help them fulfil regulatory compliance and also enhance their lending capacity. But to serve the purpose, it must act with speed.

Announced in September 2021, NARCL is to take the big-ticket defaults of the commercial banks off their balance sheet, identified to be worth Rs 2 lakh crore. As per plans, 38 NPA accounts worth Rs 82,845 crore were expected to be transferred to the NARCL in the first phase out of which 15 accounts worth Rs 50,000 crore were to be transferred by the end of the fiscal year 2022.

NARCL is supposed to acquire these assets by paying 15% in cash and 85% in tradable Security Receipts (SRs), and redeemable on the resolution of the distressed assets. The government guarantee is expected to provide liquidity to SRs and can be invoked to make up for the shortfall in case of resale failure or sales at a discount of those assets by the bad bank. The target could not be achieved due to procedural delays and the deadline stands extended to July 2022.

Designed policies often fail to deliver desired results due to the implementation challenges. In this case, time is of the essence and delays could be detrimental. NPAs have been beleaguering the banking sector in India for a long time, but have worsened lately. Gross NPAs of the Scheduled Commercial Banks (SCBs) have steadily increased from Rs 59,373 crore in 2005 to Rs 2.63 lakh crore in 2014 and further to Rs 8.35 lakh crore in 2021. In between, they had peaked at Rs 10.36 lakh crore as of March 2018. Gross NPAs of the Public Sector Banks (PSBs) have been no exception, as they too jumped up from Rs 47,621 crore to Rs 2.27 lakh crore and Rs 6.17 lakh crore during the corresponding period.

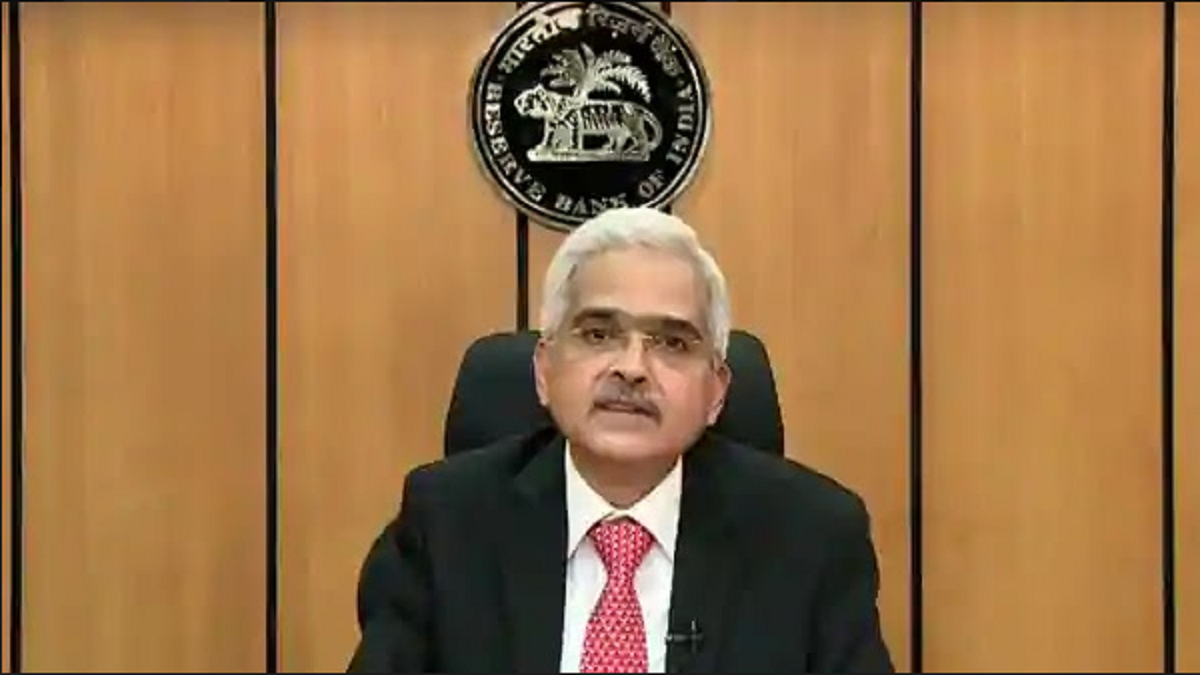

The pandemic has further exacerbated the situation. The RBI’s financial stability report estimates that the gross NPA ratio might rise from 6.9% in September 2021 to 8.1% in the best-case scenario. In the worst case, they could rise to 9.5% by September 2022. The recent hikes in repo rate by 40 and 50 basis points to restrain the deteriorating inflation outlook is expected to make repayment of the loans more difficult putting further stress on NPAs in the coming months.

Bad Banks have been tested in an assortment of countries with variable success. Assets Reconstruction Companies (ARCs) have been generally successful where NPAs were caused due to delay and default on account of real estate lending, presumably because the mortgage assets for such lending are easier to identify, evaluate and sell. Will it work in case of the big-ticket bad loans each worth Rs 500 crore or more, particularly when they are accumulated over time due to the bad lending decision for unviable projects or restructuring of previous loans or where money could have been siphoned off?

Design-wise, the NARCL is structured well with built-in checks and balances. The PSBs being a 51% equity stakeholders in it will have a vested interest in the speedy resolution of bad debts acquired by NARCL. The government guarantee for the Security Receipt (SRs) issued by it against the bad debt of banks gives it grit.

Though the extent of the guarantee is stated to be Rs 30,600 crore, the actual outflow is expected to be much less as it is to be restricted to the shortfall between the face value of the SRs and the actual realisation by way of resolution or liquidation. The liability could be further contained by the provision that it could be invoked only if the resolution and realisation of the toxic assets happen within 5 years.

Additionally, to discourage the resolution of assets from being prolonged, NARCL would be required to pay to the banks a guarantee fee of 0.25% of the outstanding amount, from the second year onward, which would increase to 0.5%, 1% and 2% in the third, fourth and fifth year. Besides, the NPAs identified to be acquired in the first phase are fully provisioned as per the prudential norms.

The success of the Bad Bank idea could hinge on two factors: Firstly, the objectivity and transparency in the valuation of NPAs and their fair resolution; and secondly, the expertise of the debt resolution company. As far as the valuation and resolution of NPAs are concerned, these have been lying in the books of the banks for years, despite their best efforts to realise them, but in vain. Most would be compelled to sell their toxic assets at discount ranging between 40-70% of the book value minus accumulated interest.

As regards expertise, India should not have a dearth of knowledge and as regards experience, Indians are known to have a steep learning curve. The real challenge would, however, be to find the buyers of the bad debt. All the more critically, will the market have the appetite for such Assets? Protecting the process from the vested interests, who often use their acumen to circumvent the prescribed procedure for personal profit is all the more difficult to gauge and forestall.

A study by the Bank of International Settlements in 2020 highlighted that bad banks work best if supported by a recapitalisation. It further pointed out that a capable, effective and robust regulatory system is a sine qua non for the desired results. It was a good sign that the Union budget 2021-22 had provided Rs 20,000 crores for recapitalisation of PSBs, though the amount was reduced to Rs 15,000 crore in the revised estimate. Sadly, no fresh provision has been made for capital infusion into PSBs in the 2022-23 budget. However, many experts regard the government guarantee for SRs as an indirect form of recapitalisation. Still, given the magnitude of NPAs, the provision may seem scanty.

The banking sector is the backbone of a robust economy. A large number of small savers and risk-averse investors trust banks with their hard-earned savings in the hope that their deposits would be safe and earn a positive real return. This can be possible only if banks are able to lend in productive investments that are realisable in time as per the loan arrangements. NPAs bleed banks, impinge on their profitability and efficiency and shake the confidence of crores of savers and investors. The Bad Bank must succeed in letter and spirit.

Furqan Qamar, a Professor in the Faculty of Management Studies, Jamia Millia Islamia, is a former Advisor (Education) in the Planning Commission of India. Taufeeque Ahmad Siddiqui is an Assistant Professor in the Faculty of Management Studies, Jamia Millia Islamia.

Bad Banks have been tested in an assortment of countries with variable success. Assets Reconstruction Companies (ARCs) have been generally successful where NPAs were caused due to delay and default on account of real estate lending, presumably because the mortgage assets for such lending are easier to identify, evaluate and sell. Will it work in case of the big-ticket bad loans each worth Rs 500 crore or more, particularly when they are accumulated over time due to the bad lending decision for unviable projects or restructuring of previous loans or where money could have been siphoned off?

Reserve Bank of India Governor Shaktikanta Das announces to increase the policy repo rate by 50 basic points, in New Delhi on 8 June 2022. The RBI’s financial stability report estimates that the gross NPA ratio might rise from 6.9% in September 2021 to 8.1% in the best-case scenario. In the worst case, they could rise to 9.5% by September 2022. ANI