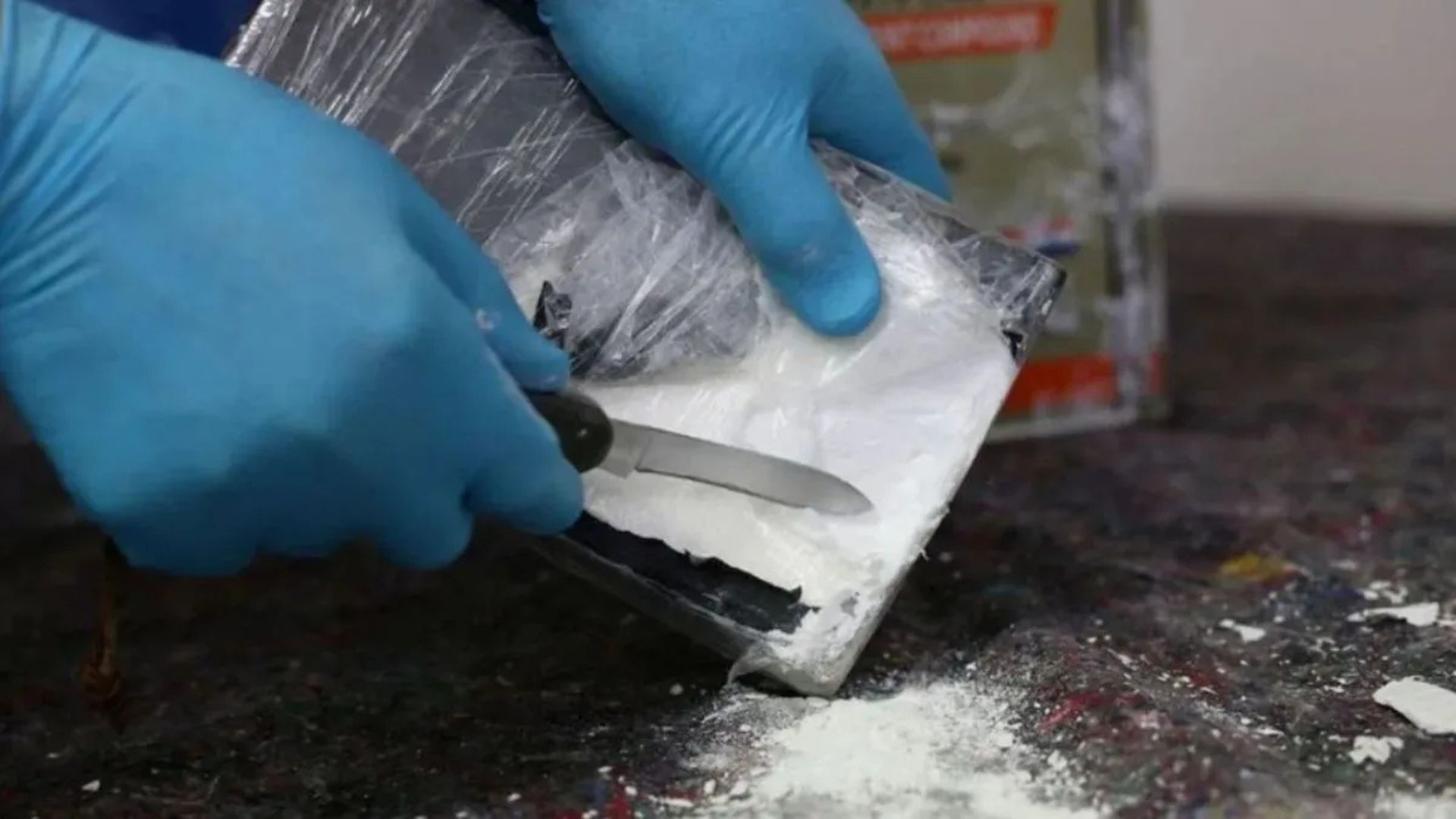

Companies, businesses, or organizations play an indispensable role in developing any country. It supports the national economy and development, contributes foreign exchange and taxes to the nation, and provides jobs and workplaces to many people. As the company expands its operations, it becomes more prone to unethical behavior by a few employees who try to get extra benefits illegally by taking advantage of their positions and experience in the workplace. These benefits are measurable in monetary terms. Many studies have been attributed to preventing fraudulent behavior in the workplace; however, completely eradicating the same seems highly unlikely. According to ACFE, the fraud committed by such employees is called occupational fraud, which can be of three categories: Asset misappropriation, Corruption, and Fraudulent Financial Reporting. Out of the three categories, the frequency of occurrence of Asset Misappropriation is highest with the least median losses. Fraudulent Financial Reporting has minimum instances with massive median losses. The instances and median loss out of Corruption fall somewhere between the two. This is a bitter truth that frauds cannot be completely eliminated from the system, yet the steps can be taken to control their occurrence. To prevent fraud in the workplace, we need to identify the key elements which drive the commissioning of fraud, e.g., focus more on the root problem of the emergence of fraud behavior. If we look closely, in all the occupational fraud cases, employees commit fraud in their professional capacity; hence the critical element may be the “employee acting in a professional capacity.” The professional capacity of an employee comes with terms of employment, time spent in the organization, hierarchical position, management trust, etc. One effective measure to control the instances of occupational fraud can be fixing the character of new employees by instilling in them the noble culture of the company, good norms, business ethics, and work ethics. By developing this anti-fraud commitment early on, the fraud learning chain that typically passes from seniors to juniors will be intended to be broken. This can be referred to as developing the anti-fraud policies at the workplace and effectively communicating them to employees at all levels and at all times, especially at the time of joining.

Occupational fraud, however, always exists regardless of whether or not there are any preventative measures in place because the environment creates habits and lessons for potential perpetrators. Fraud offenders or fraudsters are entrusted to run the company with their skills but subsequently turn out to take advantage of available opportunities and official positions.

Given the negative impact of fraud on both the company and the country, efforts must be made to mitigate fraud behavior since inception so that all employees and administrators carry out their duties and obligations by the principle of fiduciary duty, and the company can run smoothly to achieve its goals and objectives. The companies must look to implement the corporate culture continuously, foster good character in employees, and ensure good corporate governance.

Fraud results in significant losses for both the company and the country. The modern fraudsters are not limited to the upper crust; many have infiltrated the lowest ranks of the workforce. According to the ACFE Survey, most fraudsters are between the ages of 36 and 45, hold a middle management position, have worked for more than ten years, and have a bachelor’s or master’s degree. If fraudsters are more familiar with the organization because of their background, it will be easier to commit fraud.

However, fraud is not only committed by company personnel but is also frequently committed by the company itself to cover financial losses by manipulating financial data for the company to perform well. Fraud occurs in almost all businesses irrespective of size, geography, profitability, and region. As a result, fraud is harmful to companies, society, and the state. Fraud can occur under a variety of circumstances, including:

• Employees who are hired without considering their honesty and integrity;

• Employees who are suspected of having personal problems that cannot be resolved, such as financial, gambling, or other issues; and

• Management or employees who are pushed or under pressure to commit fraud.

• An opportunity to conduct fraud exists when there is no monitoring, inadequate supervision, or management overrides and lack of Internal Controls.

• Some employees may have attitudes, personalities, or principles that enable them to display fraudulent behaviors on purpose.

Organizations anticipate the potential of fraud in various ways. They can implement better practices to combat them, including improved standard operating procedures, digital technologies and automation, a sophisticated internal control system, and other precautions. With the advancement of technology, fraudsters are also finding newer ways to commit fraud, yet technology enables organizations to monitor both fraudulent and non-fraudulent activities. Hence, to a more significant extent, technology is a deterrent to the commissioning of fraudulent acts. Though, no matter how advanced the system is, people will continue to play an essential role because the system will not function correctly without operators. Many researchers have proposed that to combat the fraud, think like a fraudster, i.e., a criminal approach can be used to avoid and overcome fraud instances.

As a result, this fraud behavior problem has received extensive international attention. Some actions, such as misuse of facilities, seeking illegal benefits out of company funds, and deviating from the policies, are possible fraudulent behaviors that require punitive punishment under the law. However, some companies adopt an internal approach to combat fraud, such as employing reinforcement rather than punishment. Companies build a reward system to maintain behavior by awarding and recognizing good work and a punishment system to discourage fraudulent behavior. Punishment is considered a sign of displeasure for fraudulent acts. It is understood that punishment brings negative stimuli; however, in most fraud cases, the impact is so severe that punishment, including the terminating fraudster’s employment, is insufficient.

Fraudsters make rational choices when it comes to breaking the law. Interests of the people drive actions, and because people’s interests differ, there comes the problem of choice. As a result, following the law is a choice for most people and not a compulsion. In most cases, employees commit occupational fraud as a thoughtful choice in the wake of the available opportunity. Once they see the opportunity, they perform their delinquent acts that harm the organization while enriching themselves. The best way to deal with this fraud problem is to take a coordinated approach that emphasizes corporate culture awareness and improvement in employee and management character. As a business ideology, corporate culture must continue to be established from the most fundamental norms.

Hence, fraudulent behavior and availability of opportunity are positively correlated, yet there comes the concept of integrity. Integrity prohibits the misuse of authority. According to Steve Albrecht, even if the opportunity is available and integrity is high, the fraudulent behavior will be restrained. From the first day of work, a sense of integrity must be instilled in all employees.

As a poison for which no antidote has yet been discovered, fraud must be dealt with differently, not through legal assertiveness but through simultaneous anti-fraud education instilled early so that it later becomes a habit and a positive culture. Suppose the majority of the community believes that every activity in the society must be based on a set plan. In that case, self-discipline in planning and implementation becomes a dominant feature of that culture.

Organizational change cannot be isolated from the corporate culture, or, to put it differently, the existing organizational culture must be transformed first to promote organizational change. Character is crucial in obtaining success; good character supports almost 80% of achievement, whereas knowledge only helps 20%.

The corporate culture instilled early in new employees will break the cultural learning chain of previous fraud. Anti-fraud culture can be accomplished by placing older generation employees in positions that are not directly related to activities that have the potential to generate fraud. Similarly, the management and employees must make a formal pledge to consistently follow business ethics, which includes not giving anything in return to company employees.

Sometimes the management also commits fraud for a variety of reasons. In most cases, employees learn the fraudulent behavior from management itself. It helps them offer the rationalization of their delinquent acts. Under certain circumstances, it may also be viable to replace the fraudulent management personnel with legitimately honest personnel who do not attempt to obtain management positions through deception.

Fraudsters will no longer be able to enjoy the benefits if the source of the recipient is defeated. Developing corporate cultural commitment from an early age is the most critical effort in dealing with fraud instances that the next generation can easily learn. The development of corporate culture will strengthen the mental attitude of corporate leaders and increase the loyalty of the younger generation. Employees must be made aware that in a fraud-free culture, employees’ future will be better and more comfortable, ensuring continuity in the company’s career.

As a result, it will develop the perception that fraudulent acts are unethical and should not be carried out by employees and that the company has fulfilled its employment rights.

Prevention and deterrence of fraud behavior in the workplace can thus be achieved by building a corporate culture that works in tandem with other integrated efforts in the organization. Since new employees are hired, the organizations must cultivate corporate culture by providing soft skills training, self-motivation sessions, anti-fraud training, and training on exemplary behavior that are continuously carried out while carrying out their duties and obligations to the organization. Employees will benefit from the organization’s anti-fraud culture, which will help both the organization and the employees, and the organization will ultimately maintain and provide benefits to employees and their families.

(Author is a finance and fraud investigation expert and is associated with education industry in the capacity of Finance Officer)

In most cases, employees commit occupational fraud as a thoughtful choice in the wake of the available opportunity. Once they see the opportunity, they perform their delinquent acts that harm the organization while enriching themselves.