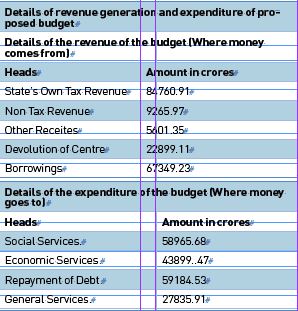

With the announcement of the Budget for Financial Year 2024-25, the state claims to be focusing on the betterment of all sections. Amid this, the question continues to arise pertaining to’’ where the money comes from and where the money goes to’’. . The budget is mainly divided into 4 to 5 heads in terms of revenue generation and expenditure with a notion to depict a clear financial picture . According to the information provided in the House regarding the budget, a large amount of Haryana’s budget for the financial year 2024-24 will be spent on repaying the debt. Out of the proposed budget Rs 1.89 lakh crore, and out of this, a huge amount of Rs 59184 crore has been earmarked for the repayment of debt. Similarly, an amount of rs. After this, 58965 i.e. 31.05 percent has been allocated to social services head. Further in this series,

An amount of Rs 43899 crore and Rs 27835 crore will be spent on two categories including economic and general services which is 23.12 and 14.66 percent of the total budget respectively.

It is noteworthy that the budget has been divided into 5 categories namely State Government’s Own Revenue, Non-Tax Revenue, Devolution from the Centre, Borrowing and Other Receipts in terms of Revenue and Income. According to official figures, the state will get Rs 84760 crore i.e. 44.64 percent from the State Government’s Own Revenue.

Whereas, an amount of Rs 9265 crore, Rs 5601 crore and 22899 crore will be received from Non-Tax Revenue, Other Receipts and Central government constituting 4.88 percent, 2.95 percent and 12.06 percent of the total budget respectively. Devolution from the Centre category includes CSS shares and other grants while the loan head includes state development loan, food grains purchase, NABARD and NCRPB, loan from Government of India and others. The state’s own tax revenue head comprises SGST, VAT, State Excise, Stamp and Registration, Vehicle Tax and Others. Whereas non-tax revenue includes income received from transport, urban development, mines and geology, interest, dividends and profits, education and others. In continuation to aforesaid, it is pertinent to mention that a maximum provision of Rs 21873 crore has been made for the agriculture sector followed by an amount of Rs 20772 crore for the education department, Similarly, an amount of Rs 15342 crore, 14411 crore and 9531 crore will be spent on pension, social welfare and nutrition, health and family welfare.