Mining in Goa has reached a stalemate and this stalemate needs to be resolved. It is very important to do a sort of SWOT analysis of what is local for the state of Goa to have sustainable growth heading towards surplus and continue to contribute to the state GDP.

Goa with its 15 Lac population, its major income resources are tourism and mining and these can be complementary to each other and need not to be at logger heads with each other and that is where the beauty lies in the policy making that we are able to strike a balance between the two. At this point of time, Goa is having double whammy. The COVID 19 had adverse impact on tourists visiting Goa and the closure of mines has dimmed the chances of the State to contribute to the vision of five trillion economy of the country. Mining came to a grinding halt in Goa from 16th March 2018 after the Supreme Court quashed 2nd renewal of 88 mining leases and imposed ban on entire mining operation.

The issues of concern to be immediately resolved are as follows:

1. The concerns of Environmentalists

2. Geographical Location & Geological emplacements

3. Mining & allied activities challenges

4. Legal interpretation of the two major acts Goa Daman Diu Abolition and Declaration as mining lease act 1987 which is commonly known as Abolition Act 1987 and the MMDR Act 2015 and its amendment of 2020 to be read along with the court directions,

5. The impact on Economy due to non-resolution of stalemate on the employment, lowering of income and that of state GDP

6. How to restart by consistent and credible holistic approach to boost the economy of Goa and Unlocking stalemate

1 . The concerns of environmentalists:

The concerns of environmentalists can easily be addressed as adopting appropriate technology and methodology, mining can be very environment friendly. That can be insisted upon and monitored. A well laid out plan with bench marking to ensure that during mining operations the environment protection measures are adhered to, a systematic dedicated arrangements of dumping of waste and reclamation of land post mining to be a part of agreement between the miners and the State.

In 2015, when Supreme Court has given a verdict that dumping outside lease area is not allowed unless the provisions in the Rules and Acts are made available as that had been an age old practice of Goa iron ore mining as the lease hold area of Goa iron ore mining is very small. On an average the lease areas are about 70-75 acres as compared to much larger lease areas greater 100 hectare in other parts of India. This brought in challenge of re-handling of this waste material disposed over the mineralized zone and adds to the cost of production. Thus a clear arrangement of dumping of waste is to be laid and executed.

Goa did have a history of environment friendly mining and notable good practices were demonstrated at international forums as well. ISO 14001 Standards and independent Mineral Foundation of Goa were early start ups. Thus, miners of Goa are coconscious of the issue and with a well laid out plan with bench marks have endeavor to achieve the same. These norms will ensure that mining do not cause harm to the locality and to the beauty of Goa and yet add to the economy.

2. Geographical location & geological emplacements

Goa has been trying to find a place in international markets, mostly to Japan, China, South Korea and Europe. The nature of its Geographical location and its geology, that is a low grade hematite ore, that works very well to blend with higher grades sourced elsewhere by major steel producers and thereby enable Goa to compete internationally,

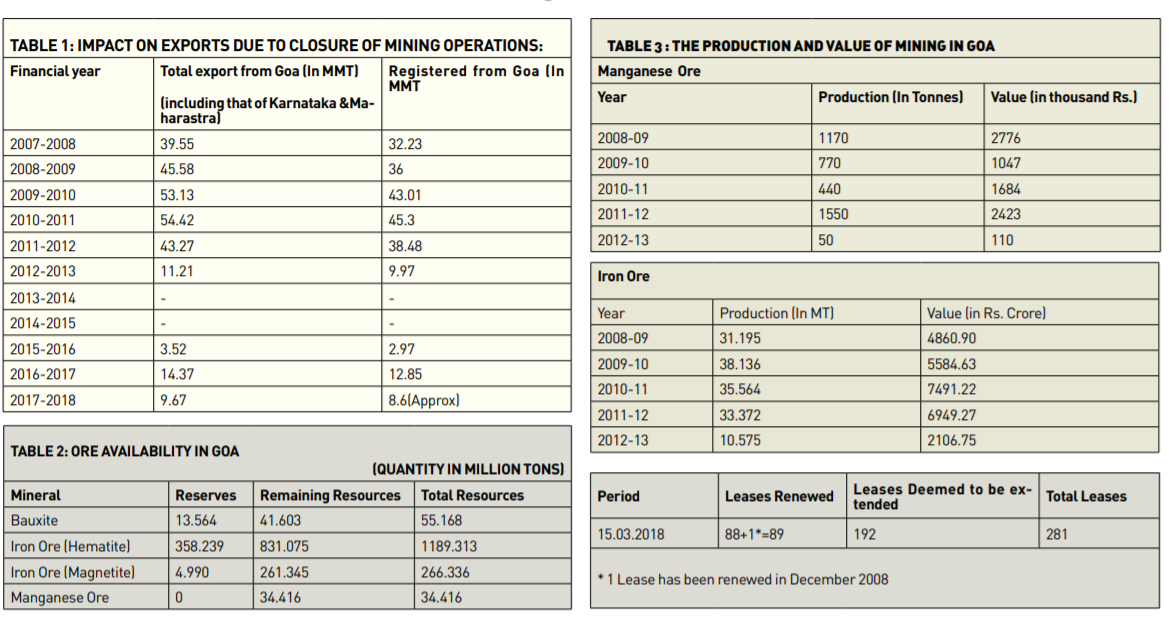

Goa is well-known for its iron and manganese ores. Bauxite and laterite are the other minerals produced in the State. Resources of major minerals in Goa as per National Mineral Inventory published by IBM as on 1.4.2015 are as follows:

In Goa iron-ore is mostly low grade siliceous in nature with iron contents ranging from 50%-58%Fe, Alumina & Silica combined varies from 10-12% & mostly occurs in powdery form. As such Goa has inferior quality of iron ore deposits.

It is important to understand the business model of Goa mining industry and how it is different from business model of rest of India. The five parameters, to compare the Goa mining industry, are:

• Quality and quantity of the ore,

• Strip ratio,

• Requirement of beneficiation facility,

• Transportation methodology and

• Product portfolio.

The First parameter is “quality and the quantity”. The total geological resource base for iron ore of Goa is to the tune of 1.45 billion ton, out of which almost 82% is hematite ore and rest 18% is magnetite ore. Bulk of the magnetite deposits however within protected areas(WLS). This corresponds to almost 5% of total India’s hematite resource, other states like Odisha contributes almost 37%, Jharkhand 24% and Chhattisgarh 22% and Karnataka 11%.

On the quality front, Goa iron ore the Fe ranges from 50%-58% (Average grade is 54-55%Fe), Alumina plus Silica will be around 10-12% , inherent moisture will be in the tune of 10% and it’s mostly powdery ore. Goa has inferior quality of iron ore deposits as compared to other major iron ore producing states of India.

Second parameter is Strip Ratio, in general strip ratio means in removing 1 ton of ore how much waste needs to be removed. So for the Goa iron ore mining the strip ratio is as high as 1:4, compared to other states like Jharkhand, Odisha which is like 1:2.5 max and for Karnataka it’s 1:3 max. Higher the steep ratio results in higher cost of production.

On Third parameter is a requirement of beneficiation and value addition as the ore is of inferior quality in Goa and cannot be sold directly by dry screening and sizing, it requires wet beneficiation. Infact, out of total capacity of wet beneficiation in the country, around 50% lies in Goa region. However, even after beneficiation 3-4% Fe enhancement of Fe Grade, 20-25% reduction in alumina and 30-35% reduction in silica is possible and then there is a loss of recovery that 30-35% loss as per tailings. So this again adds to the cost of production as more percentage of wet beneficiation need to be done to make the product sellable in the market.

On the Fourth parameter that is transportation Goa have inbuilt advantage with an evolved system as compared to the other states of India. Goa has one of the lowest transportation cost per ton from pit head to the port due to well managed river navigation system. Geographically and strategically Goa is located on the western coast that has added advantage of the ports for export. The cost of transportation in terms of freight to South Korea, Japan and China is only $10- 11 i.e. Rs 800/- as compared to the nearest steel mill in the neighbouring state being Rs1500-1800/- per ton.

The Fifth parameter is the product portfolio, what product sending in the market. Product of mines of Goa is 56-57% Fe, silica 5-6% and alumina 4.2 to 4.5%. Thus, it caters to specific market as the requirements. Goa is producing very low grade product mix. If you see the analysis that is published in mineral year book almost 80% of Goan iron production is below to 60% Fe as against rest of India that produce 80% with 60% Fe content.

This raises the question as to then where is the market for this low Fe content iron ore? Definitely there are no takers in domestic market but Goan ores are more export oriented, bringing in precious foreign exchange. This export would contribute approximately 30% of the state GDP.

3. Mining and allied activities challenges

Mining in Goa today was synonymous with iron ore mining which is completely in Private Sector. It has long cherished history of systematic & scientific mining and won various accolades from different government regulatory bodies like IBM, DGMS etc. The exemplary Reclamation & Rehabilitation of mined-out area carried out in some of mines in Goa has attracted the attention of the mining world not in India but also in overseas and used to be referred by experts on different platforms.

However the low quality of Iron-ores coupled with more removal of waste rocks for every tone of ore production (excessive stripping ratio) & comparatively higher transportation charge to iron & steel plants with respect to iron-ores mine of other jurisdictions like Karnataka, Odisha etc made it economically unviable to compete in domestic markets and thereby leaving no option other than to look for overseas markets. Thus Iron-ores produced from Goa has been exported to various countries like Japan, South Korea & China etc. The export of Iron-ores from Goa is also in tune with National Mineral Policy 2019.

It is stated under Para 6.1 of NMP2019 that thrust will be given to extraction of mineral resources in which the country is well endowed so that the needs of domestic industry are fully met keeping in mind both present and future needs, while at the same time fulfilling the demand of external markets for such minerals, so as to enhance domestic economic and social well-being.

Before suspension of Mining Activities in the State of Goa in the year 2012, it was reported that 332 Mining Leases were valid for Iron and Manganese ore. Out of these 332 leases, 118 mining leases were in operation (About 90 mines).

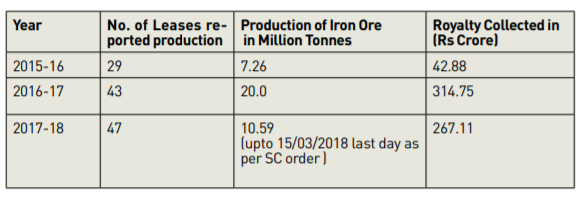

The Production of Iron and Manganese ore before suspension of mining operations is shown in following Tables:

In the year 2010-11 and 2011-12 the contribution of mining to State GDP was about 20% and 17% respectively, which has dropped to almost negligible during 2013-14.

The status of Iron ore mining leases in Goa & production from the year 2015 till the complete ban imposed by the Supreme court vide it order dated 7th February 2018 was as under:

It is estimated that Mining industry in Goa was employing over 60,000 persons directly and another 250,000 persons indirectly. About 30% of State’s population depends on mining and allied activities.

Challenges of Mining Allied Activities

• Nevertheless the iron-ore mining in Goa is beset with the following issues;

• Dumping of waste rocks/ overburden outside the leasehold as the leasehold area mostly being less than 100 hectares,

• Transportation of Ironores from mine head to nearest jetty points by tippers causing excessive burden on existing public transport infrastructure,

• Centralized location of Beneficiation plants catering the needs of multiples leaseholds leading to complexity in accounting for production from individual leaseholds

• To carry-out mining operation on the basis of Power of Attorney in the background of Mineral Concession Rules 2016

The above issues need to be resolved to avoid further complication in future. There is need for technolegal audit of the entire flow process of mining operation to find out the likely aberration so that suitable remedial measures are taken in advance to avoid knee jerk reaction.

4. Legal interpretation of the two major related acts Goa Daman Diu Abolition and Declaration as mining lease act 1987 which is commonly known as Abolition Act 1987 and the MMDR Act 2015 and its amendment of 2020 to be read along with the court directions

History of Mining in State of Goa at a Glance

• 1941-53: Erstwhile Portuguese Government granted most mining concessions under Mining colonial laws 1906 (not granted under MMDR Act of 1957)

• 1961: Goa becomes part of Union of India

• 1963: Mines and Minerals (Regulation and Development) Act, 1957, extended to Goa Daman and Diu

• 1975, (10th March)the Controller of Mining Leases for India issued notices to every mining concessionaire under the Mining Leases (Modification of Terms) Rules 1956.

• MMRDA excludes power to modify leases granted before October 25, 1949

• 1966 – 1983: Aggrieved concessionaires moved the Bombay High Court, Goa Bench and by judgment dated 29.09.1983, Bombay High Court restrained the Union of India from treating concessions as mining leases.

• Attempts to modify leases fail. High Court notes that no modification can be done as concessions principally not granted under MMDR Act.

• 1987: Parliament abolishes concessions, introduces leases in Goa, Daman & Diu under MMRDA that was notified on May 23, 1987 – Termed as Abolition Act (GBA)

• 1987: Appointed date indicated in GBA reads retrospective from Dec 20, 1961

• 1987: Miners challenge the Act before High Court. Interim relief granted threafter.

• 1997 High Court abolishes the challenge to the virus of the GBA, however, holds the Act and the recovery of dues prospectively

• HC judgment thereafter challenged in Supreme Court of India through SLPs

• 1998: SC’s 3-Judge bench passes interim order permitting mining operations and restricts any recovery of royalties retrospectively

• 2006/2007 –337 apply for renewals in the stipulated time. Workings permitted under deeming provision as in rest of India.

• 2012 – 1st Suspension of Mining Operations

• 2014 – Hon’ble SC permits mining operations. Caps Production capacity to 20 Million tons & Introduces concept of Iron Ore fund (before the advent of DMF to follow thereafter).

• •2014/2015 – Goa Government grants second renewal to 88 (out of 409) leases before ordinance introduced in January 12, 2015.

• 2015: NGO challenges renewal orders of the State Government.

• 2018: SC’s 2-Judge Bench quash 88 Mining leases which were granted second renewal by Goa Government in 2015.

• 16th March 2018 onwards Mining activity comes to a halt.

• 2018-19 – State Government pitches to the Central Government to remove the impasse created by harmonizing the Abolition Act & MMDR Act. Interventions filed in the SC, including by Ministry of Mines indicating vested rights of Miners in Goa cases.

• 30th January 2020: In a partial relief, SC permits extracted ores prior to Mid March 2018 to be transported.

Dr. Aruna Sharma has served as Secretary, Govt. of India. She is a Development Economist and served as Secretary, Ministry of Steel; Secretary, Electronics and Panchayati Raj. She also held charge of Rural Development and Panchayati Raj in Madhya Pradesh state government. She conceived and launched governance software like Samagra, now operational in 10 states and coordinated for Direct Benefit Transfer. She was member in 5 member high level committee of RBI for deepening digital payments.