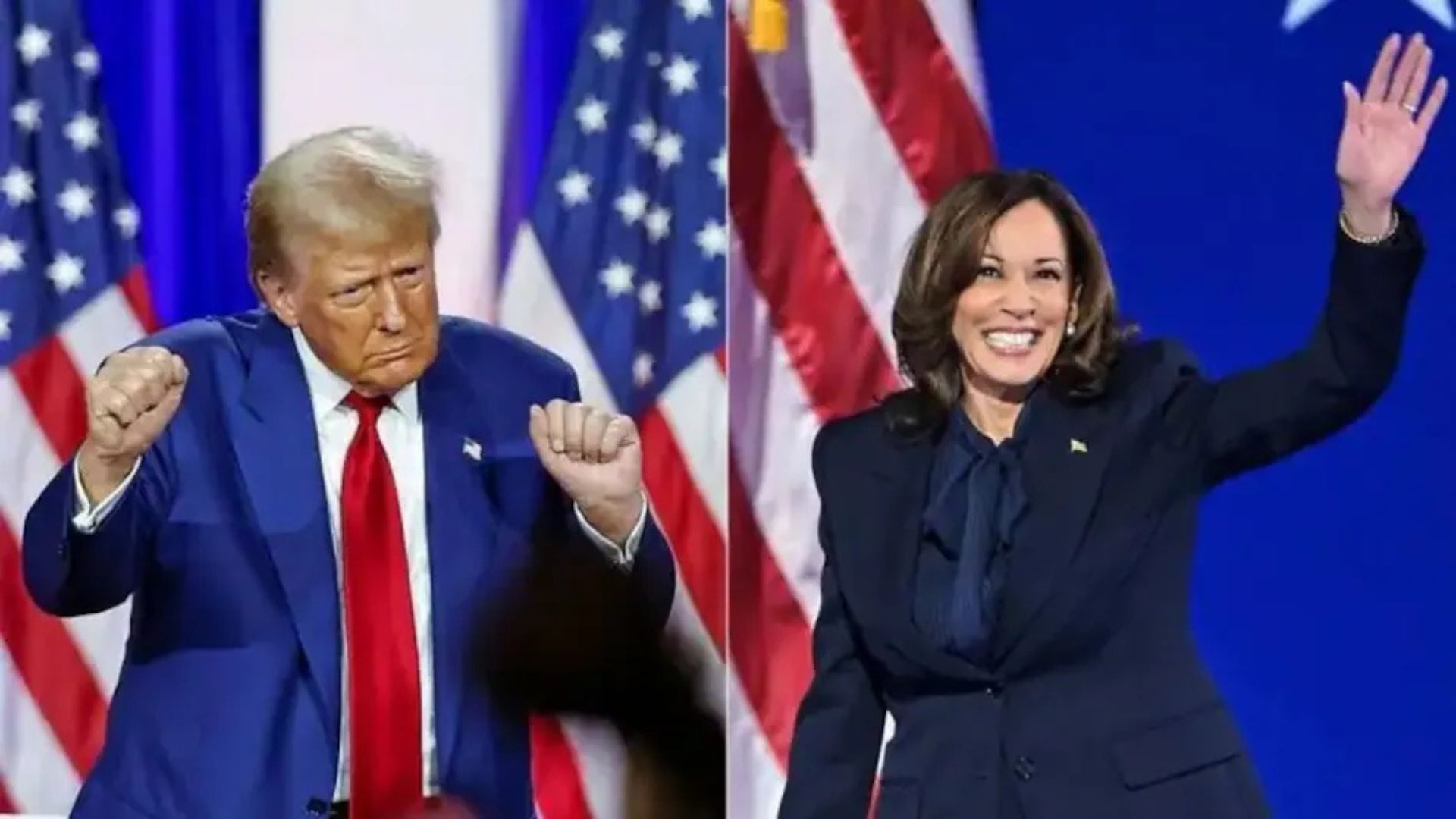

As the November 5 US presidential election approaches, financial markets appear to be positioning for a potential Donald Trump victory, which could usher in significant shifts in economic policy. Analysts suggest that a Trump-led administration may reduce global integration, influencing emerging markets, equities, and currency trends. However, a win for Kamala Harris would likely maintain current economic conditions, with limited impact on global financial markets, according to experts.

Trump Victory: Implications for Indian Economy and Stock Markets

If Donald Trump is elected, Indian markets could witness mixed reactions. Higher interest rates, a stronger dollar, and increased gold prices are anticipated under Trump’s policies, alongside potentially lower crude oil prices, which would positively impact India’s energy sector. ICICI Bank’s head of economic research, Sameer Narang, expects a Trump administration to result in US Treasury yields rising to between 4.40%-4.50% and the Dollar Index to reach 105-106 by the end of 2024. For India, the decrease in commodity prices, including crude oil, would benefit its domestic consumption-driven economy and support oil marketing companies.

Impact on Trade and Market Performance

Trump’s restrictive trade policies, aimed at boosting US growth, could enhance Wall Street’s performance, especially compared to global markets. Analysts from Nomura project that India, being less export-dependent than some other emerging markets, would be less affected by slowed US growth. In addition, weaker Chinese demand for base metals, alongside increased US fossil fuel production, could lead to lower global commodity prices, providing cost relief for Indian companies and sectors reliant on imports.

Harris Victory: Stability in US-India Economic Relations

A victory for Kamala Harris is expected to reinforce the current economic structures, creating stable market conditions. ICICI Bank analysts predict a modest rise in US Treasury yields to around 4.00%-4.10%, while the Dollar Index would likely remain steady in the range of 101.50-103.50. With Harris as president, global commodities such as oil and metals would likely see limited fluctuations, maintaining a stable trading environment. Furthermore, experts from Phillip Capital anticipate that Harris’s potential support for skilled immigration policies would benefit India’s IT sector, as her administration would likely continue the pro-trade and pro-immigration stance seen under Biden’s leadership.

Historical Market Trends under US Presidents

Historically, US and Indian stock markets have shown varied growth under different presidents. For example, the Dow Jones rose 28% under George W. Bush, 78% under Barack Obama, 54% under Trump, and 41% so far under Joe Biden. Meanwhile, Indian markets surged 200% under Bush, grew 55% under Obama, rose 63% under Trump, and have achieved an 89% increase during Biden’s term to date. These trends highlight the resilience and adaptability of the Indian market amid shifts in US policies.

While both Trump and Harris victories bring distinct implications, analysts agree that Indian markets could benefit in various ways regardless of the outcome. A Trump presidency may stimulate India’s consumption-based economy with lower commodity prices and increased domestic production incentives. Conversely, a Harris victory is expected to sustain existing trade dynamics, supporting India’s IT and export sectors while offering a predictable, stable investment environment. The Indian stock market is well-positioned to adapt to either scenario, leveraging the benefits that each administration could bring to the region.