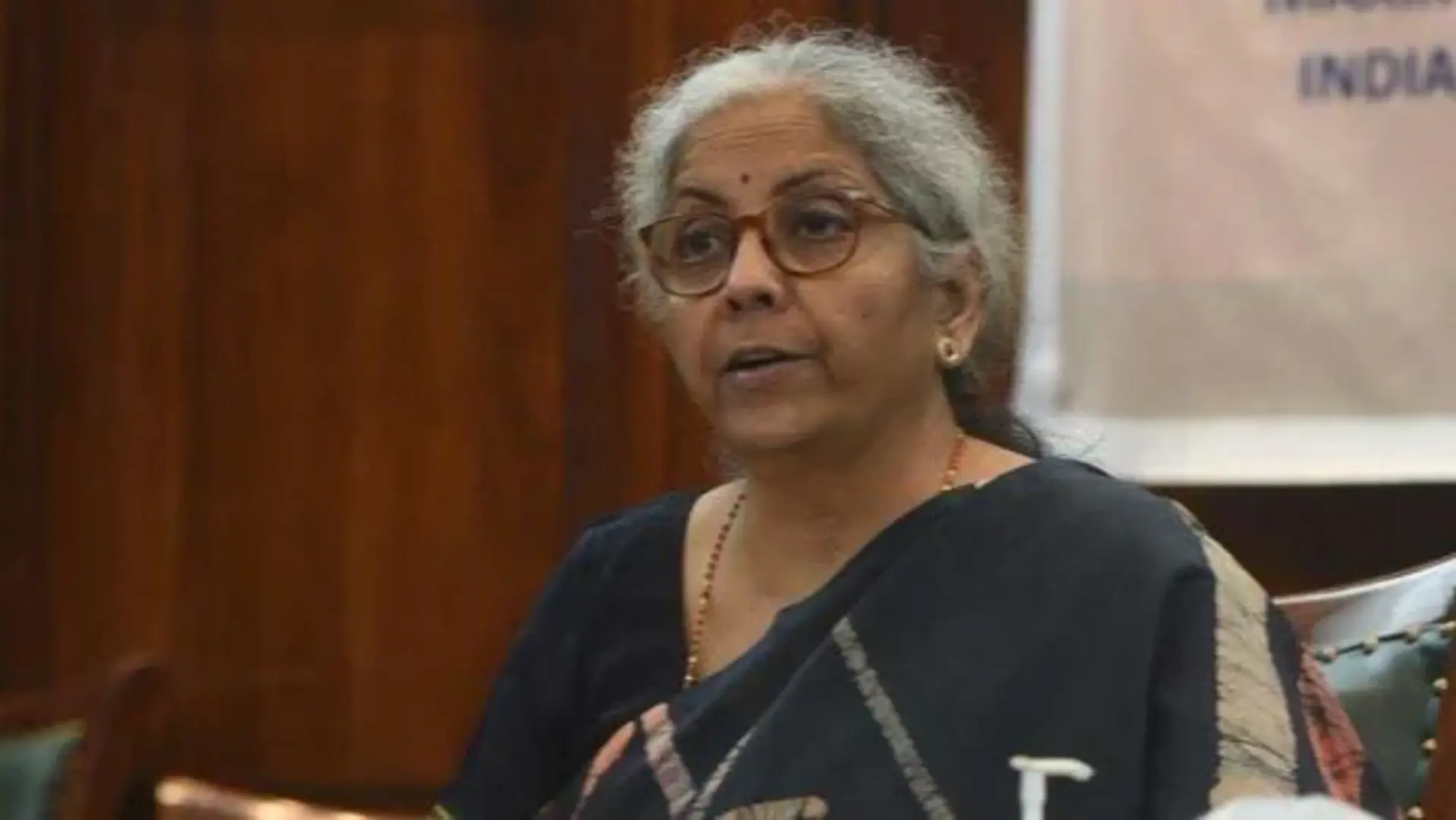

Union Finance Minister Nirmala Sitharaman has highlighted India’s extensive process and governance reforms over the past decade aimed at fostering a more investor-friendly environment. Speaking at the Roundtable on Investment Opportunities in India at the New York Stock Exchange on Monday, she identified improving the ease of doing business and reducing regulatory burdens as key policy priorities for New Delhi.

The event saw participation from various pension funds, institutional investors, and fund managers from across the United States. In a post on X, the Ministry of Finance shared, “Union Minister for Finance and Corporate Affairs Smt. @nsitharaman addressed the Roundtable on ‘Investment Opportunities in India’ at the New York Stock Exchange @NYSE, which hosts around 11 Indian companies. The Roundtable attracted numerous institutional investors and fund managers from the USA, representing one of the largest financial systems globally.”

In her remarks, Sitharaman emphasized the significance of India’s digital advancements, predicting that digitization and efficiency gains will be crucial for the country’s growth in the coming years. The Ministry of Finance noted, “FM Smt. @nsitharaman stressed that enhancing Ease of Doing Business (#EoDB) and minimizing regulatory burdens are central to India’s policy. Over the past decade, India has undertaken numerous process and governance reforms for more investor-friendly engagement. These reforms, along with digitization, are set to drive India’s economic growth in the medium to long term.”

Sitharaman received a warm welcome upon her arrival in the U.S. at Newark Liberty International Airport on Sunday, greeted by India’s Ambassador to the U.S., Vinay Mohan Kwatra, and Consul General in New York, Binaya Srikanta Pradhan, after her trip from Mexico City.

Highlighting India’s economic progress, she noted that the country’s market capitalization has reached USD 5.5 trillion, making it the fourth largest globally, trailing only the U.S., China, and Japan. The Ministry of Finance stated, “The Union Finance Minister informed the Roundtable participants that India’s market capitalization has reached the USD 5.5 trillion milestone, showcasing the effectiveness of India’s reforms.” She also mentioned that global firms like Citibank, JPMorgan, Morgan Stanley, and Bank of America are actively engaging with India’s International Financial Services Centre (GIFT City).

As of August 2024, more than 650 entities from sectors like banking, capital markets, insurance, and fintech have registered with the International Financial Services Centres Authority (IFSCA).

Sitharaman stressed that infrastructure development remains a key priority for the Indian government. She highlighted various opportunities for global investors to collaborate and participate in India’s growth. “Since infrastructure is a key focus of the Government of India, the National Investment and Infrastructure Fund (NIIF) was established as a partnership between public and private investors, now supported by numerous leading global and domestic investors. She outlined new investment opportunities across the NIIF platform, which aims to mitigate risks for investors,” the Ministry of Finance reported.

The Minister announced the introduction of new funds such as the Private Markets Fund II, the US-India Green Transition Fund (USIGF), and the Master Fund II, all designed to offer attractive long-term investment opportunities. Looking ahead to the vision of a developed India by 2047, Sitharaman emphasized the wealth of opportunities for global investment collaboration.

Notably, during her recent trip to Mexico from October 17-20, she engaged with political and business leaders and invited Mexican investors to explore opportunities in India’s Global In-House Capability Centers, aircraft leasing, and more, while also participating in the India-Mexico Trade and Investment Summit.

Earlier in September, the Ministry of Finance introduced new Foreign Exchange (Compounding Proceedings) Rules 2024 aimed at simplifying regulations for foreign investments. The new rules, which will replace the outdated Foreign Exchange (Compounding Proceedings) Rules 2000, are part of a broader initiative to streamline processes and improve the ease of doing business in India. The Finance Ministry stated, “These amendments reflect the government’s commitment to promoting ‘ease of investment’ for investors and ‘ease of doing business’ for companies.”

Under these rules, individuals or entities can settle violations of the Foreign Exchange Management Act (FEMA) by admitting to an offense and paying a penalty, thereby avoiding lengthy litigation. This move aligns with Sitharaman’s focus on prioritizing foreign investment and establishing flexible rules to encourage such investments.