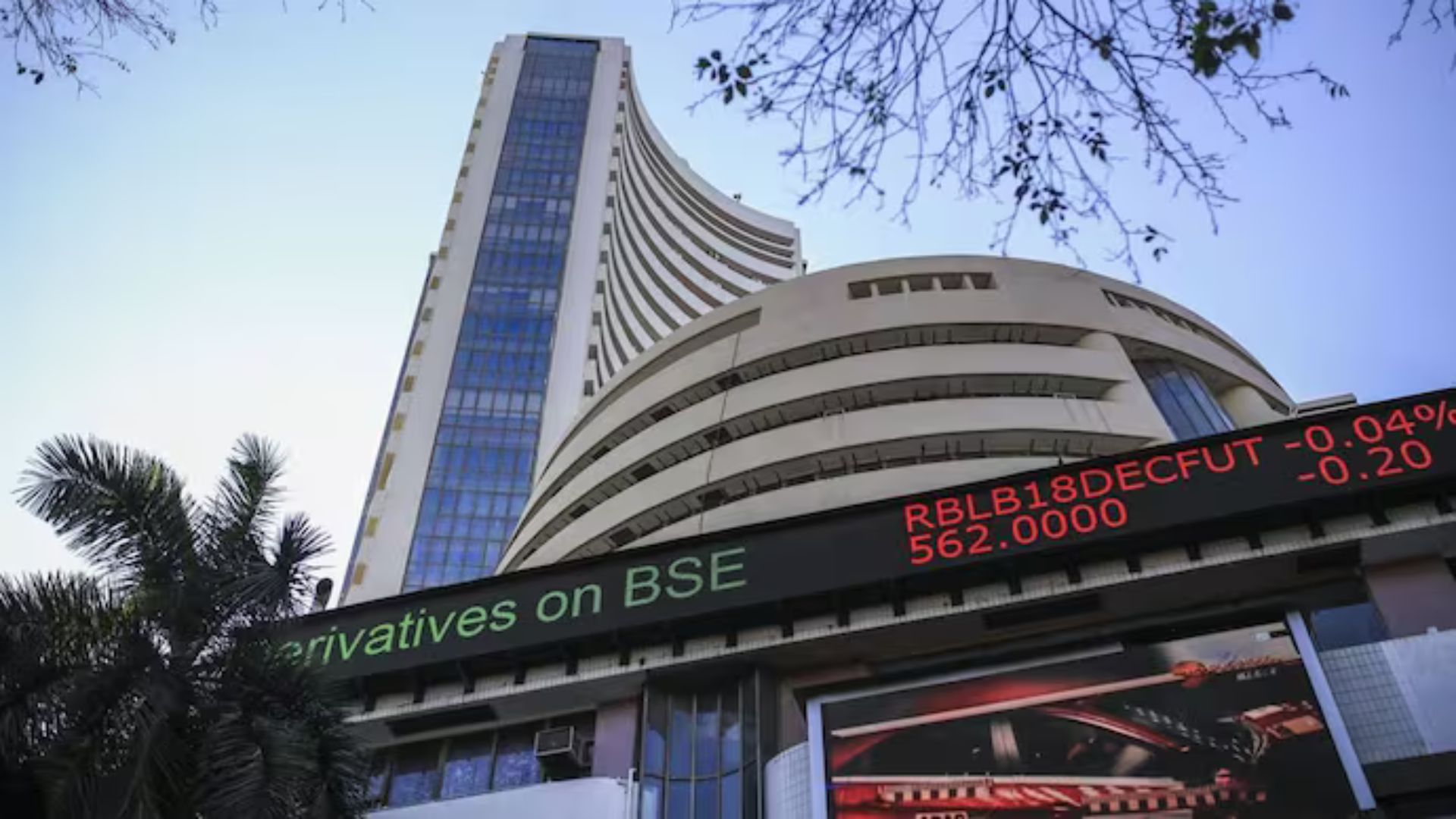

The stock market started Friday on a flat note, with both the Sensex and Nifty facing notable losses in early trading. The Sensex dropped 185.20 points to 81,426.21, while the Nifty fell by 51.30 points, opening at 24,947.15. Among the Nifty 50, 18 stocks saw gains, while 32 declined, reflecting mixed market sentiment.

Top gainers included HCL Technologies, Hindalco, JSW Steel, Wipro, and Bajaj Auto. On the other hand, CIPLA, Trent, Asian Paints, YCS, and Power Grid were the major losers, contributing to the market’s drop.

Soni Patnaik, AVP and Derivatives Research Analyst at JM Financial Services, commented on the market, noting that “Nifty remains in the 24,800 to 25,100 range.” She pointed out that the highest open interest (OI) for the weekly expiry is at the 25,000 straddle, with calls (CE) at 1.86 lakh contracts and puts (PE) at 1.57 lakh contracts. She added that FII (Foreign Institutional Investor) longs have decreased to 36%, signaling a rise in short positions. Immediate support is at 24,950, with further testing possible at 24,800 or 24,750. A break past 25,300 would be needed for short covering.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, emphasized the ongoing market volatility, stating that “FII selling and DII buying will cause short-term fluctuations.” He noted that attractive valuations in other markets, such as China, could lead to further FII selling in India due to elevated domestic valuations.

Investors are closely watching global and domestic factors to predict the next market movement amid this period of uncertainty.