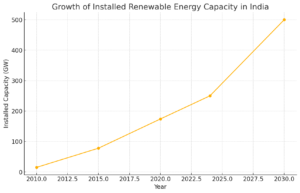

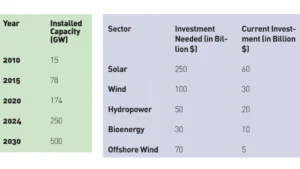

India’s renewable energy goals are ambitious, with an estimated $500 billion investment needed to achieve the target of 500 GW of non-fossil capacity by 2030. In 2022, the country attracted $19.3 billion in renewable energy investments, indicating growing interest but highlighting the need for more substantial financial inflows to meet these ambitious targets.

The scale of investment required

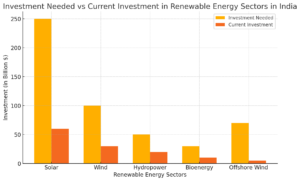

- Wind energy investment: According to Moody’s Ratings, India requires $190-$215 billion to reach its 500 GW renewable energy capacity target by 2030. This figure underscores the financial challenge of expanding clean energy infrastructure. Offshore wind energy is a significant focus, with a potential capacity of 70 GW. However, costs for offshore wind are higher than onshore, ranging from Rs 10-12 crore per MW compared to Rs 6-7 crore per MW for onshore. This necessitates financial mechanisms to mitigate risks and encourage investments.

- Solar power investment: A KPMG report suggests India needs annual investments of $350-$400 billion by 2030 to meet its clean energy targets, presenting a considerable opportunity for global investors. The goal is to achieve 280 GW of solar capacity by 2030. Despite an 85% reduction in solar photovoltaic (PV) installation costs between 2010 and 2020, reaching this target will require around $250 billion over the next decade.

Investment Needed vs Current Investment in Renewable Energy Sectors in India

Domestic financial mobilization: Progress and gaps

India’s financial sector is increasingly interested in green investments, with initiatives like the Rooftop Solar-PM Surya Ghar Free Electricity Scheme encouraging private investments. Green bonds, totaling over $12 billion by the end of 2023, are funding various renewable energy projects, indicating growing interest in sustainable financing. Public-Private Partnerships (PPPs) have also been successful, as seen in projects like the Kachchh and Bhadla Solar Parks, which demonstrate the effectiveness of mobilizing resources and accelerating implementation.

Despite these developments, gaps remain in domestic financial mobilization. Lending rates for renewable projects are higher compared to developed countries, and the lack of a robust green finance framework hinders the effective channeling of private capital into sustainable investments.

- Green Bonds: According a London School of Economics research study ‘India mobilises green finance worth $44 billion annually, which is less than a quarter of what it requires to meet its 2030 targets, and it will need $3 trillion to plug the financing gap to reach net zero. India’s sovereign issuance needs to be considered against this backdrop.’

Growth of Installed Renewable Energy Capacity in India

The role of international support

International support through climate finance and technology transfer is essential for India to scale up its renewable energy capacity. Despite pledges by developed countries to mobilize $100 billion annually by 2020 for climate action, actual fund flows have been insufficient, reaching only $79.6 billion in 2019 according to OECD. India needs access to these funds to accelerate its clean energy transition.

- Bilateral and multilateral funding: Organizations like the Asian Development Bank (ADB) and the World Bank have provided loans and grants for solar and wind projects in India. The World Bank approved a $500 million program in 2020 to support grid-connected rooftop solar systems, which helps build institutional capacity and technical expertise.

Renewable energy sectors

Technology transfer and capacity building

Enhancing Technology Transfer Offices (TTOs) in India is crucial for accelerating the commercialization of innovations, as highlighted by the DST–Centre for Policy Research’s 2024 study. Despite progress in domestic solar manufacturing, India still relies on imports for critical components like solar cells and modules. Access to advanced manufacturing technologies can help reduce this dependence and build a self-sufficient solar industry.

- Solar technology: According to the International Renewable Energy Agency (IRENA), the cost of utility-scale solar PV in India fell by 85% between 2010 and 2020. Despite the cost reductions, achieving the 280 GW target will require approximately $250 billion in investment over the next decade. Significant progress has been made in domestic solar manufacturing, but it still relies heavily on imports for critical components such as solar cells and modules. Access to advanced manufacturing technologies can help India reduce its dependence on imports and build a self-sufficient solar industry. Initiatives like the International Solar Alliance (ISA), co-founded by India and France, aim to facilitate technology transfer and capacity building among member countries.

- Grid management and storage:The investment gap in grid management and storage in India is significant. With an estimated fund requirement of around ₹4,800 billion until 2031-32 for Energy Storage Systems (ESS) including Battery Energy Storage Systems (BESS) and Pumped Hydro Projects, substantial financial commitments are necessary to bridge this gap and ensure grid stability and storage capacity.

Case studies of international support

Several case studies illustrate the impact of international support on India’s renewable energy transition:

Green Climate Fund (GCF) and Solar Power: In 2018, the GCF approved a $1 billion program to support India’s rooftop solar power expansion. The program, implemented by the State Bank of India (SBI), aims to finance the installation of solar panels on rooftops of residential, commercial, and industrial buildings. This initiative is expected to reduce carbon emissions by 10 million tonnes over its lifetime and create around 15,000 jobs.

European Investment Bank (EIB) and Solar Parks: The EIB has provided funding for the construction of large-scale solar parks in India. In 2020, the EIB signed a €150 million loan agreement with the Indian Renewable Energy Development Agency (IREDA) to support the development of solar power projects across the country. This funding helps finance projects that contribute to India’s target of achieving 100 GW of solar power capacity by 2022. The operation consists of a framework loan to support utility-scale (50MW ) solar energy investments in India. The operation will focus on solar projects with in principle limited environmental and social impact.

Asian Infrastructure Investment Bank (AIIB) and Wind Energy: As on January 2024, the AIIB invested Rs 4.86 billion (around USD 58.4 million) in India’s largest renewable energy Infrastructure Investment Trust (InvIT), Sustainable Energy Infra Trust (SEIT). SEIT, co-sponsored by Mahindra Susten and Ontario Teachers’ Pension Plan, has a 1.54 GW solar capacity and aims to promote green infrastructure and long-term financing in India. The AIIB has also invested in wind energy projects, including a $100 million loan for the construction of wind farms in Gujarat and Karnataka. These projects aim to increase India’s wind power capacity and support the integration of renewable energy into the national grid.

Addressing challenges and enhancing effectiveness

- Streamlining access to climate finance: Simplifying the process of accessing international climate finance is essential. This can involve creating a centralized mechanism to coordinate funding applications, reduce bureaucratic hurdles, and ensure alignment with national priorities.

- Strengthening regulatory frameworks: A robust regulatory framework is necessary to attract and manage investments effectively. This includes setting clear guidelines for renewable energy project development, ensuring transparency in financial transactions, and establishing mechanisms for monitoring and evaluating project outcomes.

- Promoting innovation and research: Investing in research and development (R&D) is crucial for advancing renewable energy technologies and reducing costs. India can collaborate with international partners to establish joint research programs, develop innovative financing models, and promote knowledge exchange.