In this dynamic world of finance, credit cards have become both a blessing and a concern, providing access to credit and conveniences on the one hand and leading to reckless spending and debt burdens on the other. For the youth in India, the allure of credit cards has become an irresistible temptation, drawing them into potentially difficult financial situations. The credit card industry in India is witnessing a wonderful revolution with rapid growth among the country’s young generation. This trend, characterized by altered perceptions about credit and the expansion of digital finance, is one aspect that calls for both opportunities and the need to be careful.

The Numbers Speak Volumes

The Indian credit landscape is witnessing a significant shift, with many youth holding financial products at an early age. The Paisabazaar report determined that a shocking 22% of the personal loan borrowers were under 25. This finding clearly shows that young people nowadays are more responsible and know how to take advantage of credit. Additionally, the penchant goes beyond credit cards, as 24% of people use their first plastic card before age 25. This early realization reveals the changing aspirations of the new generation of young individuals who are now looking for convenience. Apart from that, the research demonstrated that about 25% of consumers who checked their credit score on Paisabazaar carried between 5 and 10 active credit accounts, revealing a huge appetite for credit. As individuals progress through their late 20s and early 30s, a subtle shift in credit behavior emerges. The analysis reveals that the age group of 25 to 30 prefers a balanced approach, opting for a combination of one credit card and one personal loan. This blend caters to their need for convenience while providing financial support for various life stages, such as higher education, relocation, or starting a business. Among those in their early 30s, the most popular combination involves two credit cards and one personal loan, reflecting a growing appetite for credit and a desire for greater financial flexibility.

In its February 2024 release, the Reserve Bank of India highlights significant growth in credit card usage. The data reveals that credit card transactions increased substantially year-over-year, with transaction volume rising by 34.0 percent and transaction value growing by 25.7 percent. Interestingly, the outstanding credit card numbers have gained 10-crore figures, taking up to 26% of the population. The total amount of his credit score amounts to 6% In addition, a large budget variance has taken place when we compare the financial year 2023-24 (April-February) to the same period of the previous year, which is 14. Up to 6% of personal loans as a result of credit card transactions show a crucial connection as well as a rising influence of the financial types of credit in the Indian market. The escalating trend of credit card expenditure in India highlights a growing reliance on plastic money among the youth, raising questions about its implications for financial freedom and potential debt. In the financial year 2020, credit card spending stood at 7.30 trillion INR. This figure saw a dip to 6.30 trillion INR in 2021, likely influenced by the economic disruptions of the pandemic. However, subsequent years have shown a dramatic increase: 9.71 trillion INR in 2022, 14.30 trillion INR in 2023, and a staggering 18.30 trillion INR in 2024. This surge reflects an increasing comfort with credit usage, driven by consumer confidence, the convenience of cashless transactions, and aggressive credit card marketing. While this trend signals enhanced purchasing power and financial inclusion, it also raises concerns about the risk of accumulating debt, especially among younger demographics who might be enticed by the short-term benefits without fully understanding the long-term financial commitments.

This further signifies a decisive shift on the part of the youth in the usage of credit. It would improve access to financial freedom through the circulation of credit cards with the help of credit. A loan arrangement that independent teenage Indians often use to complete expensive transactions is the equated monthly installment (EMI). Young Indians do not consider it a problem to have a loan or a mortgage for pricey vacations and the most advanced gadgets.

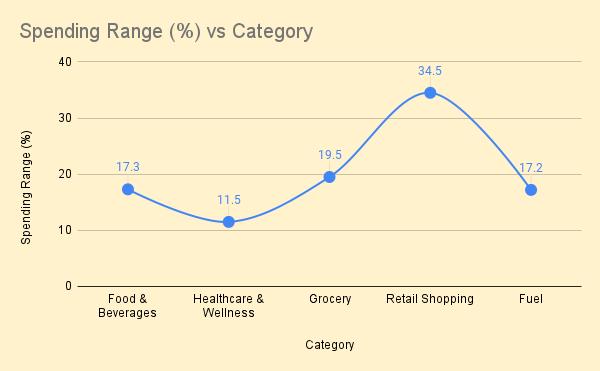

Analyzing the expenditure patterns of credit card holders reveals significant insights into consumer behavior and broader economic trends. With regard to the spending on food and beverages, which constitutes between 10% and 15% of total expenditure, these costs are also considered necessary. This category is further fueled by the need to feed oneself, the rate at which people are turning to eating out due to tight schedules, and the use of takeaway and delivery services. Medical and wellness expenses, which form 5-10% of the total, can be attributed to increased consciousness about disease prevention, self-care, and fitness, as well as higher medical requirements as a result of an aging population. This encompasses expenditures such as medical bills, fitness subscriptions, and wellness products, among others. Grocery expenses make up 12-17% of total spending and reflect people’s focus on necessity purchases and the desire to cook at home. The growth of online groceries also shows a social change of people preferring convenience and the ability to save time. Retail shopping, the biggest expenditure at 25-30 %, involves the consumption of goods including clothing, electronics, and household goods. This category is affected by lifestyle and leisure and is found to be relatively higher during sales, holidays, and other occasions. The rise of e-commerce adds more evidence on how digital transformation affects consumer expenditure patterns. Transportation costs, which account for 10-15% of costs, indicate recurring travel needs and vehicle maintenance. This category also illustrates the effects of increasing fuel prices.

Altogether, these expenditure patterns give an indication of different facets of life among consumers, such as their economic status, their lifestyle, and technological advancement in their lives. Higher spending on retail and dining suggests discretionary income, while essential categories like groceries and fuel indicate basic needs. Preferences for dining out, fitness, and online shopping point to evolving lifestyle choices and the convenience of digital solutions. Further, the data also offers ideas on global socio-economic factors like urbanization, health consciousness, and spending patterns of the aging population.

Top 10 cities with the healthiest credit scores

| 1 | Bengaluru |

| 2 | Ahmedabad |

| 3 | Mumbai |

| 4 | Pune |

| 5 | Chennai |

| 6 | Delhi |

| 7 | Hyderabad |

| 8 | Kolkata |

| 9 | Surat |

| 10 | Coimbatore |

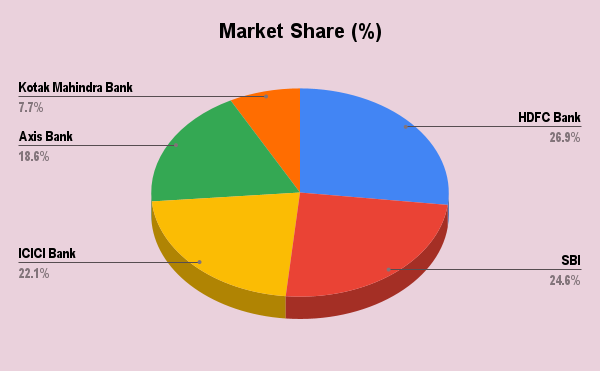

The five leading credit card issuers in India accounted for 75% of the market share at the end of the fiscal year.

The youth’s attraction to credit cards and their tendency to overspend can be attributed to a multitude of factors that intertwine societal pressures, psychological influences, and a lack of financial education.

Firstly, credit cards have transcended their functional role to become coveted symbols of financial independence and social status among the younger generation. The ability to make purchases without immediate cash outlays fuels a sense of empowerment and societal acceptance, appealing to the youth’s innate desire for validation and recognition from their peers. This perception of credit cards as a status symbol is further amplified by the ubiquitous presence of aspirational lifestyles and material possessions portrayed on social media platforms.

Secondly, the widespread acceptance of credit cards and the seamless integration of online transactions have made them an indispensable tool for the digital native generation. The convenience of making purchases with a simple swipe or click resonates with their desire for instant gratification and aligns with their fast-paced, technology-driven lifestyles. This ease of access and convenience can lead to impulsive buying behavior, as the act of making a purchase becomes detached from the tangible exchange of cash, creating a dangerous disconnect from the actual cost.

Lastly, the lack of measured budgeting skills and financial discipline among youth is significant a reason and factor that raises the tendency of youth to overspend on credit cards. Spending without due care and budget limitations can lead to such a debacle that the comfort of credit card usage makes you think about future obligations, such as saving.

On the other hand, despite the continuous progress in the world of technology in the new age, the improvement in the general awareness of personal finance is still not adequate amongst young individuals. Many consumers often lack knowledge on how credit cards should be managed or used properly, and choosing the pricey alternative is where we go wrong. The ideas of saving with compound interest, financial debt managing, and planning for the long-term future may not seem appealing to young people, and therefore, they may be ignorant of the possibly harmful outcomes that could befall them, such as debt with high interest and bad credit. It becomes a situation that keeps getting bigger and bigger because young people influence each other’s behavior. One person overspends, and then another follows suit, and gradually more and more people get caught up in the same pattern. Confronted with the new reality of social media, looking at what others have becomes an adversary, including the ideal pictures of lifestyles and material possessions. A feeling to belong to someone, meaning someone in the outside world or the online world, and this can sometimes push you beyond the limits of overspending as you need to maintain a certain social class or standard. As an additional point, credit card firms do many things to enable customers into temptation including attractive reward programs, cash backs, and promotional discounts. Such incentives can function as the main promoters pursuing the frivolity of spending in the illusion of getting discounts or rewards, with the very possible implication of becoming a debtor and giving scant consideration to the future.

Impact of Overspending

Credit cards offer instant access to cash and give freedom which in turn influences youths to spend recklessly. With credit cards easily accessible, one starts to spend on unnecessary extras, ranging from the latest gadgets, fashionable clothes, or exotic restaurants. This is because credit cards give consumers a perception of wealth, hence leading to credit consumption which is beyond their earning capacity.

Usually, debt combined with high interest charges as well as the mounting late payment fees becomes a never-ending cycle when it comes to financial woes. For instance, a young professional earning a salary less than ₹50,000 and having a credit card debt of ₹3 lakhs bearing an interest rate of 28% per annum pay over ₹84,000 only towards the interest charges in a year. A financial burden of such proportions makes it complicated for the youths to meet other life goals like home ownership, education, and retirement since their income is used to repay debts.

Moreover, damaged credit scores due to missed payments can act as a significant barrier, as it leads to exclusions in future loan and credit facilities, job, and housing opportunities. This makes it tough to borrow when its score is low because a low credit score acts as a warning sign to a lender. There are also instances where employers also factor credit scores in their employees especially where low credit scores are deemed of the employee as being financially irresponsible.

However, the stress and anxiety that come with being in debt cannot be contemplated aside from the money aspect of it. High levels of stress arising from the need to repay debts and manage cash can cause depressed moods, anxiety disorders, and ruined relations with friends and family. For example, a young couple struggling with credit card debt may experience increased conflicts and tensions, putting a strain on their relationship and overall well-being.

Additionally, the emotional pressure of being locked into repaying loans is enormous, which can negatively affect a person in their daily activities and career pursuits. Financial stress is one of the most common sources of stress that can cause a lack of focus, reduced efficiency, and illness that negatively affects the quality of life and productivity of affected individuals.

The Way Forward

The way forward requires a multipronged strategy that involves educational institutions, financial institutions, regulatory authorities, and the families themselves. Partnerships between schools, colleges, and banks can potentially set the foundation for effective financial education strategies. Such programs should enable the youth to learn how to budget properly, why credit scores matter, and how to handle debts. Having deconstructed the multifaceted nature of managing money, it is crucial to allow the youth to make sound decisions in regard to the credit market. The regulatory authorities need to act proactively to set high standards and enforce these rules across credit card companies. Fixed minimum levels of income, restrictions to the issuance of credit cards, and restrictions to the amount of credit granted according to the worth of the borrower may act as preventive measures against overborrowing. Transparency has to be the foundation, with easily understandable terms and conditions related to interest rates, fees and charges, late payments, and excessive credit. Further, the regulating authorities should monitor the marketing strategies used by the banks and NBFCs. These are some of the aggressive strategies that should be controlled, as they especially focus on the youth, who cannot differentiate between a real and a fake note. Penalties and fines that should be levied on institutions include appropriate punishment for those who mislead or engage in predatory lending.

The need for readily available counseling and support services cannot be overemphasized when dealing with the effects of excessive spending and the build-up of debt. The need for professional advice on how to manage debts, how to create a budget, and how to deal with creditors is typically met by such centers; professional counseling helps to foster proper attitudes toward managing one’s finances. These services may come from non-profit organizations, governments, or financial institutions, and are a source of assistance for those who are striving to take control over their financial situations. This is why it is very important for parents and other members of the family to provide guidance and set positive examples when it comes to issues of managing money. By being good role models of budgeting and explaining how credit cards, interests, and other components of finance work, parents can help their children make good financial choices as adults. Direct discussions of other aspects of necessity, such as the need to budget, the dangers of incurring credit card balances, and the advantages of saving before buying, might help.However, the risks resulting from an unhampered credit explosion have to be taken into consideration, as the Reserve Bank of India has recently found rather fast growth in personal loans, an unsecured product, suspicious. Misuse of credit may result in a lifelong tendency to accumulate debt, and a poor or no credit rating, which negates the financial potential and hinders the future of youth.

The use of credit cards in India is the new age revolution and holds certain prospects and threats. Although it promotes financial inclusion and enablement, there is concern about education, awareness, and responsible usage of credit facilities. With the right balance demonstrated by a combination of financial literacy programs, economic regulation, counseling services, and parenthood messages, credit liberation can be achieved in India, with the youth protected from the negative vices of indebtedness, thus placing the country on a pedestal of sustainable financial prosperity.