Amid favourable market sentiment driven by stable fuel prices, positive monsoon outlook, festive demand and the marriage season, the Indian auto retail sector achieved a robust 27 per cent year-on-year growth in April 2024, even as the industry remains cautiously optimistic due to rising interest in new models, election-related uncertainty and financial challenges which are now crucial to navigate the evolving market, says the Federation of Automobile Dealers Associations (FADA) on Wednesday.

The FADA vehicle retail data for April 2024 shows that on a yoy basis, retail sales of passenger vehicles grew 16 per cent, two-wheelers (2W) were up by 33 per cent, three-wheelers (3W) increased by 9 per cent, tractors grew by 1 per cent and commercial vehicles experienced a modest 2 per cent growth. “The combined March-April period shows 14 per cent yoy,” says FADA President Manish Raj Singhania. “While some attribute this growth to the shift in Navratri to April instead of March last year, the overall increase was significant,” adds Singhania.

The FADA outlook for May 2024 is shaped by several positive indicators. Improved vehicle supply and strategic planning in the 2W segment have led to rising customer bookings and better market sentiment, driven by favourable crop yields. In the PV segment, new model launches and favourable monsoon forecasts are set to stimulate customer interest, while bulk deals in CV segment should bolster demand in sectors like iron ore, steel, and cement.

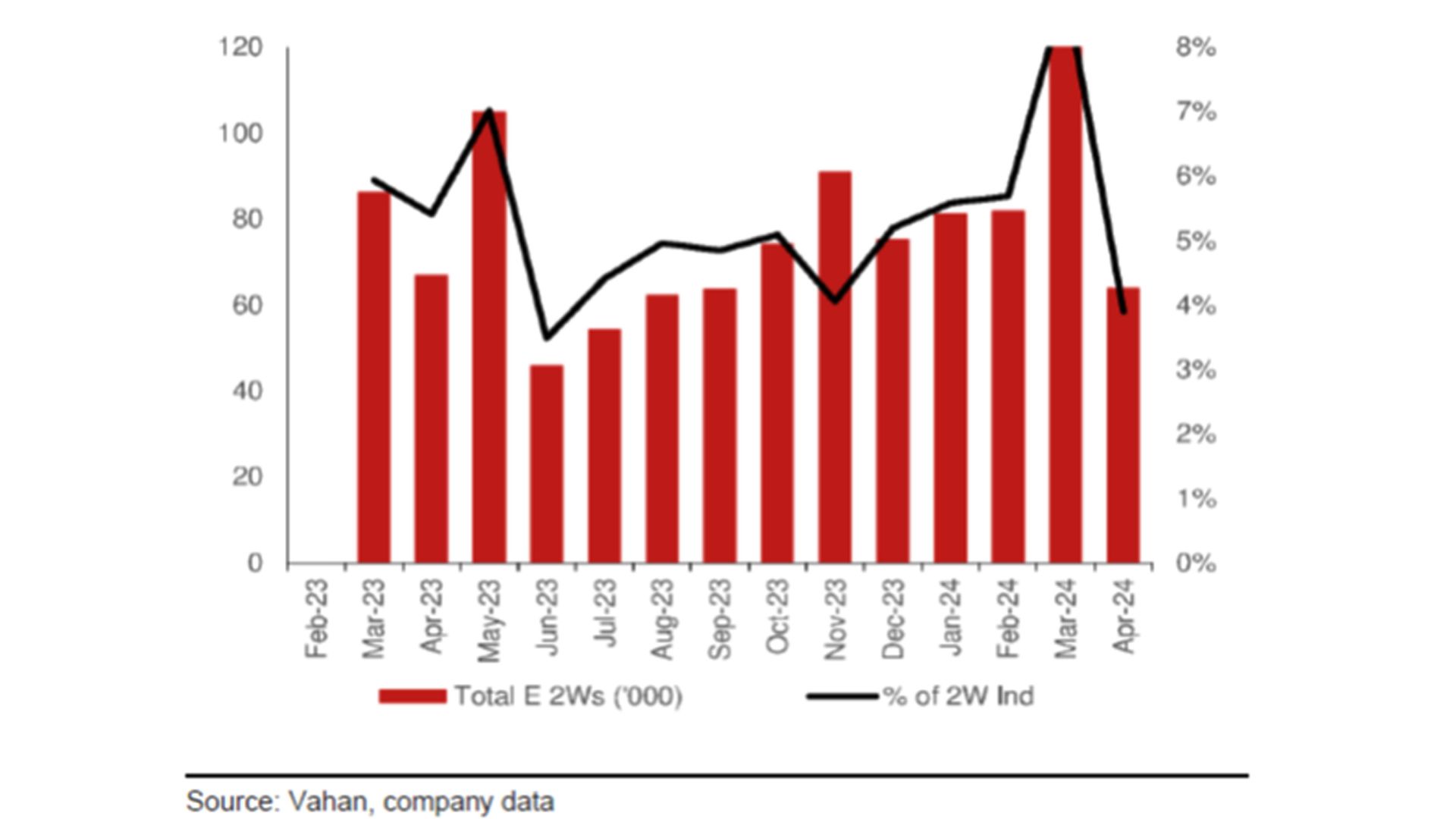

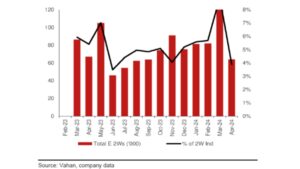

According to Nomura, vehicle registration (according to Vahan) is up sharply in April with 2Ws up 33 per cent y-y and PVs up 17 per cent y-y, benefiting from Navratra and a higher number of marriage dates as highlighted earlier. In EVs, 2W EV retail sales share declined m-m to 4 per cent (from 9 per cent in March ‘24) at 63000 units, -6.4 per cent yoy, due to the pull forward of demand in March 2024 as subsidy was reduced in April. Ola’s market share increased to 52 per cent from 37 per cent in March ‘24) while Ather/TVS saw 600 basis point decline m-m each.

The auto industry, according to FADA, faces various challenges ranging from limited financing options, overcapacity and extreme summer season. The overcapacity in the CV segment and rising temperatures could further slow growth, warns FADA. Election uncertainty continues to affect market sentiment, delaying customer conversions and stalling purchasing decisions. The industry thus remains cautiously optimistic about its near-term outlook. Market opportunities exist with rising customer interest in new models. However, election-related uncertainty and financial constraints remain key challenges that the industry will need to monitor closely to navigate this evolving landscape effectively.

The apex body representing the interests of India’s auto retail sector, has teamed up with Frost & Sullivan to spearhead an ambitious customer experience index (CEI), a quantitative research to assess customer satisfaction and customer experience. The survey looks to understand and quantify customer satisfaction focusing on their journey in sales, after sales service and product quality in the passenger vehicle category, to assess key drivers of satisfaction and quantum of their contribution to the satisfaction and to determine the key barriers of satisfaction and identify the areas of improvement.

The comprehensive study will target passenger vehicle category, including hatchbacks, sedans, SUVs/MPVs, EVs and luxury vehicles, utilising a detailed questionnaire to capture insights from 8,000 participants across 26 cities. This includes seven metropolitan areas, 16 tier-2 cities and three tier-3 locations, ensuring a broad and inclusive data set that spans the diverse Indian landscape. The results, which will provide invaluable insights for the entire automotive ecosystem, are expected in September 2024. The respondent’s profile includes males and females aged 18 years onwards, who are key purchase decision makers for the primary vehicle and must be a primary user (only personal usage) of a personally owned vehicle. The other criteria is that primary vehicle must be ‘new’ when purchased (exclude, preowned, leased, rented) and purchased from an authorized dealer.

The initiative comes at a critical juncture, poised for significant growth amidst changing consumer behaviours and technological innovation, says Vinkesh Gulati, Chairman of FADA’s Research & Academy. The survey is designed to systematically harness customer feedback across a wide demographic, something that has not been undertaken at this scale in our industry before.

By integrating detailed assessments of sales, after-sales and product quality experiences from various vehicle categories, FADA aims to provide OEMs and dealers with the insights necessary to elevate their service standards and product offerings.