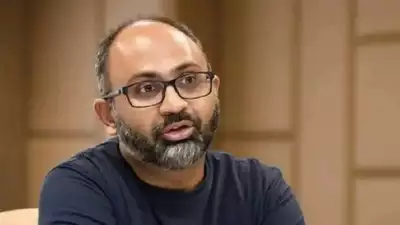

As per sources familiar with the matter, Paytm Money, the wealth management arm operated by Paytm’s parent company One 97 Communications, has appointed Rakesh Singh as its new CEO. Singh takes over from Varun Sridhar, who served as the firm’s chief executive since 2020, as reported by ET.

Singh, formerly the CEO of broking services at Fisdom, a company backed by PayU, reportedly assumed his new role at Paytm Money last month. Meanwhile, Varun Sridhar is said to be transitioning to a different position within the group.

Under Sridhar’s leadership, Paytm Money experienced an increase in profitability, with profits reaching Rs 42.8 crore, and revenue surged to Rs 132.8 crore in FY23. The company faces competition from rivals such as Groww, Upstox, Zerodha, and Angel One.

In February, Paytm Money, the stock and mutual fund broking division of Paytm, appointed Vipul Mewada as its Chief Financial Officer (CFO). Mewada previously served as the Deputy CFO at ICICI Securities, according to a report by ET.

There has been significant leadership changes in the digital wealth management sector. Earlier in January, ET reported that several key executives from Kotak Mahindra Bank’s digital wealth platform Kotak Cherry, including CEO Srikanth Subramanian, are likely to join rival broking firm Angel One.

Bengaluru-based company Paytm Money focuses on investing in stocks and mutual funds, with a specialization in direct mutual funds that bypass distributors. While Paytm Money is a key player in direct mutual funds, it doesn’t perform as well in stockbroking compared to its competitors. According to data from the National Stock Exchange (NSE), Paytm Money has around 760,000 active trading clients and 860,000 systematic investment plans (SIPs). In contrast, Groww and Zerodha boast over 7.6 million and 6.7 million clients, respectively.