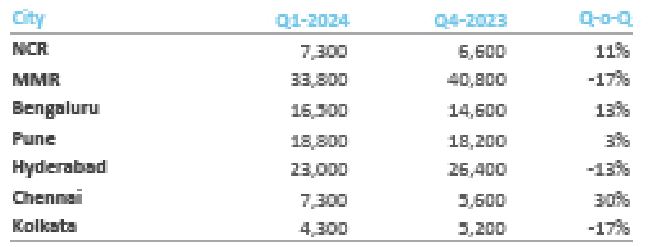

The first quarter of 2024 witnessed a decent increase in new housing launches across the top 7 cities in India, according to a report by Anarock, a leading real estate services company. A total of approx. 1,10,900 residential units were launched, representing a year-over-year growth of 1% compared to Q1 2023 (1,09,600 units launched). However, there was a slight quarter-over-quarter decrease of 6% from Q4 2023 (1,17,400 units launched).

MMR (Mumbai Metropolitan Region), Hyderabad, Pune, and Bengaluru were the key contributors to the surge in new launches, collectively accounting for 83% of the total supply addition. Notably, MMR and Hyderabad emerged as the frontrunners, contributing over half (51%) of the new launches within the top 7 cities. Kolkata held the smallest market share at 4%.

In terms of budget segmentation, the mid segment (INR 40 lakh – INR 80 lakh) continued to dominate new housing supply, holding a significant market share of 33% in Q1 2024. The premium segment (INR 80 lakh – INR 1.5 crore) and the affordable segment (less than INR 40 lakh) captured respective shares of 24% and 18%.

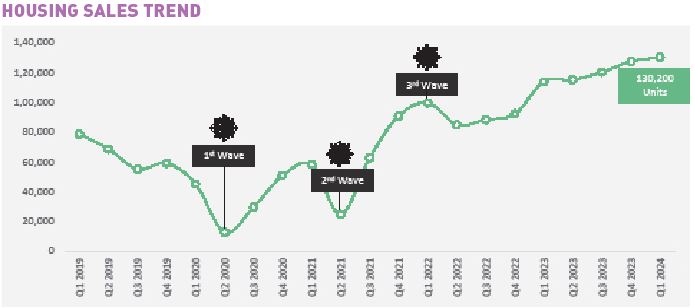

SALES TREND

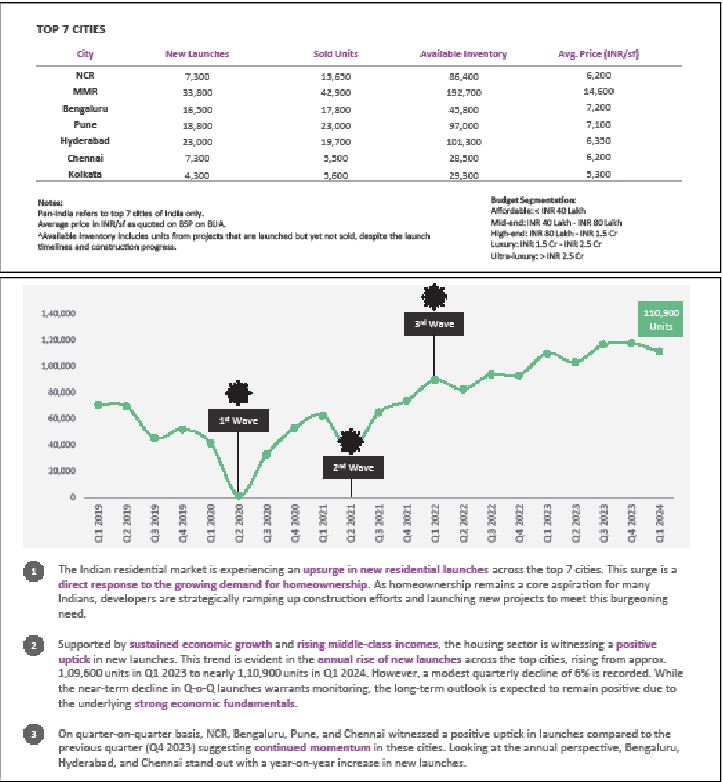

Q1 2024 witnessed robust sales activity in the Indian housing market, with approx. 1.30 lakh units sold. This represents a 2% increase compared to the previous quarter (Q4 2023) and an impressive 14% year-over-year growth across the top 7 cities. Residential sales activity remained concentrated in NCR, MMR, Bengaluru, Pune, and Hyderabad – collectively accounting for a 91% share of total sales in Q1 2024. Chennai and Kolkata witnessed relatively lower sales volumes, each contributing a modest 4% share individually.

AVAILABLE INVENTORY

Q1 2024 saw a reduction in available inventory across the top 7 cities. Compared to Q4 2023, the available inventory levels decreased by 3%. This trend continued on a yearly basis, with a more significant decline of 7%. NCR experienced the steepest year-on-year decline in available inventory among the major cities, with a decrease of 27%. Kolkata and Bengaluru followed suit with noticeable Y-o-Y declines of 20% and 16%, respectively.

TOP 7 CITIES

Four key cities – MMR, Hyderabad, Pune, and Bengaluru – emerged as the powerhouses of new residential launches in Q1 2024, collectively accounting for an impressive 83% of the total launches across the top 7 cities. MMR, the perennial powerhouse, claimed the top spot with a commanding 30% share. Hyderabad followed closely behind, contributing a significant 21% of new launches. Following suit, Pune and Bengaluru, have accounted of 17% and 15% of the Pan India supply, respectively. NCR, Chennai, and Kolkata witnessed a comparatively modest influx of new launches, collectively accounting for the remaining 17% market share.

Chennai takes the lead for the most impressive quarter-onquarter growth, boasting a 30% surge in new residential launches. Bengaluru, NCR, and Pune followed suit, emerging as the only other cities to witness growth, with increase of 13%, 11%, and 3% respectively compared to Q4 2023.

Looking at the annual picture (Y-o-Y), Hyderabad stood at the forefront, showcasing a remarkable 57% increase in new residential launches. Bengaluru and Chennai stand out as the only other major cities experiencing positive YoY growth, with impressive gains of 22% and 14% respectively compared to the same period last year.