Yet another unexciting MPC meet is lined up this week. “We think the RBI’s tone will slowly tiptoe to ‘Gracklish’ from the usual ‘Hawk-Dove’ signaling, implying a non-committal stance and limited definite forward guidance ahead,” says a research report ‘RBI MPC Preview’ by Emkay Global Financial Services.

The fluidity of global narratives and policy repricing, in conjunction with the near-term problem-of-plenty on INR/bonds, could make it arduous for the RBI to find a balance in its policy biases, according to the report.

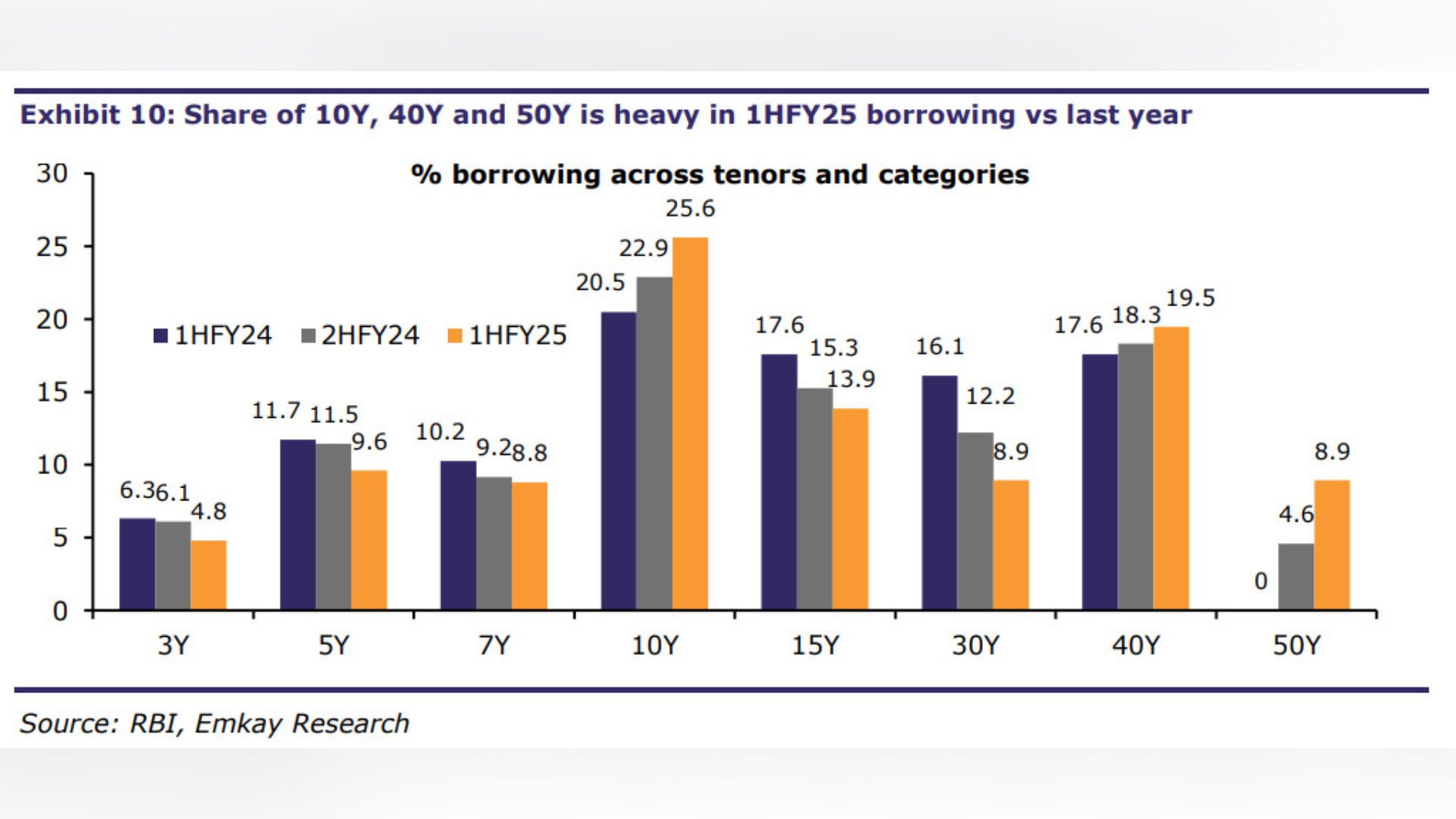

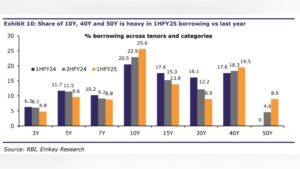

“While the upcoming policy may not see material changes in macro assessment by RBI, issues like 1) case & timing of policy pivot/stance change, 2) factors influencing liquidity management ahead and, of course, 3) assessing which part of the yield curve has the maximum juice, etc would be key for markets. While bull-steepening looks to be a popular trade, consistent repricing of Fed cuts could spill over into the RBI’s reaction function and will be cyclically noisy for bonds/FX,” it said.

What’s moved since the last MPC in Feb-24

The comfortable policy tone in Feb-24 was helped by healthy growth-inflation and external financing dynamics, topped by low volatility in global risk assets, as ‘Goldilocks’ became the dominant narrative.

There has been little change in domestic dynamics since: a) Healthy growth and in-inflation prints, with headline CPI poised to hit sub-4% briefly in Jul-Aug ’24. b) Comfortable external sector financing ahead, with FY24E/25E BoP headed for a USD38bn/USD20-30bn surplus. But there now appear cracks in the Goldilocks narrative (soft/no landing + rate cuts), wherein the global growth tale has not mellowed, but Fed rate-cut hopes are becoming moving goalposts again (Fed funds futures now attaching under-50% probability for a June cut). Meanwhile, Brent is up 15% since early Feb-24, and global supply-chain pressures have tightened with the protracted Red Sea crisis (albeit transport costs play a marginal role in global cost pressures).

Will 2024 see the RBI pivot on rates?

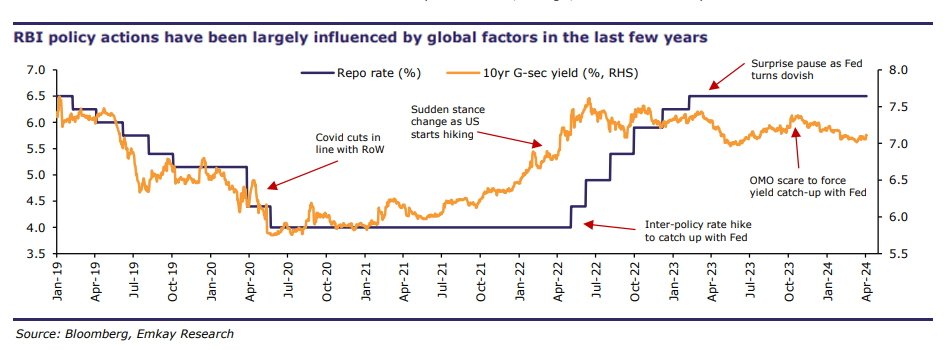

“We have long maintained that the RBI policy has been somewhat pegged to the Fed, specifically over the last two years, even as it formally targeted inflation. This seems fair, as external dynamics have been fluid, implying that the policy prerogative needs to be flexible for ensuring financial stability. The policy narrative has been explicitly domestic, but swift policy turns/pivots in the last two years have been purely influenced by the global cause (recall a few key pivots: Apr-22 – stance change followed by start of the rate hiking cycle; Apr-23 – surprise pause; Oct-23 – OMO sales communication). This suggests that when needed, the aim of financial stability may even precede inflation management,” said the report.

Will 2024 see a Fed cut? Emkay’s calculations suggest that key DMs would be lumbering into the last mile of disinflation which will stall at an elevated ~3.5% by end-2024 – absent a recession.

Markets have already priced-in a more gradual pace of Fed easing. To date, this has not yet spilled over into EM CB pricing, including that of the RBI, but that could change soon.

“While we feel it is time to reassess our faith in the guidance of central banks, we think the Fed may be revisiting its mid-1990s strategy of ‘opportunistic disinflation’ – implying a shallower cut cycle and a real scenario of ‘no cut’ in 2024,” it said.

But can the RBI precede the Fed?

Emkay sees no merit in this.

1) Unless delayed Fed action comes with an immediate negative growth shock, we do not see a crash in EM risk assets, but there may be a little froth. The RBI would want to avoid adding to the noise, incl. that related to stance change.

2) INR/India bonds have a lot going for them fundamentally and could remain a cherrypicked play in EMs, albeit with RBI still saddled with managing the problem of plenty, esp. in 1HFY25.

Consistent foreign flows + easy or surplus system liquidity could lead to easier financial conditions = de facto mild rate cut, unless intervened/sterilized by the RBI. It would be pointless to add more to the bounty.

So RBI may be pegged to the Fed on rate actions, while still ensuring operative call money rates not going below repo (VRRR may stay the primary tool, but OMO sales could be used too, hinging on gauging the nature of liquidity/other global dynamics.