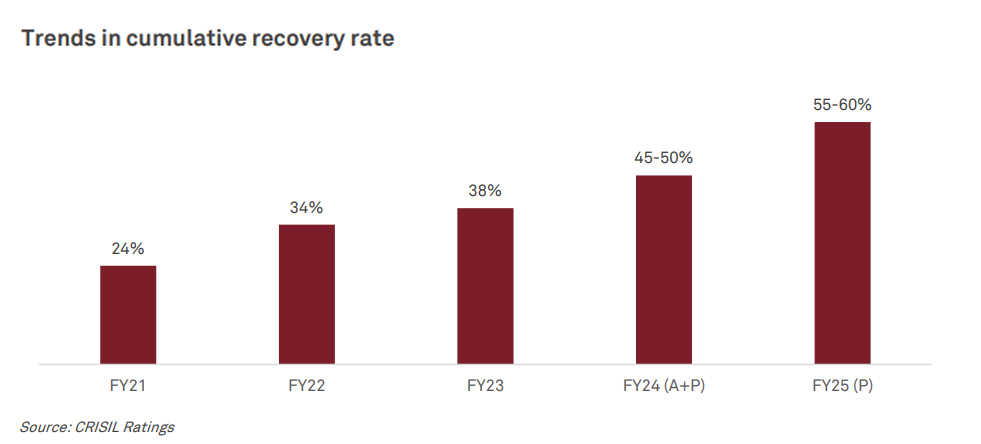

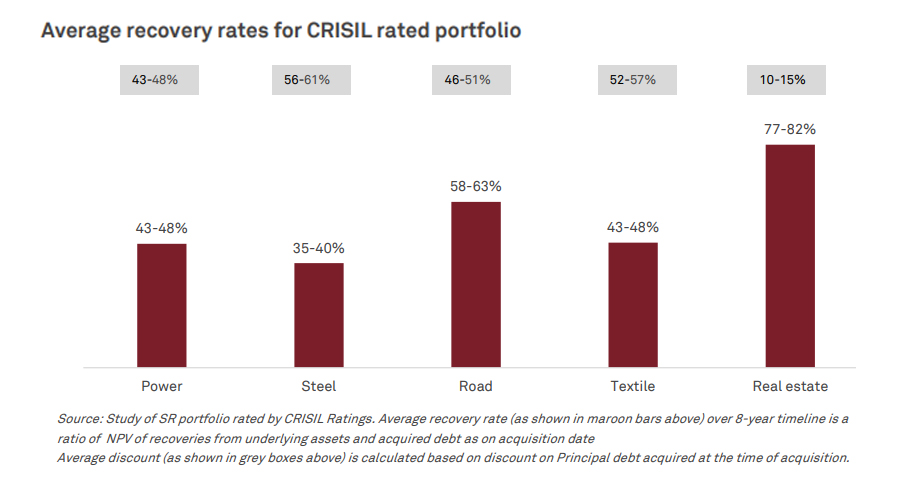

Recovery in key infrastructure sectors has cast a positive impact even on the stressed assets in these industries as is reflected in marked improvement in realisation of such assets in real estate, roads, power and steel, according to an ASSOCHAM- CRISIL Ratings study.

Recoveries in real estate topped the list, followed by the road sector thanks to several policy interventions, turnaround in these industries as also an overall positive macroeconomic. ‘’Real estate is seen to recover 77-82 per of the acquired debt (by asset reconstruction companies) over eight years followed by highway tolling with a recovery of 58-63 per cent,’’ the study noted.

As a result of high recoveries, the debt under the real estate sector is being bought at a very low discount amidst rising investor interest due to the boom in the sector.

‘’Along with several macro positives, the factors leading to a substantial improvement in recoveries in vital infrastructure sectors include a transformative role played by the Insolvency and Bankruptcy Code, though a lot of ground needs to be covered in terms of speeding up the judicial process for the IBC cases,”, ASSOCHAM Secretary General Mr Deepak Sood said.

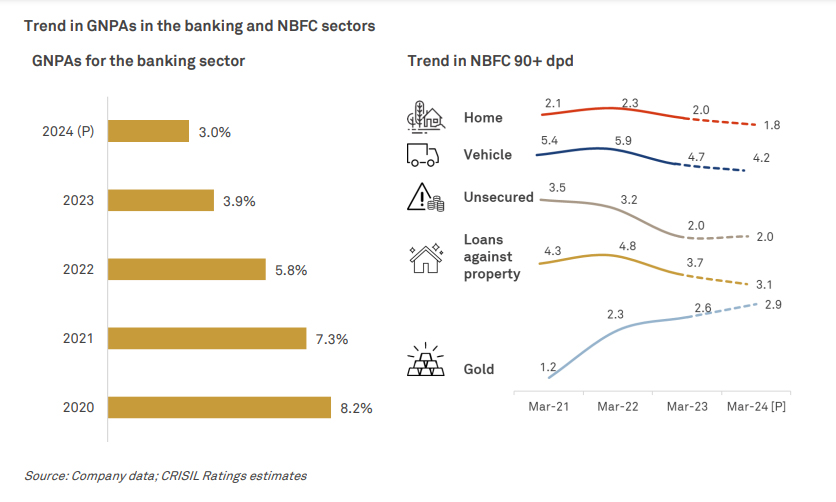

Commenting on the ASSOCHAM-CRISIL Ratings report, Mr Sood said the recoveries in the stressed assets has resulted in a marked improvement in the banks’ balance sheets with the non-performing assets, touching decadal lows in several banks.

As in the real estate industry, the stressed sectors in the power sector have the potential to recover 43-48 per cent of the total debt acquired by the ARCs. “The positive trajectory can be attributed to escalating demand for power, favourable regulatory changes such as coal auctions through the Shakti scheme, ongoing restructuring initiatives and strategic investments,’’ the paper pointed out.

Likewise in the roads including highways, the improvement is taking place due to several measures by the government to develop the public infrastructure ecosystem. These include extension of concession period for build-operate–transfers-toll operators, release of retention money to the extent of work done etc.

According to the study, stressed road assets have the potential to recover 58-63 per cent of the total debt acquired.

Referring to the journey of IBC, the ASSOCHAM-CRISIL Ratings report said the insolvency and bankruptcy law has transformed the credit culture from the ‘debtor in control’ to ‘ creditor in control’ paradigm’. It has undoubtedly tilted the power equation in favour of creditors from debtors and improved the credit culture’’.