In the realm of global economic forecasts, India emerges as a beacon of resilience, projected to retain its position as the fastest-growing major economy, according to the World Bank’s latest Global Economic Prospects report. With an anticipated growth rate of 6.4% in the fiscal year 2025, followed by a further acceleration to 6.5% in 2026, India’s economic trajectory stands out amid a backdrop of uncertainties and challenges. This positive outlook serves not only as a testament to India’s economic vitality but also as a crucial factor in shaping Prime Minister Narendra Modi’s narrative as the nation approaches pivotal general elections.

According to the latest Global Economic Prospects report from the World Bank, India is projected to maintain its status as the fastest-growing major economy. The report anticipates a growth rate of 6.4% in the fiscal year 2025, followed by an acceleration to 6.5% in the fiscal year 2026, despite a slowdown. The World Bank emphasizes that while investment is expected to slightly decelerate, it will remain robust. This resilience is attributed to increased public investment and enhanced corporate balance sheets, including improvements in the banking sector.

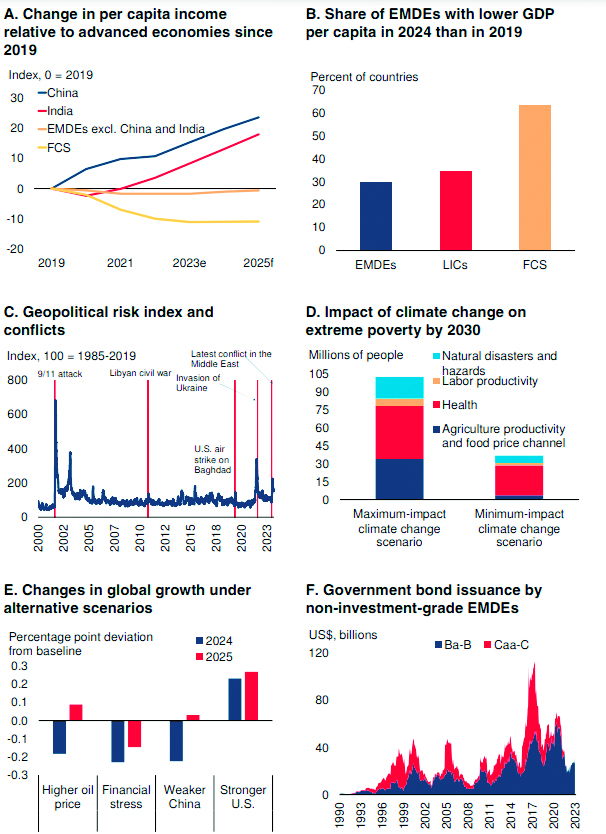

Emerging markets and developing economies (EMDEs) are anticipated to experience limited progress in catching up to advanced economy levels of per capita income. Excluding China and India, there are no projected relative gains between 2019 and 2025. Many vulnerable EMDEs are falling further behind, with per capita income forecasted to remain below its 2019 level in one-third of Low-Income Countries (LICs) and half of economies facing fragile and conflict-affected situations.

The recent conflict in the Middle East has elevated geopolitical risks, and any escalation could disrupt goods and commodities trade, impacting global growth. Climate change-related natural disasters may contribute to an increase in extreme poverty. The realization of these downside risks could result in weaker global growth compared to baseline projections. EMDEs with weak credit ratings have already faced financial pressures and lack access to international bond markets.

India anticipates an annual growth rate of 7.3% in the fiscal year ending in March, marking the highest rate among major global economies. This positive economic outlook is considered a boost for Prime Minister Narendra Modi as the country gears up for general elections scheduled to take place before May.

“These projections for 2023/24 are preliminary,” stated the National Statistical Office (NSO) on Friday, noting that subsequent revisions could be influenced by enhanced data coverage, actual tax receipts, and state subsidy expenditures. The World Bank forecasts a 6.3% growth for India in the current fiscal year. Additionally, the global growth projection by the World Bank indicates a further slowdown to 2.4% in 2024 from the previously estimated 2.6% for 2023, marking the weakest performance in half a decade over the past 30 years.

The World Bank issued a cautionary statement, emphasizing that unless a “significant course correction” is implemented, the 2020s could be characterized as “a decade marked by missed opportunities.” Regarding private consumption in the upcoming fiscal year, the World Bank anticipates a gradual reduction. This reduction is expected due to the waning effects of post-pandemic pent-up demand and the likelihood of continued constraints on spending, particularly among low-income households, attributable to persistent high food price inflation.

The institution expressed apprehensions, particularly highlighting interest payments as a cause for concern. It anticipates that government revenues in India will benefit from robust corporate profits, and concurrent reductions are expected in current expenditures as pandemic-related measures conclude. However, the World Bank projects significant interest payments, especially in countries with elevated debt levels, naming India, Pakistan, and Sri Lanka among them.

The bank raised concerns about potential risks stemming from extreme weather events and upcoming elections. It highlighted the heightened uncertainty related to these elections, which might negatively impact private sector activities, including foreign investment. The report noted that implementing policies aimed at reducing uncertainty and enhancing growth potential post-elections could contribute to an improvement in overall growth prospects.

The global outlook is affected by China’s slowing growth, projected to be 4.5% in 2024, marking its slowest expansion in over three decades outside of the pandemic-affected years of 2020 and 2022. The forecast, revised down by 0.1 percentage point from June, reflects weakened consumer spending amid ongoing turmoil in the property sector. Additionally, the forecast anticipates a further slowdown in 2025, with growth expected to reach 4.3%.

As the world grapples with economic intricacies and uncertainties, India stands poised to chart a course of robust growth, according to the World Bank’s insightful projections. The anticipation of a 7.3% annual growth rate in the current fiscal year solidifies India’s status as the pace-setter among major global economies. However, the report sounds a note of caution, emphasizing the need for a “significant course correction” to avert a missed opportunity in the unfolding decade.

As India navigates through potential challenges and embraces opportunities, the resilience of its economy serves as a beacon of hope, contributing not only to its own growth but also to the broader landscape of emerging markets and developing economies.