The agrarian community in the state as well in the country has been struggling on several fronts simultaneously requiring the state government to come up with necessary steps for their betterment. In spite of being one of the smallest (1.3 % of total geographical area) States of India, Haryana has a prominent place on the farming of the country as it contributes a sizable chunk of wheat and other crops. Most of the population in the state involved in the occupation of agriculture has been left in a state of disparity and on their own. Although different governments from time to time claimed to take big steps to improve the economic condition of the farmers, on the ground the condition of the farmers remained more or less the same.

In a bid to improve the financial conditions of the farmers, the state government has started insurance schemes for the damage to crops incurred due to several different factors namely, due to natural calamities such as unseasonal rains, flood and hailstorms. Similarly, to protect farmers from losses, the Central Government had launched the Pradhan Mantri Fasal Bima Yojana (PMFBY) several years ago, which aims to support sustainable production in the agriculture sector as well as to stabilize the income of farmers to ensure their continuity in farming along with providing financial assistance to the farmers suffering from crop loss/damage arising out of any unexpected event.

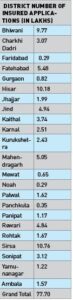

The total number of insured farmer applications under PMFBY in Haryana from the year 2018-19 to the year 2022-23 is 77.70 lakh. In this context, every year on an average about 16 lakh farmers insured themselves for their crops under the scheme. Let us tell you that under the respective PMFBY, a maximum number of farmers from Hisar, Bhiwani and Sirsa applied for compensation for crop damage. A maximum of 10.76 lakh farmers applied for insurance in Sirsa district of Haryana, while 10.18 lakh and 9.77 lakh farmers applied for insurance in Hisar and Bhiwani respey. After this, 5.48 lakh farmers in Fatehabad, 5.05 lakh in Mahendragarh, 4.94 lakh in Jind, 4.84 in Rewari, 3.74 in Kaithal, 3.12 in Sonipat and 3.07 lakh in Charkhi Dadri applied under the scheme. Panchkula, Gurugram, Mewat, Faridabad and Nuh were among the districts with below 1 lakh farmers registered for the insurance under the scheme in the five-year period. As many as 0.29 lakh farmers in Nuh district, 0.35 lakh in Panchkula, 0.65 lakh farmers in Mewat and 0.82 lakh farmers in Gurugram have got registered for insurance under the scheme. Apart from this, 2.51 lakh farmers in Karnal, 2.41 lakh in Kurukshetra, 1.99 lakh in Jhajjar, 1.62 lakh in Palwal, 1.57 lakh in Ambala and 1.17 lakh in Panipat have got their crops insured under the scheme.

In this context, recent details were sought in the Rajya Sabha by Kartikey Sharma, am MP as to how many farmers in Haryana got insured under the scheme in the last few years and took advantage of the scheme. It is pertinent to mention that the main reason for the decreasing interest of farmers in the crop insurance scheme is the delay in payment of claims and less area of loss being recorded in the crop survey. Apart from this, farmers covered under the crop insurance scheme have to inform the company within 72 hours of crop loss. Farmers who are unable to do so do not get insurance despite losses.

Regarding the scheme, the central government is of the opinion that review/revision/rationalization/improvement of insurance schemes is a continuous process and decisions are taken from time to time based on the suggestions/representations/recommendations/studies of the stakeholders. Experience gained, from various stakeholders Based on the experience gained, views of various stakeholders and with a view to ensure better transparency, accountability, timely payment of claims to farmers and to make the scheme more farmer friendly, the Government has comprehensively revised the operational guidelines of PMFBY from time to time. Has been modified so as to ensure that the benefits under the scheme reach the eligible farmers in a timely and transparent manner. The information revealed that through the Prime Minister Crop Insurance Scheme, farmers have received an amount of more than Rs 7600 crore as compensation for crop failure in a period of seven years from 2016 to the first half of last year. During the same period, the data revealed that during this period, farmers paid a premium of about Rs 1900 crore, while a payment of Rs 7648.33 crore was taken from insurance companies for crop failure. However, compared to the premium, they had to pay about Rs 835 crore more in claims to the farmers.