The top 7 cities saw total home sales of over 1.38 lakh units in 2020 against approx. 2.61 lakh units in 2019 – a decline of 47%. Further, new housing supply in 2020 declined by 46% against the preceding year – from approx. 2.37 lakh units in 2019 to approx. 1.28 lakh units in 2020. MMR and Pune were the showstoppers in overall residential activity in 2020, says data ANAROCK.

While residential real estate bottomed out in 2020 against the previous peak of 2014, there are strong revival signs in Q4 2020 – with home affordability being at its all-time best. Amidst varied offers and discounts, the top 7 cities saw robust sales of approx. 50,900 units in Q4 2020, rebounding to almost 86% of the corresponding period in 2019. Last year, the festive quarter saw total home sales of 59,160 units. MMR and Pune drove residential sales, with the two cities accounting for an over 53% total share.

On the supply front, the top cities added 52,820 units in Q4 2020 against 51,850 units in Q4 2019 – increasing by 2% y-o-y. Hyderabad outpaced other cities and added a massive new supply of 12,820 units in the quarter, followed by MMR with over 11,910 new units.

Due to increased new launches across cities, unsold inventory declined by 2% on a yearly basis – from over 6.48 lakh units in Q4 2019 to over 6.38 lakh units in Q4 2020. However, in comparison to the peak levels of 2016 – when unsold stock stood maximum at approx. 7.91 lakh units in top 7 cities – it declined by a significant 19%.

Anuj Puri, Chairman, ANAROCK Property Consultants says, “2020 has been an unprecedented year due to COVID-19, causing all-round upheaval. However, the residential segment was quick to pick up momentum in the last two quarters of 2020 on the back of growing homeownership sentiment – catalysed by the exigencies of the pandemic. This pent-up demand was further accelerated by the ongoing discounts and offers, the prevailing lowest-best home loan interest rates and limited-period stamp duty cuts in states such as Maharashtra.”

“ANAROCK Data reveals that the festive quarter (Oct.-Dec. period) stood out among all four quarters in 2020, witnessing maximum sales due to multiple offers and discounts, low interest rates and limited-period stamp duty cuts in states such as Maharashtra. Buoyed by the rising sales, developers also saw it fit to unleash ample new supply into the market, leading to a 2% y-o-y jump in Q4 2020 against the same period in 2019. The new supply was dominated by strong branded developers. This strong growth in Q4 has set the stage for revival of residential activity in 2021 as well.”

HOUSING SALES OVERVIEW – 2020 VS 2019

Altogether, the top 7 cities saw housing sales of approx. 1,38,350 units in entire 2020 as against 2,61,370 units in 2019, declining by 47%. MMR saw maximum yearly sales of approx. 44,320 units, followed by Bengaluru with 24,910 units.

• MMR saw housing sales of approx. 44,320 units in 2020, reducing yearly by 45%. Last year, the city saw total sales of nearly 80,870 units.

• In Bengaluru, housing sales touched 24,910 units in 2020 against 50,450 units in 2019 – a decline of over 51%.

• In Pune, housing sales stood at 23,460 units in 2020 against 40,790 units in 2019 – a fall of 42%.

• NCR witnessed housing sales of 23,210 units in 2020 over 46,920 units a year ago. The region saw its sales plummet 51%.

• Hyderabad sales stood at 8,560 units in 2020 versus 16,590 units in 2019 – thus reducing by 48%.

• In Chennai, housing sales in 2020 stood at around 6,740 units as against 11,820 units in 2019 – a 43% fall.

• Kolkata saw housing sales of 7,150 units in 2020 against 13,930 units in 2019 – a 49% yearly drop.

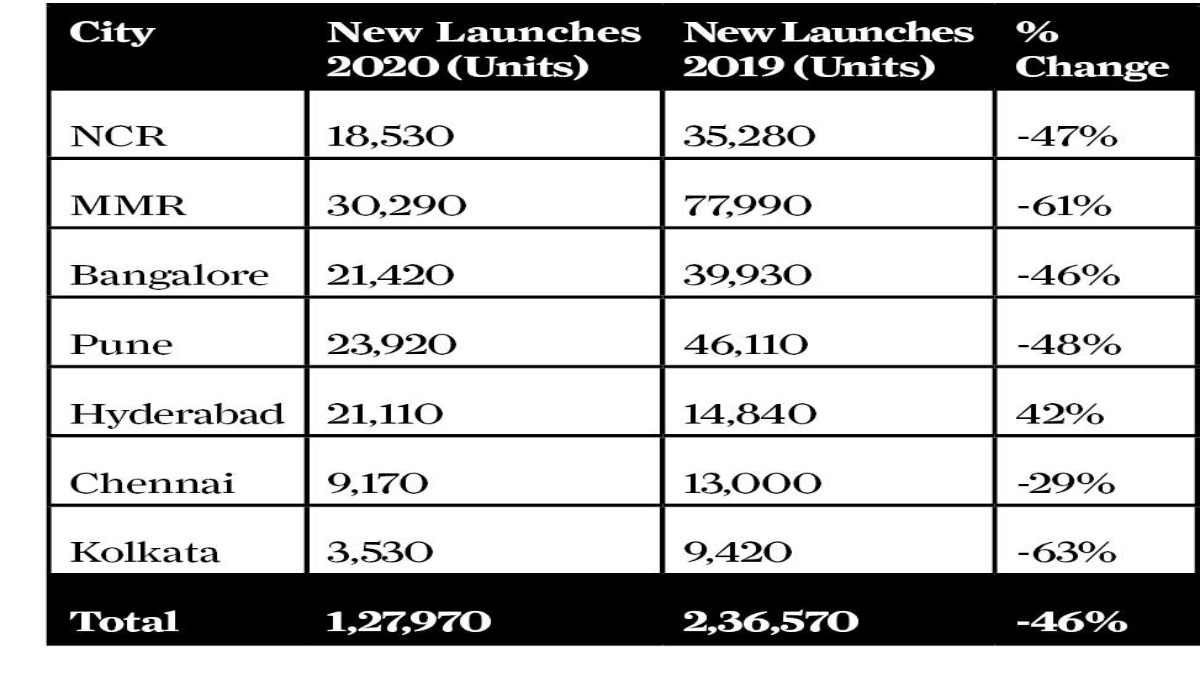

NEW LAUNCHES OVERVIEW – 2020 VS 2019

Annually, the top 7 cities saw approx. 1,27,970 new units launched in entire 2020, against 2,36,570 units in 2019 – reducing by 46%. Hyderabad was the only city to see new launches increase during the year. The key cities contributing to 2020 new unit launches were MMR, Pune, Bengaluru and Hyderabad, which together accounted for 76% of addition.

• In Hyderabad, new launches increased by a whopping 42% in 2020 compared to 2019. New launches stood at approx. 21,110 units in 2020, against 14,840 units last year.

• Meanwhile, MMR saw restricted new launches of approx. 30,290 units in 2020 as against 77,990 units last year – declining by 61%.

• Pune added approx. 23,920 units in 2020 against 46,110 units in 2019 – reducing by 48%.

• Chennai added approx. 9,170 units in 2020 against 13,000 units a year ago, reducing by 29%.

• Bengaluru added approx. 21,420 units in 2020 against 39,930 units in 2019, a fall of 46%.

• NCR kept its new supply restricted to approx. 18,530 units in 2020 against 35,280 units in 2019 – a decrease of 47%.

• Kolkata added the least new supply of approx. 3,530 units in 2020 against 9,420 units in 2019 – a decline of 63% y-o-y.

UNSOLD INVENTORY OVERVIEW

The top 7 cities saw their unsold stock decline by 2% in the year – from approx. 6,48,400 units in 2019-end to approx. 6,38,020 units as of 2020-end. Kolkata saw the maximum decline of 8% in the year, followed by Bengaluru and MMR that witnessed a decline of 6% each.

Interestingly, the last seven-year data trends (2013 till date) indicate that the unsold stock in the top 7 cities was highest at the end of 2016 – approx. 7,90,500 units. In comparison to this peak-level, unsold housing stock has declined by a significant 19%.

• However, Q4 2020 recorded strong growth in the residential segment – heralding housing market revival in 2021

• In 2020, the top 7 cities saw sales decline by 47% from approx. 2.61 lakh units in 2019; MMR sales highest at 44,320 units this year

• New launches fell by 46% in 2020 from approx. 2.37 lakh units in 2019; Hyderabad the only city to see new supply increase by 42% this year

• Unsold inventory saw 2% yearly decline; maximum drop in Kolkata (8%), MMR & Bengaluru (6% each)

• Meanwhile, Q4 signals positive growth trends – top 7 cities saw housing sales of 50,900 units in Q4 2020 against 59,160 units in Q4 2019, rebounding to ~87%; MMR & Pune together comprised a 53% share

• Approx. 52,820 units were launched in Q4 2020 compared to 51,850 units last year; Hyderabad topped new supply with launch of 12,820 units

• Mid-segment new supply (priced INR 40 lakh – INR 80 lakh) rose 39% in Q4 2020 against same period in 2019; affordable supply reduced 39%